How a breaker and mitigation block get formed

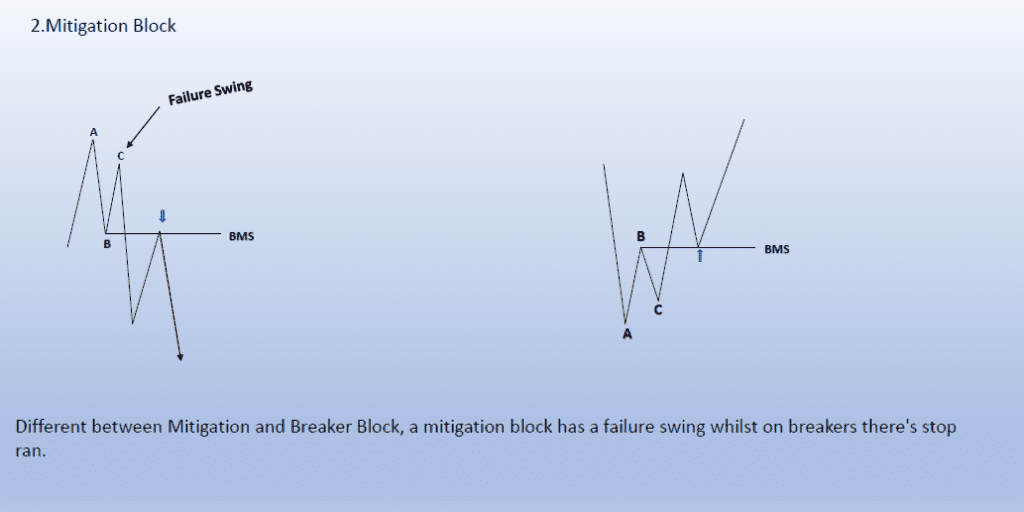

A mitigation block is a reversal pattern formed when the market fails to make a higher high or lower low. In simple terms, a mitigation block results from a failure swing in the foreign market. In contrast, a breaker results from a successful swing in the market. Meaning price will form higher highs, collecting buy-side liquidity on previous highs or forming lower lows; collecting sell-side liquidity on previous lows if it’s a bullish mitigation block.

comparison between a breaker and mitigation block

A breaker forms a higher high, while a mitigation block forms a lower high. When these unfold, we are looking for trading opportunities in the market. A breaker will collect buy-side liquidity on the previous high creating a new higher high, while a breaker will fail to collect buy-side liquidity forming higher lows. This means a mitigation block is a result of a failure swing. In comparison, a breaker results from a successful swing in the market.

Different types of mitigation blocks and breaker blocks

- Bearish mitigation block and bullish mitigation block

- Bearish breaker block and bullish breaker block

How to trade bearish mitigation block and bullish mitigation block.

A bearish mitigation block occurs when a failure swing results in a lower high after the price has failed to collect buy-side liquidity on previous highs due to an order block or rejection block. So, this means a bearish mitigation block results from a failure swing due to an order block or rejection block. pushing price down to collect sell-side liquidity on the nearest previous low, thus forming a lower low.

After price has formed a lower low, it will pull back up to fill the liquidity void that has been created as price was pushed down by the order block. To fill in liquidity voids, it will use the previously violated low as a point of reference to fill 50% of the liquidity void and then continue to bearish/sell. With these in mind, we can use the previously violated low as our entry point. Also, in our Fibonacci, we can see the previously broken low lining up with our equilibrium, giving confluence.

A bullish mitigation block occurs when there`s a failed collection of sell-side liquidity on previous lows in the market. A high low is formed after price has been unable to collect sell-side liquidity on previous highs due to an order block or rejection block. So, this means a bullish mitigation block results from a failed collection of sell-side liquidity on previous lows due to an order block or rejection block. Pushing price up to collect buy-side liquidity on the nearest previous high, thus forming a higher high.

After price has formed a higher high, it will pull back down to fill the liquidity void created as price was pushed up by the order or rejection blocks. In an attempt to price pulling back to fill in liquidity voids, it will use the previously violated high as a point of reference to fill 50% of the liquidity void and then continue bullish. With these in mind, we can use the previously violated high as our entry point. Using our Fibonacci, we can see the previously broken low lining up with our equilibrium, giving confluence.

How to trade bearish breaker block and bullish breaker block.

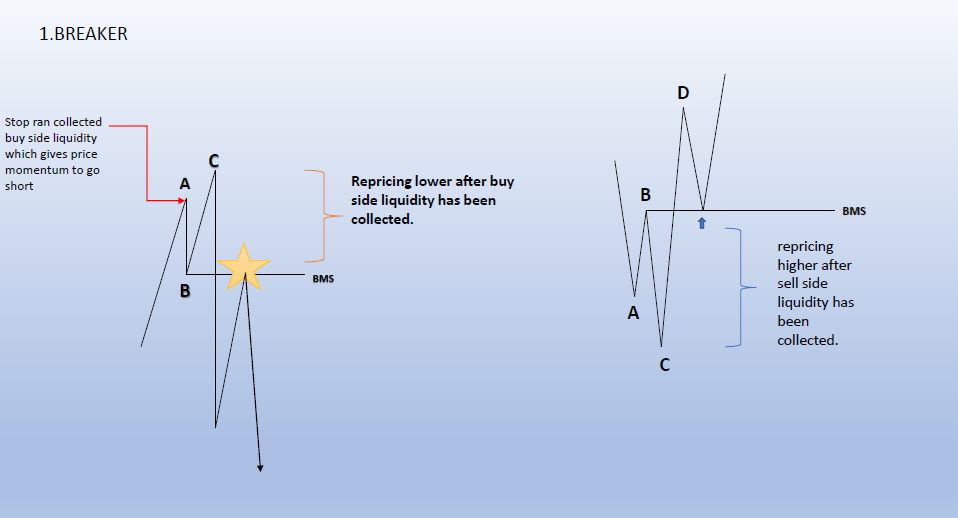

A bearish breaker occurs when price creates a lower low, collecting liquidity pools by taking out the previous low and then pulling up and collecting buy-side liquidity on the nearest high the price will return later to retest the previously violated high and continue to go down. This happens to close all the liquidity voids created our main goal is to wait for a pullback to the previously violated high, and once we see a good rejection, we make our buy entries.

A bullish breaker occurs when price creates a higher high, collecting all the resting liquidity pools on previous highs forming a higher high. then price will drop and collect sell-side liquidity on previous lows and form a lower low. after that price will retrace up to the previously violated low and retest, then continue to drop. that’s where we will take advantage of price and sell short on the previously violated low.

These videos have helped you understand in-depth what has been addressed in this article. this article didn’t only talk about how To Trade Mitigation Blocks, Breakers, and QML but also addressed what a mitigation block is.

Difference Between Qml and Breaker Block in Forex

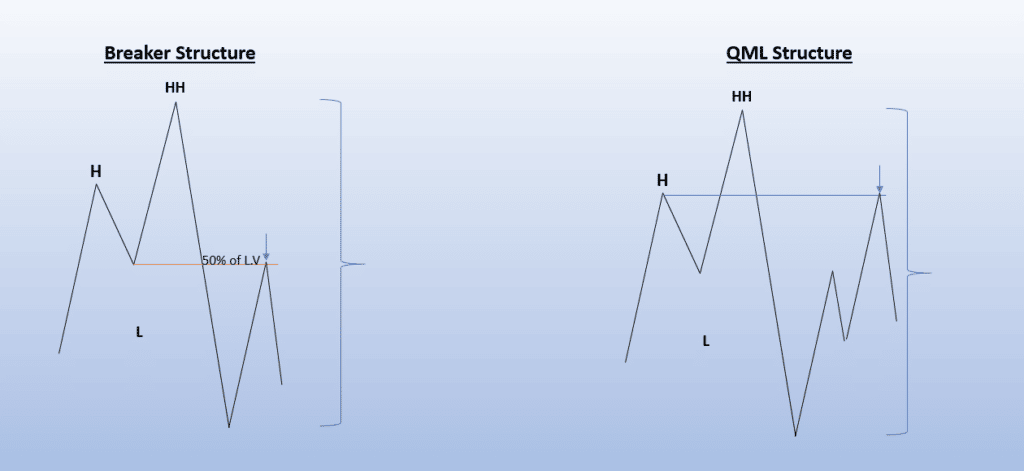

Don’t be confused by the QML structure and breaker structure; they are similar structures, in fact, it’s the same structure. The only difference between a breaker block in forex and QML is what we are targeting as our entry point. In a Breaker, we are targeting previously violated low after the lower low has been formed. whilst in a QML, we target the previously violated high that was formed when price was forming a higher high.

If price successfully sells short at our breaker level, an FTR will be formed, which is simply the high that will be taken out when price reaches back to our QML level. F.T.R. it’s an abbreviation for Failure To Return. The reason it’s called a failure to return is because price failed to return to our expected level, which is our QML in this case. The reason price failed is due to the breaker structure. A breaker structure is the one responsible for F.T.R[FAILURE TO RETURN] to our QML level Immediately. The Understanding of a breaker Structure and a Qml Structure is important. Instead of waiting for price to reach the level of our QML, we can take advantage of the breaker before price reaches our QML level

Trading concept that can be used with mitigation block and breaker block

Another Trading Concept that we can use for confluence with breaker block or mitigation block is the understanding of order flow in forex trading, this gives enlightenment on which high or low is exposed to be taken out. this will guide us on the directional bias of the market. The understanding of order flow coupled with fair value gaps and liquidity voids is gold in the high probability trading concept. This helps you understand not only how to trade mitigation blocks. but also gives an understanding of the price delivery algorithm works. which will help understand what the smart money traders are doing in the market.

Now you know How To Trade Mitigation Blocks, Breakers, and QML!!! all you need is to go back and backtest everything that has been discussed. Remember there are no shortcuts work hard. Check our YouTube Channel and Instagram. To join our mentorship, check: out HERE