market structure is the foundation for reading price action with precision. It provides a roadmap to understand institutional behavior, helping traders anticipate shifts in trends, key reversals, and continuations with accuracy. Mastering market structure allows traders to stay aligned with smart money flows, avoid retail traps, and make precise entries and exits.

In this article, we’ll explore the essential elements of market structure, including trends, shifts, and key levels, and how you can leverage them to trade like a precision technician.

What is Market Structure?

Market structure refers to the way price moves and evolves, creating trends, ranges, and reversals. It reflects the interaction between supply and demand and provides insight into how institutional traders place and manage their orders.

By following the market structure, traders can:

- Identify the direction of the trend.

- Anticipate reversals and trend continuations.

- Pinpoint areas of liquidity where institutions are likely active.

Key Components of Market Structure

- Trends

A market trend consists of a series of higher highs and higher lows (bullish) or lower highs and lower lows (bearish). Identifying the trend is essential for trading with the dominant market direction.- Bullish Trend: Price creates higher highs (HHs) and higher lows (HLs), signaling institutional buying.

- Bearish Trend: Price creates lower highs (LHs) and lower lows (LLs), indicating institutional selling.

- Ranges and Consolidation

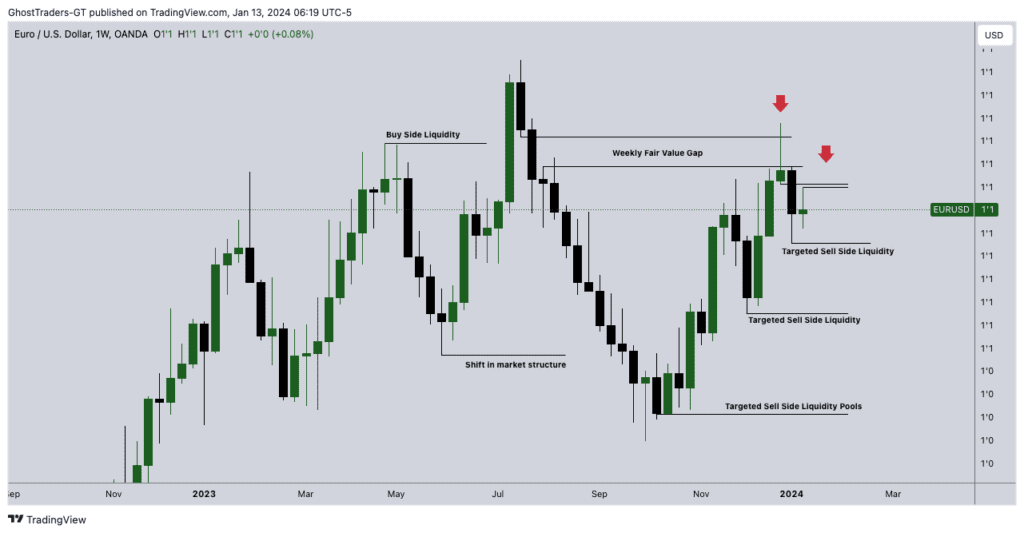

When price is trapped between a support and resistance zone, it forms a range or consolidation. Institutions accumulate or distribute positions within these ranges before a breakout occurs. - Market Structure Shifts (MSS)

A market structure shift happens when the trend breaks a previous key high or low, signaling that the direction may change. For example, if a bearish trend breaks a recent swing high, it may indicate the start of a bullish reversal. - Swing Highs and Lows

Swing highs and lows are pivotal points in the market. These points often act as liquidity pools where stop-loss orders accumulate, giving institutions the liquidity needed to enter or exit trades.

How to Identify Market Structure with Precision

Step 1: Start with the Higher Timeframe

Precision technicians always begin their analysis with higher timeframes (daily, 4 hours) to identify the dominant trend. This gives context to the lower timeframe movements and helps avoid false signals.

- Bullish Context: On the daily chart, if price is making higher highs and higher lows, look for long opportunities on lower timeframes.

- Bearish Context: If the higher timeframe shows lower highs and lower lows, align your trades with the bearish trend.

Step 2: Break Down the Trend into Phases

Each trend has three key phases:

- Accumulation: Institutions build positions in a range or consolidation.

- Expansion: Price breaks out of the range, creating new highs or lows.

- Reversal or Continuation: Price either retraces into an order block for continuation or shifts structure to reverse the trend.

Step 3: Use Market Structure Shifts (MSS) to Identify Reversals

A market structure shift occurs when price violates the previous swing high or low, signaling that institutions may be changing direction. This is a critical concept for precision traders, as it helps them enter early in the new trend.

- Bullish MSS: A swing high is broken after a bearish trend, indicating the start of a potential uptrend.

- Bearish MSS: A swing low is broken after a bullish trend, suggesting a possible reversal to the downside.

Step 4: Identify Key Liquidity Zones and Order Blocks

Liquidity pools often exist near swing highs, swing lows, or key psychological levels, where retail stop-losses accumulate. Institutions manipulate these zones to trigger stop runs, creating high-probability entry points for precision technicians.

- Bullish Order Block: Look for a down candle before an upward move that acts as a support when revisited.

- Bearish Order Block: Identify an up candle before a downward move, which will act as resistance.

How to Trade Market Structure with Precision

Once you’ve identified the trend and key structure levels, you can refine your entries with concepts such as order block retests, liquidity grabs, and fair value gaps (FVGs).

Strategy 1: Trading with the Trend

- Identify the Trend: Start with the higher timeframe to confirm the trend.

- Look for Pullbacks: Use lower timeframes (15-min, 1-hour) to find pullbacks into order blocks or liquidity zones.

- Enter on Confirmation: Wait for price action signals—such as pin bars, engulfing candles, or market structure shifts—to confirm your entry.

- Set Stop-Loss: Place your stop-loss below the order block or swing low (for long trades) to protect against further manipulation.

Strategy 2: Reversals with Market Structure Shifts (MSS)

- Identify the Key Swing High or Low: Look for the point where the previous trend may reverse.

- Wait for a Structure Shift: Enter only after the swing high or low is violated to confirm the new trend.

- Retest Entry: Wait for the price to retest the broken level or an order block near the shift for a safer entry.

- Target the Next Liquidity Pool: Use swing highs/lows or liquidity zones as profit targets.

Strategy 3: Trading Liquidity Hunts

- Identify Liquidity Pools: Look for recent highs or lows where retail stop-losses are likely placed.

- Wait for a Liquidity Grab: Allow price to sweep the liquidity and form a reversal pattern.

- Enter on the Reversal: Enter the trade with confirmation that the liquidity grab is complete.

- Set a Tight Stop-Loss: Place your stop-loss just beyond the liquidity pool to manage risk effectively.

Common Mistakes

- Ignoring Higher Timeframes:

- Always start your analysis with the higher timeframes to avoid trading against the dominant trend.

- Overtrading Structure Breaks:

- Not every market structure break results in a reversal. Wait for confirmation from price action before entering trades.

- Trading Without a Plan:

- Precision trading requires a clear plan. Identify your stop-loss and profit target before entering any trade.

Conclusion

Mastering market structure is essential for becoming a precision technician. By understanding how price trends, shifts, and liquidity pools evolve, traders can align with institutional order flow and make high-probability trades. Use market structure shifts, order blocks, and liquidity grabs to refine your entries and exits, and always start with the higher timeframe context for clarity.

With practice and discipline, mastering market structure will allow you to trade with confidence, avoid retail traps, and profit alongside smart money.