The risk-reward ratio (RRR) is a metric that compares the potential profit of a trade to its potential loss. It is expressed as a ratio, such as 1:2 or 1:3, indicating how much reward a trader can expect for every unit of risk taken. For example, a risk-reward ratio of 1:3 means that for every dollar risked, there is a potential to earn three dollars.

Understanding the concept of risk-reward is fundamental for anyone engaged in trading, whether in forex, stocks, or cryptocurrencies. This article aims to delve into the intricacies of the risk-reward ratio, its importance in trading, and how to effectively manage risk while maximizing returns.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

Why is Risk-Reward Important?

Understanding the risk-reward ratio is crucial for several reasons:

- Foundation of Successful Trading: It helps traders make informed decisions about entering and exiting trades.

- Managing Risk and Maximizing Returns: By evaluating potential risks against rewards, traders can optimize their strategies for better profitability.

- Psychological Benefits: Knowing the risk-reward ratio can reduce anxiety and improve discipline, leading to more consistent trading performance.

Common Mistakes Traders Make in Neglecting Risk-Reward

Some traders focus on the reward without accounting for the risk, leading to overleveraging and large losses. Others set overly tight stop losses, making them prone to being stopped out prematurely. The key is to balance both risk and reward without becoming too focused on just one aspect.

Managing Risk and Maximizing Returns

Successful traders know that it’s not just about winning trades but managing risk efficiently. By understanding risk-reward, traders can make informed decisions, taking calculated risks that yield higher returns over time.

Risk-Reward Basics

A. How to Calculate Risk-Reward Ratio

The Risk-Reward Ratio (RRR) is calculated by dividing the potential reward of a trade by the potential risk. Here’s the formula:RRR=Potential RewardPotential risk = \frac{\text{Potential Reward}}{\text{Potential Risk}}RRR=Potential RiskPotential Reward

For example, if you’re risking $50 on a trade with a potential reward of $150, your risk-reward ratio would be: RRR=15050=3:1RRR = \frac{150}{50} = 3:1RRR=50150=3:1

B. Choosing the Right Risk-Reward Ratio

Industry standards suggest ratios such as 1:2 or 1:3, meaning you risk 1 unit to gain 2 or 3 units, respectively. The ideal RRR depends on your trading strategy, market volatility, and timeframe.

- Higher Ratios (1:3 or more): Suitable for swing or position traders looking for larger, longer-term gains.

- Lower Ratios (1:1 or 1:2): Common among scalpers and day traders who prioritize frequent trades.

C. Understanding Risk and Reward Metrics

Defining risk in dollar amounts or percentages is essential. For instance, you may choose to risk 1% of your account per trade. If your account size is $5,000, you would risk $50 per trade. The number of pips isn’t as important as the amount of money you are willing to lose.

Risk Management Techniques

A. Setting Stop-Loss Orders

A Stop-Loss is a predetermined level at which you exit a losing trade to limit your losses. For example, if you risk 1% of a $5,000 account, your stop loss should not exceed $50 per trade. The number of pips doesn’t matter; what matters is the dollar amount risked.

- Dynamic Stop-Loss (Trailing Stop-Loss): Adjusts with the price, locking in profits as the trade moves in your favor.

- Fixed Stop-Loss: A static stop-loss placed at a certain price level, ideal for volatile markets.

B. Position Sizing

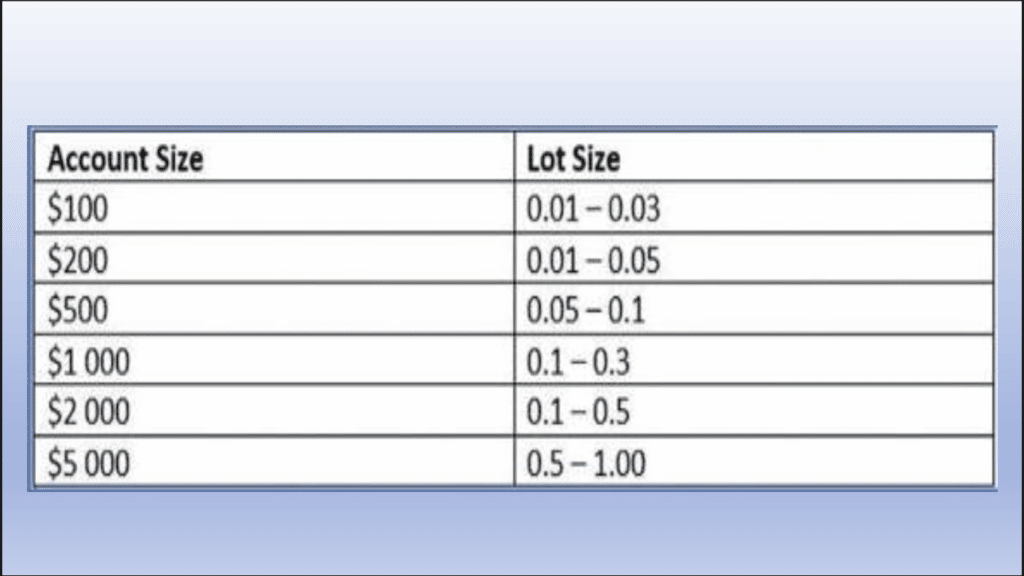

Position Sizing is determined by your risk tolerance and account size. For instance, in a $5,000 account, risking 1% means risking $50. try to calculate position size using our tool:

GhostTraders offers tools like the Position Size Calculator to make this process easier for traders across different asset classes like forex, stocks, and crypto.

C. Risk Per Trade and Maximum Drawdown

To avoid emotional trading, it’s best to limit risk per trade to 1-2% of your account. Managing drawdowns (the loss from the peak to the current balance) is key to avoiding common pitfalls like revenge trading.

Reward Optimization

A. Setting Target Profits

Logical Take-Profit Levels can be identified using previous highs or lows. Price tends to seek liquidity, which resides near these levels. For example, in a sell position, your take-profit level should be placed near the previous lows, as price will likely take out liquidity at that point.

B. Scaling Out of Trades

Partial Profit-Taking allows traders to secure profits while still leaving some capital in the market. You can hold a portion of the trade while gradually taking profit, ensuring you capture more of the move without exiting too early.

C. Adapting to Changing Market Conditions

Market conditions change, and traders must adjust their reward expectations accordingly. In volatile markets, you may need to adjust take-profits or reduce position sizes to maintain favorable RRR.

Analyzing Risk-Reward in Different Trading Strategies

A. Scalping

Scalpers typically use lower risk-reward setups, such as 1:1, because they rely on quick trades with frequent wins. To increase the reward without adding risk, scalpers can tighten stop-losses or trade during high-volatility periods like market opens.

B. Day Trading

Day traders aim for higher frequency trades with manageable risk. They can balance risk-reward by focusing on 1:2 or 1:3 setups. However, beginners may struggle with small timeframes due to the market noise, making it crucial to first focus on higher timeframes for clarity.

C. Swing Trading

Swing traders, targeting larger moves, often use risk-reward setups of 1:3 or higher. They rely on technical indicators like moving averages or Fibonacci retracement to determine their ideal setups.

D. Position Trading

Position traders benefit from low risk while expecting larger gains. This strategy is particularly effective for growing small accounts, as patience is rewarded with substantial moves. Fundamental analysis plays a key role here, and GhostTraders’ Economic Calendar helps traders anticipate important market events.

Tools for Evaluating and Managing Risk-Reward

A. Trading Platforms and Risk-Reward Calculators

Platforms like cTrader, MetaTrader, and TradingView offer built-in tools for managing risk. GhostTraders provides additional resources like a Forex Margin Calculator, Pip Value Calculator, and Lot Size Calculator to simplify the process.

B. Journaling and Tracking RRR Performance

Journaling trades and their associated risk-reward ratios helps traders analyze their performance over time. By reviewing past trades, traders can identify patterns and adjust strategies to improve future performance.

C. Advanced Techniques: Expected Value and Win Rate Analysis

Expected Value (EV) is a concept that combines your win rate and risk-reward ratio. Even if your win rate is less than 50%, a high risk-reward ratio can result in positive returns. For example, with a win rate of 40% and an RRR of 1:3, you will still be profitable.

The Psychology of Risk and Reward

A. Overcoming Fear of Loss

Many traders hesitate to take trades due to fear of loss. However, adhering to a solid risk-reward ratio minimizes the emotional impact of losses, allowing you to stick to your trading plan.

B. Greed and Unrealistic Reward Expectations

Chasing unrealistic rewards can lead to overtrading or taking unnecessary risks. By maintaining discipline and realistic expectations, traders can achieve steady profits over time.

C. The Role of Patience and Discipline

Successful traders emphasize patience and discipline as keys to consistent profits. Exercises such as meditation or trade journaling help cultivate these traits, ensuring you remain focused in the long term.

Famous Traders and Their Approach to Risk-Reward

- Mark Douglas emphasized the importance of consistency in following a risk-reward plan.

- Paul Tudor Jones is known for managing risk efficiently, always prioritizing the preservation of capital over profit-seeking.

Conclusion

The Risk-Reward Ratio is the backbone of successful trading. It provides a structured approach to managing risk while maximizing potential returns. By calculating the right risk-reward ratio, using proper position sizing, and maintaining discipline, traders can navigate volatile markets and achieve long-term profitability. Whether you are a scalper, day trader, or swing trader, understanding and applying risk-reward principles will set you on the path to success.