Navigating the intricacies of Order Flow Trading might sound complex, but let’s break it down into understandable terms. This concept revolves around deciphering the market’s directional bias – essentially, the way significant players influence price movements. Imagine them steering a ship; they guide it in a particular direction.

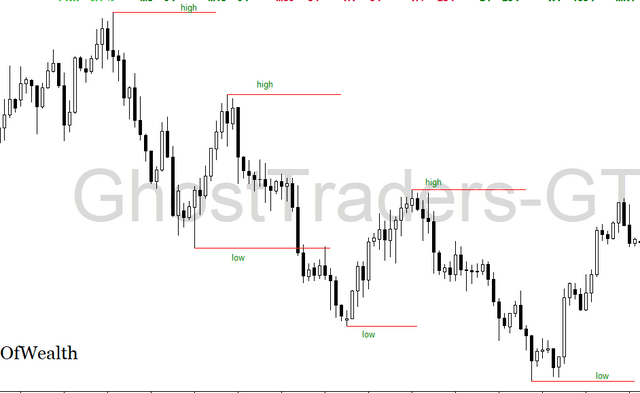

These influential players have a knack for pinpointing resting liquidity pools, which are like treasure troves for them. They strategically aim for these pools nestled around previous market highs and lows. They do this by either triggering stop-loss orders or targeting pending orders. It’s like they’re tapping into a wellspring of potential price shifts.

Picture this: If the price scoops up liquidity around past market lows, it’s like a signal that the market structure might adopt a bearish stance. It’s as if the winds are blowing in favor of the bears.

Now, consider retail traders – those of us not in the heavyweight league. We utilize order flow to discern this directional bias. It’s like reading the stars to anticipate which way the market might lean.

In a nutshell, Order Flow Trading is like a strategic chess game played by the big players. They manipulate price movements by zeroing in on liquidity pools tied to past highs and lows. This manipulation then hints at the market’s potential direction – whether it’s bullish or bearish. And we, the retail traders, use this insight to align our sails and navigate the trading waters.

So, next time you hear about Order Flow Trading, remember: it’s about understanding who’s at the helm, where they’re steering, and using that knowledge to make informed trading decisions.

Picture this: You’re at the helm of your trading ship, navigating the ever-changing waters of the market. In your toolkit, there’s a secret weapon that sets successful traders apart – Order Flow knowledge. It’s like having a crystal ball that lets you glimpse into the future of price movements.

Here’s the twist: Despite its power, Order Flow trading remains a bit of a hidden gem. Many traders have yet to harness its potential, possibly because they believe it’s complicated. But fear not, it’s simpler than it might seem.

Let’s break it down. Think of the market as a series of fractals – those mesmerizing patterns that repeat themselves across different scales. Now, imagine you’re not just looking at one fractal, but a whole sequence of them. This is where Order Flow comes into play.

When you delve into Order Flow, you’re essentially peering into the gears that drive the market machinery. You’re learning to interpret the dance between supply and demand, between the big players and the smaller traders. This insight is invaluable because, believe it or not, the larger time frame’s influence is mirrored in the smaller time frame.

It’s like having a magnifying glass that lets you spot patterns on both the macro and micro scales. By understanding what’s happening in the larger context, you can anticipate the smaller ripples that lead to bigger waves in the market. It’s about connecting the dots and seeing the bigger picture within the smaller strokes.

So, the takeaway is crystal clear: Every trader should grasp the magic of Order Flow. It’s not rocket science; it’s the key to deciphering market movements and foreseeing the next move. The market is a puzzle, and Order Flow is your decoder ring. Embrace it, and you’ll find yourself making strategic decisions that others might miss.

Remember, the market is a symphony of patterns, and you’re the conductor. Order Flow is your sheet music, guiding you through each crescendo and diminuendo. So, don’t shy away from Order Flow – embrace it, and you’ll be dancing to the rhythm of market success.

Summary for order flow

Market Sentiment and Order Flow Dynamics:

Market sentiment and order flow play a pivotal role in the forex trading landscape. Understanding these concepts is vital for trading effectively and making informed trading decisions. Here’s a breakdown of how they interplay:

Market Sentiment:

Market sentiment refers to the overall attitude of traders and investors toward a particular currency pair or asset.

It can be bullish (positive) or bearish (negative) and is often influenced by economic, political, and geopolitical factors.

Recognizing shifts in market sentiment is essential as it can impact price movements.

Order Flow:

Order flow represents the actual buy and sell orders in the market, often referred to as market liquidity.

It reveals the supply and demand for a particular currency pair.

Order flow can provide insights into short-term price movements and trading opportunities.

Market Sentiment and Order Flow Interaction:

Market sentiment influences traders’ decisions, leading to an influx of buy or sell orders.

A surge in positive sentiment can result in increased demand (buy orders), causing prices to rise.

Conversely, negative sentiment can lead to more sell orders and price declines.

Trading Opportunities:

Traders can capitalize on shifts in sentiment by following the direction of the prevailing market sentiment.

Using technical analysis and indicators, traders can identify entry and exit points based on order flow dynamics.

Risk Management:

Managing risk when trading based on sentiment and order flow is crucial. Setting stop-loss orders and defining risk tolerance levels are essential steps.

Monitoring Economic Events:

Keeping an eye on economic events and news releases is important as they can significantly influence market sentiment.

In summary, comprehending the interplay between market sentiment and order flow is vital for effective forex trading. Recognizing shifts in sentiment and utilizing order flow data can lead to profitable trading strategies while managing risk effectively.

There’s bullish and bearish order flow; for more check this in-depth order flow blog :

Institutional Order Flow Trading

check us on Instagram