Last updated on April 10th, 2024 at 03:05 am

The New York Kill Zone is a trading strategy that integrates price and time, focusing on certain time intervals with high volatility. This approach enables traders to identify high-probability trading opportunities using institutional trading reference points like fair value gaps (FVG) or order blocks (OB).

Kill zones are broadly classified into two types: the London kill zone and the New York kill zone. While our focus here is on the New York kill zone, it’s important to note that the concepts taught are equally applicable to the London kill zone

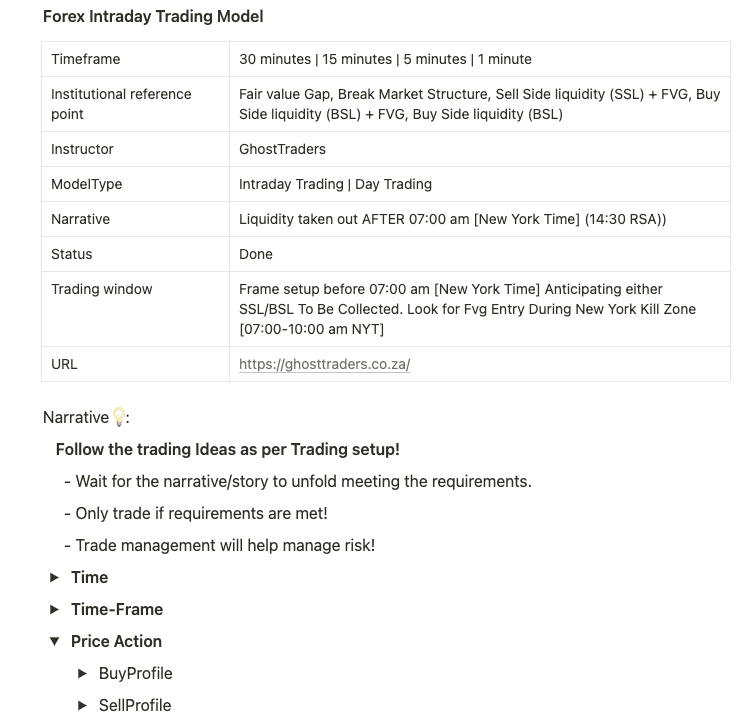

| Time Frame: | 30 minutes | 15 minutes | 5 minutes | 1 minute |

| Institutional reference point: | Fair value Gap, Break Market Structure, Sell Side liquidity (SSL) + FVG, Buy Side liquidity (BSL) + FVG, Buy Side liquidity (BSL) |

| Model Type: | Intraday Trading | Day Trading |

| Narrative: | Liquidity took out AFTER 07:00 am [New York Time] |

| Trading window: | Frame setup before 07:00 am [New York Time] Anticipating either SSL/BSL To Be Collected. Look for Fvg Entry During New York Kill Zone [07:00-10:00 am NYT] |

| Instructor: | GhostTraders |

| Status : | Done |

| Website: | https://ghosttraders.co.za/courses |

| Recommended Broker | ICMarkets, Account Type : Raw Spread |

Time

- Prior 07:00 am Mark Previous Highs and Lows Were Price Is Mostly Likely To Collect Liquidity.

- After 07:00 expect either BSL/SL To be collected and start hunting for setup formation

- From New York Kill Zone[07:00-10:00]Look FVG entry After Liquidity Has Been Collected

- Landon Close Profit Taking Hour is 10:00-11:00 [ Mostly we see a major Retracement during this time, therefore, its best to take profit]

Framing a Buy setup and Sell setup using New York Kill Zone

This checkbox list on how to frame a buy and sell setup

You can get this complete template below and duplicate it in your nation

The videos below will help you understand more

New York Trade Setup Risk management guide

Risk 1% or max 2% of the Account balance. 1% Risk Highly Recommended

Execute trades in the time frame where price action met all the requirements.

- EntryLevel:

- At the failure swing, when price fills the Fair value Gap (FVG).

- Stoploss:

- For Sell—> Above the recently created swing High.

- For Buy—> Below is the recently created swing Low.

- Takeprofit:

- For Sell—> The nearest swing Low before 07:00 am [New York Time]

- For Buy—> The nearest swing High before 07:00 am [New York Time]

Trade examples

follow us on our social media