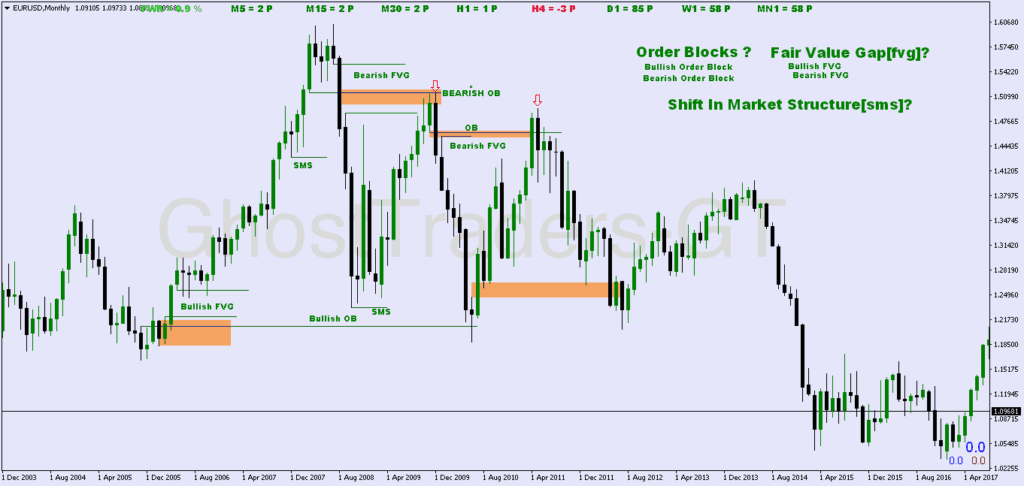

Order blocks and fair value gaps (FVG) are two powerful concepts in institutional trading. Fair value gaps occur when the market experiences an imbalance in buying and selling, creating inefficiencies. These gaps are visually represented by a three-candlestick pattern, where rapid price movement leaves a gap between the first and third candles, bypassing the middle one. In contrast, order blocks signal a shift in price delivery, confirmed by fair value gaps.

A bearish order block is marked by the last bullish candle at a swing high before a downtrend, while a bullish order block is identified by the last bearish candle at a swing low before an uptrend. These areas often highlight where institutional players and large banks have placed significant buy or sell limit orders, shaping future market moves.

What Are Order Blocks?

Order blocks represent areas on a price chart where institutions or large traders (such as banks and hedge funds) have placed a significant number of buy or sell orders. These blocks are usually created when an institution accumulates or distributes a large position in the market, causing a significant price movement. Understanding the dynamics behind these Order blocks helps retail traders capitalize on high-probability areas of price reversal or continuation.

Key Characteristics of Order Blocks:

- Accumulation of large orders: When a large player like an institution enters the market, they can’t execute their orders at once. Instead, they place orders at different levels, creating an “order block.”

- Price consolidation: Often, order blocks are preceded by a phase of consolidation or sideways movement as the institutions slowly build their positions without causing large fluctuations in price.

- Sharp movement afterward: Following an order block, prices will often move sharply away, indicating that the large players have completed their accumulation or distribution, and the market is reacting to this change in demand.

How to Identify an Order Block:

- Look for consolidation: Before an impulsive move, order blocks are often found in areas of consolidation, where price moves sideways or within a tight range.

- Spot the impulsive move: After consolidation, a sharp, impulsive move up or down signals the presence of institutional interest in that price area.

- Return to the block: After an impulsive move, the price often returns to the order block before continuing in the direction of the original move. This is your entry opportunity.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

Trading Order Blocks:

To trade order blocks, the most important step is to wait for price to return to the block after the impulsive move. Here’s a step-by-step guide on how to trade them:

- Identify an order block on the chart (typically on higher time frames like 4 hours or daily).

- Wait for a retest: The price should return to the area where the order block was formed.

- Confirmation: Look for additional confirmation, such as a bullish or bearish candlestick pattern, to enter the trade.

- Entry: Once confirmation occurs, enter the trade in the direction of the original impulsive move.

- Set Stop Loss: Place your stop loss just below (for long trades) or above (for short trades) the order block to manage risk.

- Profit Target: Set your profit target based on nearby resistance or support levels, or use a trailing stop to maximize profit if the trend continues.

What Are Fair Value Gaps (FVG)?

Fair Value Gaps refer to the imbalance created when the price moves too quickly, leaving behind unfilled orders. These gaps are important because they represent inefficiencies in the market, where buying and selling activity was not balanced. When the market moves through a gap, it often retraces to “fill” it, offering opportunities for traders to capitalize on the imbalance.

Key Characteristics of Fair Value Gaps:

- Imbalance: FVGs occur when there is a strong imbalance between buyers and sellers, usually resulting in a gap on the price chart.

- Reversion: Price often returns to fill the gap as market participants attempt to resolve the imbalance by entering positions at the missed levels.

- Continuation: After the gap is filled, the market typically resumes its original direction.

How to Identify a Fair Value Gap:

- Look for rapid price movement: A fair value gap is created when the market makes an aggressive move, causing a gap between the candle wicks or bodies.

- Note the imbalance: Identify where price did not trade efficiently, leaving behind areas that market participants may later revisit.

- Price retracement: After the price leaves a gap, it tends to retrace to that level to fill it, providing a trading opportunity.

Trading Fair Value Gaps:

FVGs are best traded by waiting for the price to return to the gap and enter when the gap is filled. Here’s a simple approach:

- Spot the Gap: Identify a fair value gap after a fast price move. This gap will usually appear between two consecutive candles, either in the wicks or bodies.

- Wait for Price to Return: After identifying the gap, wait for the price to retrace to fill the gap.

- Look for Confirmation: Use additional technical tools such as support/resistance levels or candlestick patterns to confirm your entry.

- Entry: Once the gap is filled, enter in the direction of the original move (typically a continuation of the trend).

- Set Stop Loss: Place your stop loss just beyond the fair value gap to limit potential losses.

- Profit Target: Similar to order blocks, set your profit target based on key levels or use a trailing stop to capitalize on longer trends.

Combining Order Blocks and Fair Value Gaps

Combining these two concepts can lead to more precise and high-probability trade setups. When an order block and a fair value gap occur nearby, this confluence provides even stronger confirmation for a trade. For instance, if you spot a fair value gap within an order block, this indicates that institutional traders are likely involved, making the area a strong point of interest for market reversals or continuations.

Conclusion

Mastering order blocks and fair value gaps can significantly improve your trading performance, especially in markets driven by institutional players. By understanding how these concepts represent the actions of large traders, retail traders can align their trades with the market’s underlying structure. Remember to combine these methods with other technical analysis tools for more robust trade setups and to manage risk carefully. As always, backtesting and refining your approach in different market conditions is key to long-term success.