Last updated on October 3rd, 2024 at 01:33 pm

In smart money trading, one of the most effective techniques for capturing large market moves is the Power of Three. This strategy is based on how institutional traders manipulate the market in three key phases: accumulation, manipulation, and distribution. By understanding and trading the Power of Three, traders can align themselves with institutional order flow, effectively avoiding traps that catch many retail traders off guard.

In this blog post, we will explore the Power of Three concept, break down its components, and provide actionable steps on how to trade it successfully.

What is the Power of Three?

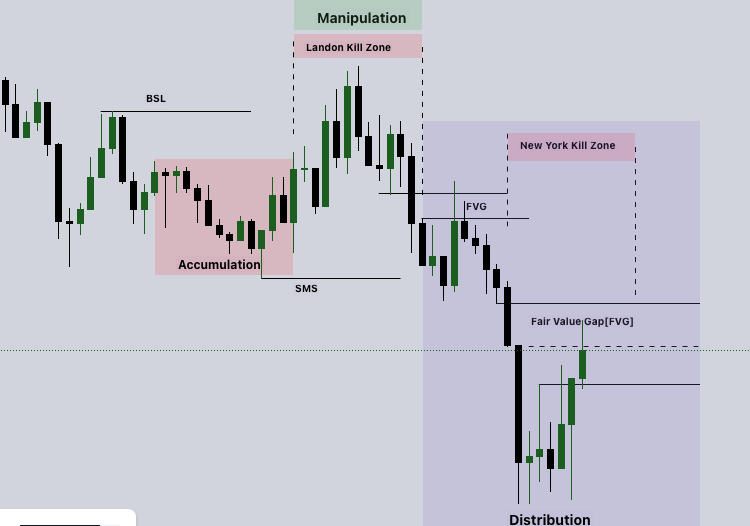

The Power of Three is a price action concept that describes how institutional traders manipulate the market over three phases:

- Accumulation: The smart money accumulates positions quietly without causing large price movements.

- Manipulation: Institutions manipulate price action to create liquidity, often by trapping retail traders in poor trades (e.g., triggering stop-losses).

- Distribution: The smart money offloads its positions, driving the market in the desired direction with momentum.

This pattern often plays out within a single trading session, but it can also occur over longer time frames, such as weekly or monthly market cycles. The Power of Three is rooted in the understanding that institutional traders need to create liquidity in the market to execute their large orders efficiently, which leads to the recognizable three-part structure.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

The Three Phases of the Power of Three

To trade the Power of Three successfully, it’s important to understand the phases that make up the pattern. Each phase has a specific role in how smart money manipulates the market, and knowing how to recognize these phases will help you enter and exit trades at the right time.

1. Accumulation Phase: Smart Money Laying the Groundwork

The accumulation phase is the first step of the Power of Three, where institutional traders begin to build their positions without causing major price moves. This phase typically occurs in a period of consolidation or range-bound trading, where price moves sideways in a tight range.

During this phase, institutions are quietly accumulating long or short positions, preparing for the next phase. For retail traders, this period may seem uneventful, but it is critical to identify accumulation zones because they often precede large moves.

How to Identify the Accumulation Phase:

- Look for price consolidation or a range that forms during low volatility periods (e.g., the Asian session or pre-market hours).

- Price tends to oscillate between support and resistance without breaking out, indicating institutional accumulation.

Tip for Traders:

Patience is key during the accumulation phase. Avoid entering trades prematurely, and focus on identifying the boundaries of the range. The breakout from the accumulation phase signals the start of the next phase—manipulation.

2. Manipulation Phase: Creating Liquidity Traps

The manipulation phase is where institutions “shake out” retail traders by triggering liquidity. They achieve this by creating false breakouts, stop hunts, or spikes in price, moving the market in the opposite direction of the intended move. This is done to accumulate liquidity before the smart money moves the market in the true direction of their positions.

During this phase, price may appear to break out of the accumulation range, but it is often a trap. Retail traders who enter at this point (believing a new trend is beginning) are quickly caught on the wrong side of the market when it reverses sharply.

How to Identify the Manipulation Phase:

- Look for a false breakout above or below the accumulation range, where price breaks key support or resistance but quickly reverses.

- Watch for price spikes into liquidity zones, such as above recent swing highs or below recent swing lows, triggering stop losses.

- The manipulation phase is often marked by a rapid price move that seems to trap traders in the wrong direction.

Tip for Traders:

Stay cautious during the manipulation phase and avoid chasing price. Instead, wait for confirmation of the next phase—distribution—before entering a trade. This phase is intended to “trick” retail traders, so patience is key.

3. Distribution Phase: The Real Move Begins

The distribution phase is the final part of the Power of Three, where institutional traders finally drive the market in their intended direction. This phase follows the manipulation phase and is often accompanied by a sharp, directional move.

In the distribution phase, the smart money offloads their accumulated positions, using the liquidity generated during the manipulation phase to execute their trades with minimal slippage. This creates the true trend for the session, and traders who recognize this phase can ride the momentum for significant gains.

How to Identify the Distribution Phase:

- After the manipulation phase (false breakout), look for the market to reverse and break out in the opposite direction.

- The distribution phase is often accompanied by high volume and strong price momentum, confirming that institutional traders are in control.

- This phase usually lasts until the end of the trading session or until a key level of support or resistance is hit.

Tip for Traders:

Once the distribution phase begins, look for confirmation of the new trend. Enter trades with the trend, placing your stop-loss just beyond the manipulation zone to protect against further false moves.

How to Trade the Power of Three Successfully

Now that we understand the three phases of the Power of Three, let’s break down a step-by-step strategy for trading this pattern successfully:

Step 1: Identify the Accumulation Phase

- During periods of consolidation (e.g., during the Asian session or early in the trading day), identify the boundaries of the range. This will be the accumulation phase.

- Avoid trading inside the range, as this is where institutions are building positions, and price movement will be choppy.

Step 2: Watch for Manipulation

- As price begins to break out of the accumulation range, wait for signs of manipulation. This could be a false breakout or a spike into a liquidity zone.

- Stay patient and avoid taking trades during this phase. The goal is to wait for the liquidity grab to complete before entering the market.

Step 3: Enter on Distribution

- Once the manipulation phase completes and price reverses in the opposite direction, this is your cue to enter the trade.

- Confirm the direction of the new trend using price action signals such as a break of market structure or strong momentum candles.

- Enter the trade with the trend, setting your stop-loss just beyond the manipulation zone (either above the high or below the low of the liquidity grab).

Step 4: Manage Risk and Take Profits

- Use tight stop-losses during the distribution phase, as the market should move decisively in one direction. If the market hesitates or reverses, it could signal that the trade is invalid.

- Take profits at key levels of support or resistance, or use a trailing stop to lock in gains as the market continues to move in your favor.

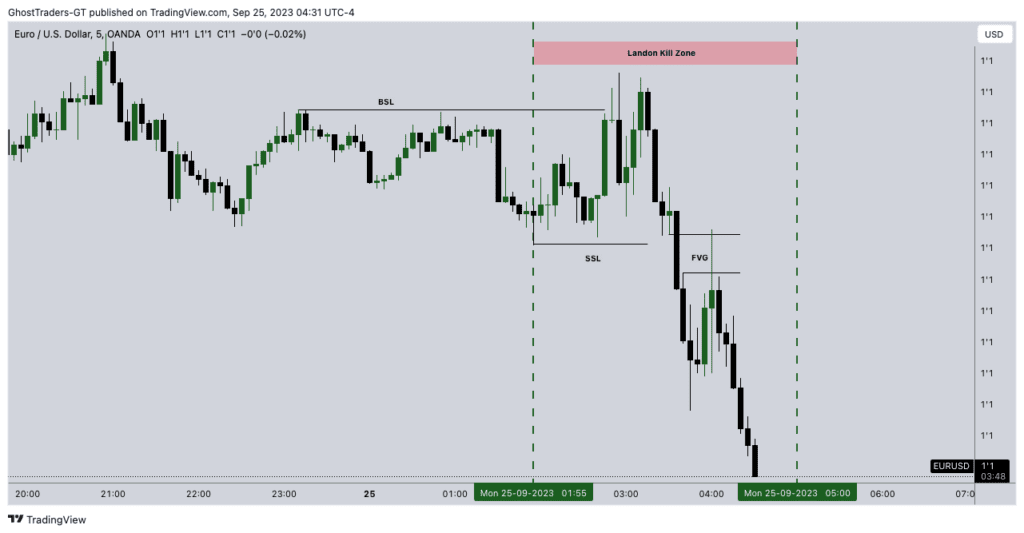

Example of Trading the Power of Three

Let’s consider an example where we apply the Power of Three strategy in a forex market, using a 15-minute chart of EUR/USD:

- Accumulation Phase: During the early hours of the London session, EUR/USD consolidates in a tight range, oscillating between 1.1000 and 1.1020. This is the accumulation phase, where institutional traders are building their positions.

- Manipulation Phase: Shortly after the London open, price spikes above the range to 1.1030, triggering stop-losses above the accumulation zone. However, the price quickly reverses, indicating that this was a false breakout and a manipulation to create liquidity.

- Distribution Phase: After the manipulation phase, the price breaks below the accumulation zone at 1.1000 and begins to trend downward. This is the distribution phase, and smart money is driving the market lower. Traders can enter a short position at 1.1000, placing a stop-loss above the manipulation high at 1.1030.

- Trade Outcome: The price continues to drop, reaching a key support level at 1.0950. Traders can take profits here or use a trailing stop to capture further downside moves.

Conclusion

The Power of Three is a powerful price action strategy that helps traders align with institutional market manipulation. By understanding the three phases—accumulation, manipulation, and distribution—you can trade alongside the smart money rather than against it.

The key to trading the Power of Three successfully is patience. Waiting for the manipulation phase to complete and entering during the distribution phase allows you to capture the real market move while avoiding the traps set by institutional traders.