Last updated on August 3rd, 2024 at 03:58 am

In the constantly changing landscape of prop trading, ICFunded has emerged as a noteworthy competitor. This review aims to provide an impartial evaluation of IC Funded, comparing its offerings to established firms such as 5ers and FTMO, and emphasizing what sets IC Funded apart as a potential game-changer in the industry.

Superior Features

One of the standout features that set IC Funded apart from well-established prop firms is its strategic partnership with IC Markets, a globally reputable broker known for its robust trading platforms like cTrader and TradingView. This partnership enhances the trading experience by providing access to advanced trading technology and tools. Additionally, IC Funded offers a Raw Spread account, a significant advantage for traders seeking minimal trading costs.

Trust and Reputation

While IC Funded is relatively new in the prop trading arena, it has garnered positive Trustpilot reviews, enhancing its reputation. Many traders trust IC Funded, in part due to its association with IC Markets, which boasts a stellar 4.8-star rating from over 37,452 reviews on Trustpilot. However, it’s important to be cautious with newer firms that haven’t yet proven themselves over time.

ICFunded Evaluation Plans and Fees

IC Funded’s evaluation plans are appealing due to their affordability and structured approach to assessing trading skills. For instance, traders can start with a $5,000 evaluation account for just $49 or opt for a $10,000 evaluation account for $99. These competitive fees make it accessible for a broader range of traders, especially those who are starting or wish to test their strategies without significant financial commitment.

Here’s a comparison of their evaluation plans:

- $5,000 Evaluation Account: $49 fee

- $10,000 Evaluation Account: $99 fee

- $50,000 Evaluation Account: $289 fee

- $100,000 Evaluation Account: $499 fee

These plans provide flexibility and a cost-effective way for traders to showcase their skills and potentially gain access to funded accounts.

ICFunded Trading Technology and Tools

IC Funded leverages state-of-the-art trading technology, including advanced trading platforms like cTrader and TradingView. These platforms are known for their user-friendly interfaces, comprehensive charting tools, and efficient execution speeds, enhancing the overall trading experience. The provision of a Raw Spread account further underscores IC Funded’s commitment to providing a professional trading environment with low-cost trading.

IC Funded is making significant strides in the prop trading industry. Its partnership with IC Markets, competitive evaluation fees, and advanced trading technology make it an attractive option for traders. While it is important to remain cautious with newer firms, IC Funded’s trajectory suggests that it could soon be a top player in the industry if it continues in its current direction.

Is IC Markets connected to ICFunded?

In the world of trading, clarity and trust are paramount. Traders rely heavily on the reputations of brokers and firms to make informed decisions. Recently, a question has arisen in the trading community: “Is IC Markets connected to IC Funded?” This query stems from the noticeable similarities between the two entities’ websites and branding. Let’s dive into the details and unravel the truth behind their relationship.

Understanding the Entities: ICMarkets and ICFunded

ICMarkets is a well-established broker, renowned for providing traders with access to financial markets through popular platforms such as MT4, MT5, and cTrader. Their strong reputation and reliability have garnered the trust of traders globally.

IC Funded, on the other hand, is a relatively new prop firm that has entered the prop trading space with a mission to provide traders with access to company capital. Prop firms like IC Funded evaluate traders through specific programs and offer profit-sharing arrangements.

The Nature of IC Markets and ICFunded Partnership

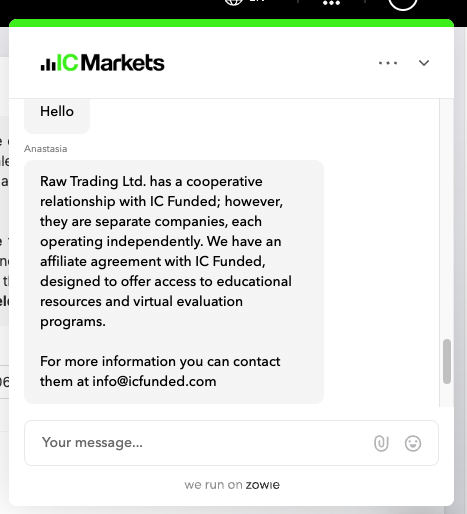

To clarify the nature of their partnership, we reached out to IC Funded. Here is what they had to say:

“Raw Trading Ltd. has a cooperative relationship with IC Funded; however, they are separate companies, each operating independently. We have an affiliate agreement with IC Funded, designed to offer access to educational resources and virtual evaluation programs.”

This statement makes it clear that while there is a cooperative relationship between Raw Trading Ltd. (the operator of IC Markets) and IC Funded, they are indeed separate entities. The affiliate agreement primarily focuses on providing educational resources and evaluation programs, but it does not imply that they are the same company or that one controls the other.

Addressing the Design Similarity of IC Markets and ICFunded

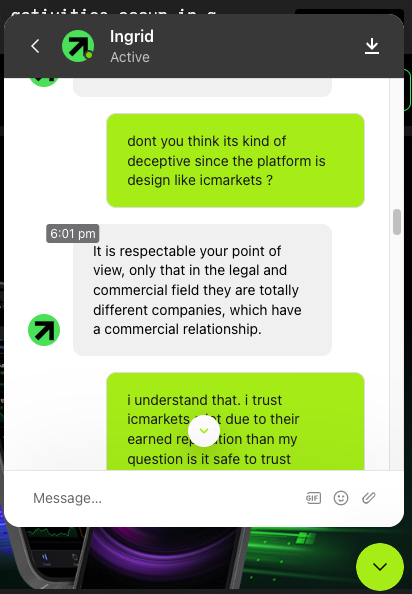

One of the main sources of confusion is the similar design and branding between IC Markets and IC Funded. When asked about this potential issue, IC Funded responded:

“It is respectable your point of view, only that in the legal and commercial field they are totally different companies, which have a commercial relationship.”

While IC Funded acknowledges the concern, they emphasize that the two companies operate independently despite their visual similarities.

ICfunded Leveraging IC Markets’ Tools

IC Funded has strategically leveraged some of the trading tools that IC Markets is known for. For instance, they offer trading platforms like MT4 and MT5, which are standard in the industry. Additionally, IC Funded offers cTrader, a platform not commonly provided by many prop firms. This alignment in tools can create a sense of continuity for traders who are familiar with IC Markets’ offerings.

However, it’s important to note that IC Funded does not currently offer TradingView integration, which some traders may find limiting. As a new entrant in the prop firm space, there is potential for IC Funded to expand its platform offerings in the future.

Trust and Reliability: Building Confidence

Your concern about trusting IC Funded as much as IC Markets is understandable. When asked about their reliability, IC Funded stated:

“As part of IC Funded we will always say yes, as we work on the project. Perhaps even more reliable than my word are the experiences of other traders who are already trading with us.”

To build trust, IC Funded encourages potential clients to look at the experiences of current traders and to engage with their community chat for further insights. but I would recommend traders check third-party platforms like Trustpilot for reviews.

Ensuring Clarity and Transparency

To prevent any potential confusion and to maintain trust within the trading community, ICFunded can take several steps:

- Clear Disclaimers: Prominently display information about their independent operation on their website.

- Distinct Branding Elements: Introduce unique visual elements that differentiate IC Funded from IC Markets to reduce perceived connections.

- Transparent Communication: Ensure all customer interactions clearly state the nature of their relationship with IC Markets, emphasizing their independent operations.

Conclusion: A Call for Transparency

The partnership between IC Markets and ICFunded is valid. However, their similar branding may cause confusion, even though this is often done to indicate that they belong to the same parent company. Traders need transparency and clarity to make well-informed decisions. By addressing these concerns, ICFunded can demonstrate its dedication to honesty and trust within the trading community.

For traders, it is always advisable to thoroughly research and understand the entities you are dealing with, ensuring you are fully aware of the nature of their relationships and the specifics of their operations. Trust is earned through transparency, and both IC Markets and IC Funded have roles to play in upholding this principle.