Lot Sizes Calculator in Forex Trading

In the intricate world of Forex trading, success isn’t merely about predicting market movements. It’s also about effectively managing your position size and controlling your risk. One crucial aspect of this is understanding “Lot Sizes.” A Lot defines the trade size or the number of currency units you’re buying or selling in a trade. To put it simply, it determines the scale of your trading activity. So, whether you’re a novice or a seasoned trader, comprehending Lot Sizes is pivotal to your success in the foreign exchange market.

Standard Lot – The Benchmark

A “Standard Lot” in Forex trading is the benchmark by which other Lot Sizes are measured. It comprises 100,000 units of the base currency. For instance, if you’re trading the EUR/USD pair, a Standard Lot would mean trading 100,000 Euros. It’s important to note that not every trader begins with Standard Lots, especially if you’re new to Forex. Leveraging other Lot Sizes is a common practice, and doing so wisely is crucial for a prosperous trading journey.

Fractional Lot Sizes – Mini, Micro, and Nano Lots

In addition to Standard Lots, most brokers allow trading with fractional Lot Sizes. These smaller Lot Sizes cater to traders who prefer to trade with lower capital, offering more flexibility and risk control. Fractional Lot Sizes are categorized as:

- Mini Lots (0.10): A Mini Lot represents 10% of a Standard Lot. For the EUR/USD example, it would equate to 10,000 Euros.

- Micro Lots (0.01): A Micro Lot is even smaller, comprising 1% of a Standard Lot. This translates to 1,000 Euros for EUR/USD.

- Nano Lots (0.001): The smallest of them all, a Nano Lot is just 0.1% of a Standard Lot. It’s perfect for traders looking to start with minimal capital and risk. For EUR/USD, a Nano Lot equals 100 Euros.

The Role of a Lot Size and Risk Calculator

Now that you understand the significance of Lot Sizes in Forex trading, the next question is: How do you calculate the right Lot Size or position size for your trades? This is where a “lot size calculator” becomes extremely useful. It assists you in determining an ideal position size for every trade, ensuring that your risk remains within your predefined boundaries.

Here’s how you can use a Position Size and Risk Calculator effectively:

- Instrument Selection: You start by choosing the trading instrument you’re interested in. This can be a major Forex pair, a minor or exotic pair, a cryptocurrency like BTC/USD, ETH/USD, or even commodities like Gold, Silver, or Oil. Let’s illustrate this using the USD/CAD pair.

- Deposit Currency: Your account’s base currency plays a crucial role in calculating the ideal Lot Size. It considers the pip value and the current market rate of the selected pair. For our example, let’s use USD as the deposit currency.

- Stop-Loss (pips): You need to specify the maximum number of pips you’re willing to risk in a trade. This figure reflects your risk tolerance. In our example, we’ll set a stop-loss of 100 pips.

- Account Balance: This field is quite straightforward. You simply enter your account equity. For the sake of this example, let’s assume it’s $2,000.

- Risk Management: This is a crucial part of the calculator. Here, you can select from either a risk percentage or a specific monetary value in your account’s base currency (e.g., $2, $20, $40, etc.). Professional traders usually adhere to a risk management rule of not risking more than 2% of their account equity in a single trade. This prudent approach allows traders to safeguard their capital and recover from previous losses. For our example, we’ll select a risk percentage of 2%.

- Calculating Your Position Size: After entering the data, you hit the “Calculate” button.

Interpreting the Lot size calculator results

The Lot Size Calculator uses a live market price feed with the current interbank rate to display the selected currency pair’s price. In our example (USD/CAD), it will show the current exchange rate.

Considering a stop-loss of 100 pips and a risk of 2% of the account equity, the calculator suggests a recommended Lot Size of 0.05. In numerical terms, this represents 5,000 units of the currency pair, or 5,000 CAD in the case of USD/CAD. Additionally, it signifies that 2% of your account equity, which equals $40 in our example, is at risk.

This dynamic tool empowers traders to make well-informed decisions, ensuring that their trading positions align with their risk management strategy. By using the Position Size and Risk Calculator, you can precisely calculate your Lot Sizes, helping you maintain a disciplined approach to trading.

It’s also worth noting that the tool doesn’t exist in isolation. You can combine it with other calculators like the Drawdown Calculator to comprehensively evaluate how your trading account equity may be affected after a series of losing trades.

Recommended Lot Size in Forex Trading

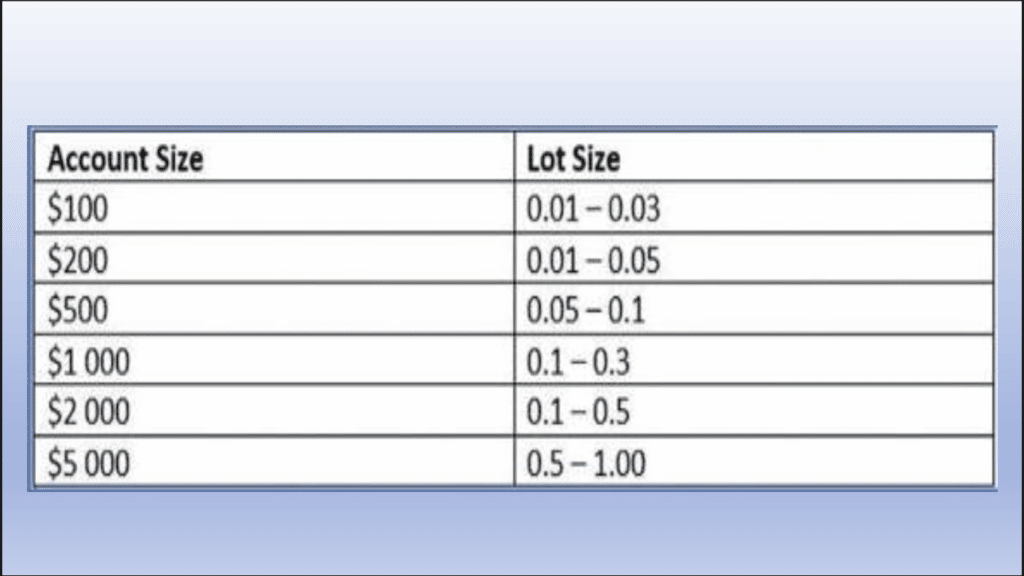

The recommended lot size in Forex trading depends on several factors, primarily your trading account balance. Using a position size calculator can help determine the appropriate lot size based on your account balance and risk tolerance.

Factors to Consider

- Account Balance: Your trading account balance is the most important factor in determining the recommended lot size. It’s generally advised to risk no more than 1-2% of your account balance per trade.

- Risk per Trade: Decide on the maximum amount you are willing to risk per trade, typically 1-2% of your account balance. This will help calculate the appropriate lot size.

- Stop Loss Level: The distance between your entry price and stop loss level also affects the lot size. A wider stop loss requires a smaller lot size to keep the risk within your desired range.

Using a Position Size Calculator

Position size calculators are useful tools for determining the recommended lot size based on your account balance and risk parameters. These calculators typically require the following inputs:

- Account Balance

- Risk per Trade (as a percentage)

- Stop Loss Level

- Base Currency of the Pair

The calculator will then provide the recommended lot size that aligns with your risk tolerance and account balance. This helps ensure you are not over-leveraging your trades and managing your risk effectively. By considering your account balance and using a position size calculator, you can determine the recommended lot size that suits your trading style and risk profile in Forex trading. This helps maintain a balanced and sustainable approach to managing your trades.

how much is 0.01 lot size in rands

To determine the value of a 0.01 lot size in South African Rand (ZAR), we first need to understand what a “lot” represents in trading. In Forex trading, a standard lot is typically 100,000 units of the base currency. Therefore, a 0.01 lot size would be 1,000 units of the base currency.

Conversion Steps

- Identify the Base Currency: The base currency is usually the first currency in a currency pair. For example, in the USD/ZAR pair, USD is the base currency.

- Current Exchange Rate: As of the latest data, the exchange rate for USD to ZAR is approximately 17.93 ZAR per USD.

- Calculate the Value in ZAR:

- For 0.01 lot size (1,000 units of USD):

- The formula to convert is: Value in ZAR=Amount in USD×Exchange RateValue in ZAR=Amount in USD×Exchange Rate

- Substituting the values:Value in ZAR=1,000 USD×17.93 ZAR USD=17,930 ZARValue in ZAR=1,000USD×17.93ZAR USD=17,930ZAR

Therefore, a 0.01 lot size is equivalent to 17,930 ZAR when using the current exchange rate of approximately 17.93 ZAR per USD.

0.01 lot size in dollars

To calculate the value of a 0.01 lot size in US dollars (USD), we need to understand that in Forex trading, a standard lot is typically 100,000 units of the base currency. Therefore, a 0.01 lot size represents 1,000 units of the base currency.

Calculation Steps

- Determine the Base Currency: The base currency is the first currency in a currency pair. For example, in the EUR/USD pair, EUR is the base currency.

- Current Exchange Rate: The value in USD will depend on the current exchange rate of the base currency in USD. For example, if we are considering the EUR/USD pair and the exchange rate is 1.10 (meaning 1 EUR = 1.10 USD).

- Calculate the Value in USD:

- For 0.01 lot size (1,000 units of the base currency):

- The formula is: Value in USD=Amount in Base Currency×Exchange RateValue in USD=Amount in Base Currency×Exchange Rate

- If we use the example of EUR/USD with an exchange rate of 1.10:Value in USD=1,000 EUR×1.10 USD EUR=1,100 USDValue in USD=1,000EUR×1.10USD EUR=1,100USD

The value of a 0.01 lot size in USD will depend on the specific currency pair and the current exchange rate. If you provide the specific currency pair, I can give a more precise calculation. However, using the example of EUR/USD at an exchange rate of 1.10, a 0.01 lot size would be valued at 1,100 USD.

In Conclusion

Mastering the art of Lot Sizes and effective risk management is a pivotal component of success in Forex trading. Whether you’re dealing with Standard Lots, Mini Lots, Micro Lots, or Nano Lots, the key is to align your position sizes with your risk tolerance and trading strategy.

As you journey through the dynamic world of Forex, remember that understanding Lot Sizes is just the beginning. Employing tools like the Position Size and Risk Calculator is essential for optimizing your trading endeavors. These tools allow you to approach each trade with precision and discipline, helping you build a sustainable and prosperous trading career.

If you ever find yourself in a series of losing trades, our Drawdown Calculator can be a valuable companion, assisting you in assessing how your trading account equity might be impacted. Successful trading is a continuous learning process, and these calculators are here to guide you on your journey to becoming a proficient and profitable trader.

Important Links: Courses, Mentorship, YouTube Channel