London Stock Exchange Hours

Complete Trading Guide for UK and International Investors

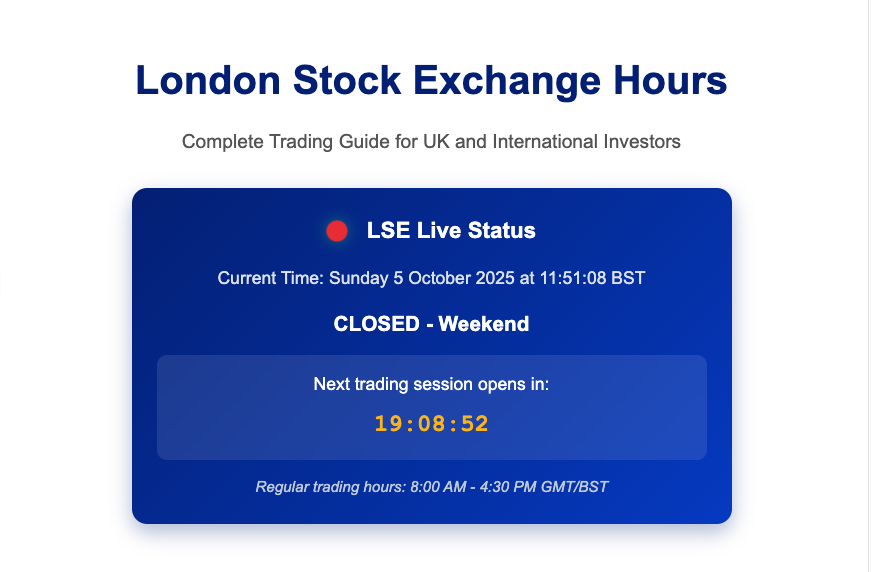

LSE Live Status

Regular Trading Hours

8:00 AM – 4:30 PM GMT/BST

Monday through Friday

Opening Auction

7:50 AM – 8:00 AM GMT/BST

Price discovery period

Closing Auction

4:30 PM – 4:35 PM GMT/BST

Final price determination

Understanding LSE Trading Hours

The London Stock Exchange Hours represent critical trading windows for one of Europe’s most influential financial markets, operating from 8:00 AM to 4:30 PM Greenwich Mean Time (GMT) or British Summer Time (BST) on weekdays. As Europe’s largest stock exchange by market capitalisation, the LSE facilitates billions in daily transactions across equities, bonds, and derivatives, making its operating hours essential knowledge for global investors seeking exposure to UK and European markets.

The strategic positioning of LSE hours creates unique opportunities for international traders, bridging Asian and American markets while providing crucial overlap with continental European exchanges. Understanding these trading windows enables investors to optimise execution quality, capitalise on cross-market arbitrage opportunities, and effectively manage risk exposure across multiple time zones and currency pairs.

Standard LSE Operating Schedule

The LSE maintains a structured trading day beginning with a pre-opening auction from 7:50 AM to 8:00 AM, allowing market participants to submit, modify, and cancel orders before continuous trading commences. The main trading session runs from 8:00 AM to 4:30 PM, providing eight and a half hours of continuous trading across all listed securities. This extended session accommodates both domestic and international participants, ensuring robust liquidity throughout the European business day.

The closing auction occurs from 4:30 PM to 4:35 PM, establishing official closing prices used for index calculations, portfolio valuations, and settlement purposes. This structured approach ensures orderly price discovery at market open and close, reducing volatility and improving execution quality for institutional and retail investors alike.

Opening and Closing Auction Mechanisms

The LSE’s opening auction represents a sophisticated price discovery mechanism that aggregates overnight order flow and establishes fair opening prices for all securities. During the ten-minute auction period, participants can submit limit and market orders that are continuously matched using a volume-maximising algorithm. This process ensures that opening prices reflect true supply and demand dynamics rather than overnight volatility or thin pre-market trading.

The closing auction serves an equally critical function, determining official closing prices that feed into FTSE index calculations and serve as reference prices for derivatives settlement. Institutional investors frequently utilise the closing auction to execute large orders with minimal market impact, as the auction mechanism provides deep liquidity and reduces implementation shortfall compared to intraday trading.

Both auction periods feature random end times within specified windows, preventing gaming strategies and ensuring fair price formation. This uncertainty forces participants to reveal true trading intentions rather than attempting to manipulate auction prices through last-second order submissions or cancellations.

British Summer Time Impact on LSE Hours

⚠️ Important for International Traders

British Summer Time transitions affect trading session overlaps with global markets, particularly impacting coordination with US and Asian exchanges.

British Summer Time significantly impacts international trading dynamics by shifting LSE hours relative to other global markets. When the UK transitions to BST in late March, the LSE effectively opens one hour earlier relative to markets that don’t observe daylight saving time, altering crucial overlap periods with Asian markets closing and affecting the timing of economic data releases from continental Europe.

The BST transition creates particular challenges for algorithmic trading systems and international portfolio managers who must recalibrate their strategies to account for changing overlap windows. The shift affects currency pair volatility patterns, as the GBP/USD and EUR/GBP pairs experience altered liquidity profiles when London and New York session overlaps change seasonally.

International investors must carefully track these transitions, as they affect not only trading hours but also settlement cycles, corporate action processing, and the timing of market-moving economic releases from the Bank of England and UK statistical offices.

Trading Systems and Market Segments

The LSE operates multiple trading systems optimised for different security types and liquidity profiles. The Stock Exchange Electronic Trading Service (SETS) handles the most liquid securities, including FTSE 100 and FTSE 250 constituents, providing continuous electronic order matching with opening and closing auctions. This system processes thousands of orders per second, ensuring tight spreads and deep liquidity for blue-chip securities.

SETSqx serves mid-cap and small-cap securities with periodic auctions throughout the trading day, supplemented by market maker quotes to ensure continuous liquidity. This hybrid model balances the benefits of auction-based price discovery with the liquidity provision of traditional market making, particularly important for less frequently traded securities.

Understanding these different trading mechanisms proves essential for optimising execution strategies, as order types, timing considerations, and liquidity patterns vary significantly between SETS and SETSqx securities. Professional traders often adjust their algorithms based on which system handles their target securities.

Bank Holidays and Market Closures

The LSE observes UK bank holidays, closing completely on New Year’s Day, Good Friday, Easter Monday, Early May Bank Holiday, Spring Bank Holiday, Summer Bank Holiday, Christmas Day, and Boxing Day. These closures affect not only equity trading but also settlement cycles, corporate actions processing, and derivative expiries, requiring careful planning from institutional investors managing multi-day positions.

Unlike some international exchanges, the LSE typically doesn’t operate half-day sessions, maintaining full trading hours on days preceding holidays unless extraordinary circumstances warrant early closure. International investors must account for these UK-specific holidays when managing currency hedges, as forex markets remain open while UK equity markets close, potentially creating basis risk in hedged positions.

Global Market Coordination and Cross-Exchange Dynamics

LSE hours create strategic overlaps with major global exchanges, positioning London as a crucial hub for international capital flows. The morning session overlaps with late Asian trading, allowing arbitrage opportunities between London-listed mining companies and Asian commodity markets. The afternoon provides several hours of simultaneous trading with New York, facilitating transatlantic capital flows and cross-listed security arbitrage.

European market coordination proves particularly important, as the LSE operates concurrently with Frankfurt, Paris, Amsterdam, and other continental exchanges. This synchronisation enables efficient execution of pan-European investment strategies and supports the deep liquidity in Euro-denominated instruments traded in London.

The timing of UK economic data releases, typically at 9:30 AM GMT, falls within active LSE trading hours, creating immediate price discovery opportunities and heightened volatility in sterling-denominated assets. Traders must prepare for these scheduled releases, adjusting position sizes and implementing appropriate risk controls ahead of potentially market-moving announcements.

Post-Brexit Trading Landscape

Brexit has reshaped the LSE’s role in European capital markets, with trading hours remaining unchanged but market dynamics evolving significantly. The shift in euro-denominated share trading from London to continental venues has altered liquidity patterns during LSE hours, particularly affecting dual-listed securities and European company ADRs.

Despite regulatory changes, LSE hours continue to anchor global trading in many asset classes, particularly commodities, emerging market debt, and forex. The exchange’s position as a listing venue for international companies ensures continued relevance of its trading hours for global portfolio managers, regardless of evolving EU-UK regulatory frameworks.

Technology Infrastructure and Trading Evolution

Modern electronic trading infrastructure has transformed how market participants interact with LSE hours. High-frequency trading firms co-locate servers in LSE data centres to minimise latency during active trading hours, executing thousands of trades within microseconds of market events. This technological arms race has compressed effective trading time, as competitive advantages now measure in nanoseconds rather than seconds.

The LSE’s Millennium Exchange platform processes over 500,000 messages per second during peak hours, supporting sophisticated order types and complex execution algorithms. Understanding peak activity periods within LSE hours helps traders optimise their strategies, as liquidity and volatility patterns vary predictably throughout the trading day.

Strategic Timing for Optimal Trading Results

Successful trading on the LSE requires understanding intraday patterns within standard hours. The first hour typically exhibits heightened volatility as overnight news gets priced in and institutional orders execute. Mid-morning often provides optimal liquidity conditions for large trades, while lunch hours may see reduced activity as traders pause for the midday break.

The afternoon session gains momentum as US markets prepare to open, with the 2:30 PM GMT/BST period marking peak liquidity when London and New York sessions overlap. Smart traders leverage these patterns, timing their executions to minimise market impact and capture optimal prices.

Month-end and quarter-end effects become pronounced during LSE hours, as institutional rebalancing activities concentrate in the closing auction. Understanding these cyclical patterns enables traders to anticipate increased volatility and adjust their strategies accordingly, particularly for index-tracking funds and pension portfolios requiring periodic rebalancing.

Key Takeaways for LSE Traders and Investors

✓ Auction Opportunities

Opening and closing auctions provide deep liquidity for large orders with minimal market impact.

✓ BST Transitions

British Summer Time shifts affect global market overlaps and require strategy adjustments.

✓ Strategic Positioning

LSE hours bridge Asian and American markets, creating unique arbitrage opportunities.

✓ System Knowledge

Understanding SETS vs SETSqx trading mechanisms optimises execution strategies.