The Pip Value Calculator

In the dynamic world of Forex trading, precision, and knowledge are the cornerstones of success. Every move, every decision, and every trade must be executed with utmost accuracy. This is where the Pip Value Calculator comes into play, serving as a vital tool in the arsenal of traders. In this blog, we’ll explore how this tool works, its significance in trading, and how to make the most of it.

Understanding the Pip Value Calculator

The Pip Value Calculator is a potent instrument that accurately calculates the value of a pip, a foundational unit of price movement in the Forex market. A pip is, quite simply, the smallest price change a currency pair can undergo. It’s the heartbeat of Forex trading, and understanding its value is paramount for any trader.

This versatile tool takes into account several critical variables:

- Live Market Quote: It hinges on real-time market data, ensuring that the calculated pip value is current and precise.

- Account Base Currency: Your trading account’s base currency plays a central role in this calculation. It affects the value of a pip, and choosing the right base currency ensures accuracy.

- Trading Pair: Forex trading encompasses a vast array of currency pairs, each with its own unique characteristics. The Pip Value Calculator adapts to these pairs, making it a versatile companion for traders.

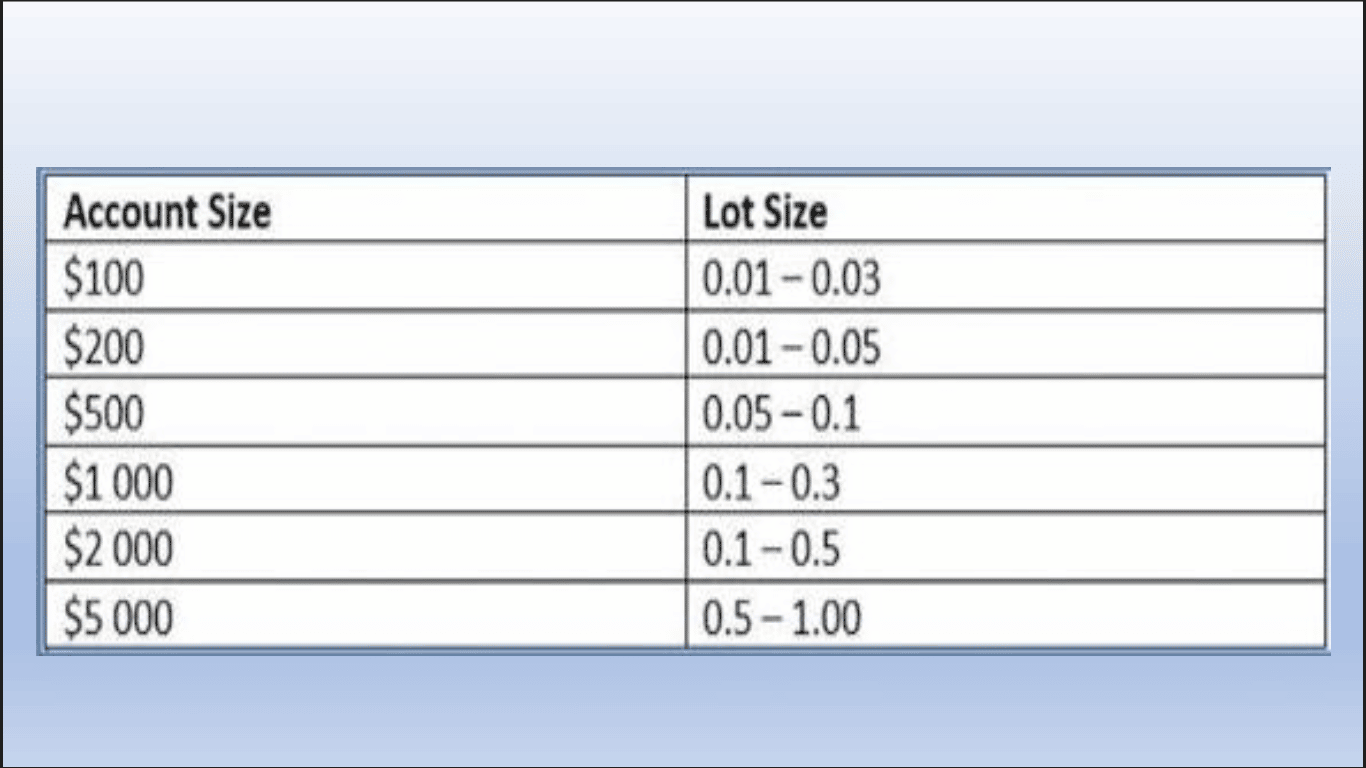

- Lot Size: The size of your trading position, often measured in lots, can significantly impact the value of a pip. The Pip Value Calculator considers this when generating its results.

- Instrument Flexibility: This tool isn’t limited to Forex; it can be utilized for indexes, cryptocurrencies, and more. Its adaptability makes it a must-have for traders of various financial instruments.

The Significance of Pips in Forex Trading

Pips, in Forex, are akin to inches on a ruler; they measure the distance a currency pair moves. To truly master the art of trading, understanding pips, and their value is imperative. It enables traders to gauge potential profits and determine stop-loss levels effectively.

For instance, some traders aim for a profit of 30 pips per trade, while others have a target of 25 pips based on their unique trading style. When the price moves 30 pips in your favor, it might be time to consider securing your profit and potentially leaving a portion of the trade open if you believe further gains are possible. While doing so, it’s wise to set a stop-loss to protect your gains, usually around 15 pips, ensuring that you don’t lose the profit you’ve already secured.

Pip Value Discrepancies and the Calculator’s Role

Pip values aren’t universal; they differ from one trading pair to another due to varying market rates. This is where the Pip Value Calculator becomes indispensable, especially when you’re dealing with a new currency pair. By utilizing this calculator, traders can quickly discern the pip value, aiding them in determining lot sizes, setting stop-loss levels, and establishing profit-taking strategies.

For the majority of currency pairs, a single pip is equivalent to 0.0001, while for pairs involving the Japanese Yen, such as USD/JPY, it’s 0.01. Precious metals like Gold and Silver share this 0.01 pip value.

With the rise of 5-digit pricing, pips can also be expressed as fractions known as ‘pipettes.’ If, for instance, the EUR/USD moves from 1.09255 to 1.09260, this movement represents half a pip.

Pips Calculator: A Step-by-Step Guide

Let’s break down how to effectively use the Pip Value Calculator:

- Instrument Selection: Start by choosing the trading instrument you’re interested in. You have the flexibility to select from major Forex crosses, minor pairs, exotic currencies, popular cryptocurrencies like ADA, BTC, ETH, LTC, and XRP, and various commodities like Gold, Silver, and Oil. For this demonstration, we’ll opt for the EUR/USD pair.

- Trade Size: Forex pairs are typically traded in lots of 100,000 units. However, for non-Forex pairs, units per lot may vary. You can also choose to calculate pip value based on lots traded or units traded. For our example, let’s consider a trading size of 10,000 currency units, equivalent to 0.10 mini-lots.

- Deposit Currency: The pip value varies for each FX pair and cryptocurrency cross. Additionally, pip values are influenced by the latest market and exchange quotes. To ensure an accurate calculation of the pip value, select your account’s base currency in this field, which can range from AUD to ZAR. For our demonstration, we’ll select EUR as our deposit currency.

- Calculation: Click the “Calculate” button to generate your results.

Pips Calculator Results

The Pip Value Calculator relies on real-time market data with the current interbank rate, displayed in a 5-digit format. It promptly reveals the pip value based on your selected account-based currency. In our example, where we’re using EUR as our deposit currency, the pip value for a 0.10 lot of EUR/USD, with a market rate of 1.21580, is €0.8225.

In Conclusion:

In the realm of Forex trading, where precision is paramount, the Pip Value Calculator emerges as a guiding light. It empowers traders to make informed decisions, calculate pip values with accuracy, and plan their trades meticulously. Understanding the value of pips is fundamental for managing risk, defining lot sizes, setting stop-loss levels, and formulating profit-taking strategies.

This versatile tool is not limited to Forex; it extends its capabilities to indexes, cryptocurrencies, and commodities. With its adaptability, it caters to the diverse needs of traders, offering precision and clarity in a world where every pip counts.

As you venture into the dynamic world of Forex trading, remember that knowledge is power, and precision is your ally. The Pip Value Calculator equips you with both, ensuring that you navigate the market with confidence and acumen, and make informed decisions to chart your path to success.

Important Links: Courses, Mentorship, YouTube Channel