Donald Trump’s recent announcement on Truth Social regarding the formation of a U.S. Crypto Reserve has sparked intense discussions across the crypto community. The former president detailed his plans for a Crypto Strategic Reserve, explicitly naming XRP, Solana (SOL), and Cardano (ADA) as key assets in this initiative. However, what stood out the most was Trump’s apparent afterthought regarding Bitcoin (BTC) and Ethereum (ETH)—a move that suggests a strategic shift away from the dominant narrative of Bitcoin being the centerpiece of the digital asset revolution.

XRP Takes the Lead—BTC and ETH as an Afterthought

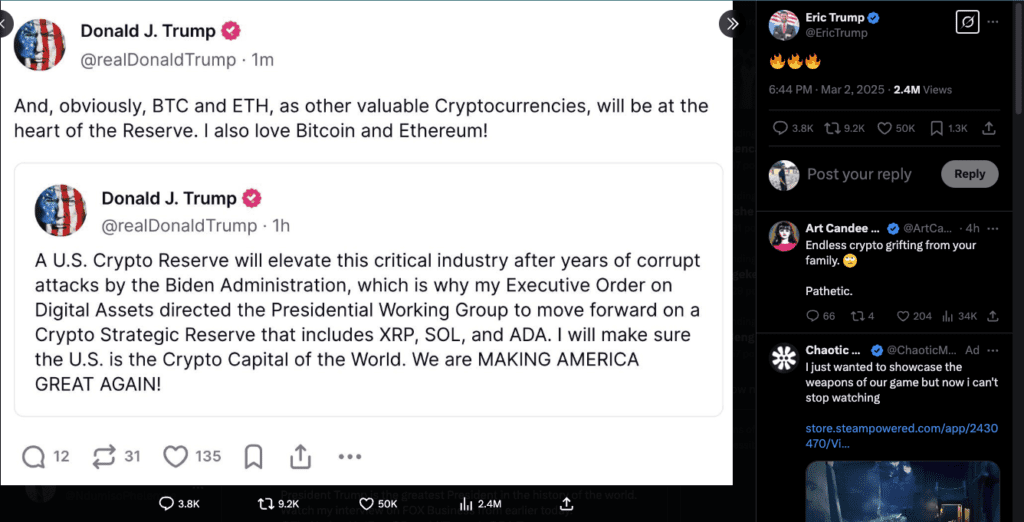

Trump’s original post made no mention of Bitcoin or Ethereum, instead focusing on XRP, SOL, and ADA as the foundation of the U.S. Crypto Reserve. It was only an hour later that he returned with a follow-up post, stating:

“And, obviously, BTC and ETH, as other valuable cryptocurrencies, will be at the heart of the Reserve. I also love Bitcoin and Ethereum!”

This sudden clarification raises questions—was Bitcoin’s exclusion in the initial post intentional? Did Trump realize the potential impact on BTC’s price if he failed to acknowledge it? Given his past statements during his presidential campaign about establishing a BTC Strategic Reserve, it’s possible that he felt compelled to balance the narrative to prevent a market sell-off.

But the fact remains: BTC was not his first choice. XRP, SOL, and ADA were the cryptos that took center stage in the initial announcement.

Bitcoin’s Lack of Utility: Just a Store of Value?

The fundamental issue with Bitcoin is that beyond being a store of value, it lacks real-world utility. Many argue that BTC is the digital equivalent of gold (XAU/USD), but that comparison is flawed. Gold has tangible uses—it is a raw material for jewelry, electronics, and even medicine. Bitcoin, on the other hand, is simply a piece of code that derives value from speculation and market hype.

What does BTC store, apart from emotions?

The Bitcoin network is slow, expensive, and heavily reliant on new participants to sustain its price—resembling more of a Ponzi structure than a true decentralized financial system. The real innovation lies with assets like XRP, which have actual utility in cross-border payments, solving real problems in the global financial system.

Bitcoin: The Illusion of Decentralization

Bitcoin maximalists often tout decentralization as BTC’s strongest attribute. However, in practice, Bitcoin is far from decentralized:

- Mining is controlled by a handful of large players—those who can afford the expensive hardware and energy costs.

- Retail investors are at the mercy of whales, who manipulate the market to their advantage.

- Transaction fees are high, making Bitcoin impractical for everyday use.

In contrast, Pi Network, which allows anyone to mine from their phone, seems more aligned with the original vision of financial inclusion than BTC ever was.

XRP: The Future of the Monetary System?

Unlike Bitcoin, XRP is designed for real-world financial applications. It offers:

- Near-instant transactions

- Low fees

- Scalability for cross-border payments

With Trump’s endorsement of XRP as part of the U.S. Crypto Reserve, it is clear that utility-driven assets are the future of digital finance.

Regulations Will Expose Bitcoin’s Weakness—The Rise of Utility Coins Like XRP

One critical factor that many Bitcoin supporters fail to acknowledge is the artificial price inflation driven by stablecoins. The crypto market, especially BTC, has been heavily propped up by stablecoins like USDT (Tether), which are often printed without full transparency regarding their backing.

Once regulatory clarity arrives, the days of unchecked stablecoin issuance will come to an end. Governments and financial regulators will demand audits, stricter compliance, and transparency in the stablecoin sector. When that happens, a massive liquidity drain from BTC will occur, triggering a major reality check for investors.

At that point, the shift toward real utility-driven cryptocurrencies will be undeniable. Bitcoin, which thrives on speculative hype and institutional manipulation, will begin to fade as liquidity dries up. In contrast, assets like XRP, which solve real-world financial problems, will emerge as the dominant forces in the market.

The future of crypto belongs to utility, not speculation. And once regulations expose the shaky foundation propping up BTC, the market will have no choice but to crown assets like XRP as the true kings of digital finance.

Conclusion: Bitcoin’s Short-Term Success, Long-Term Uncertainty

Bitcoin will likely perform well in the near future, fueled by institutional adoption and continued speculation. However, in the long run, unless utility is introduced, Bitcoin’s relevance will fade. The slow, costly, and inefficient nature of BTC means that it cannot compete with more advanced blockchain solutions like XRP.

Trump’s announcement was a signal to the market—the future of crypto is not Bitcoin, but utility-driven assets. And while BTC may still have its place as a speculative store of value, the real transformation in the financial system will be led by XRP and similar assets with real-world use cases.