What are Order Blocks and Breakers?

Master the powerful reversal price action patterns used by professional traders for high-probability trade entries

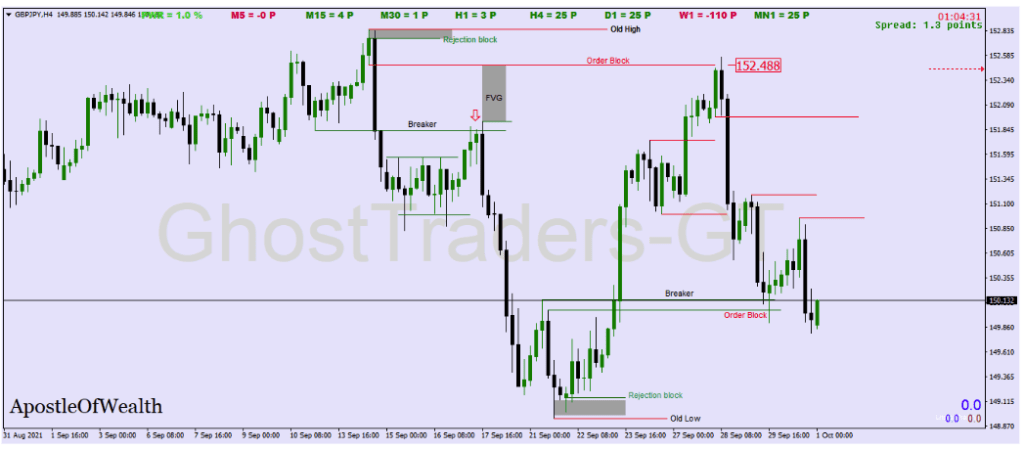

Order block and breakers are reversal price action patterns that are used for trade entries. Order blocks and breakers are visually different in a forex chart; an order block is represented by the last up/down candle that forms the highest high/lowest low in a swing point or a series of bullish and bearish candles, whilst a breaker is a swing low (in a bearish scenario) or swing high (in a bullish scenario) that initially launches a strong move to create a new high/low, but then gets broken when price reverses and trades through that original swing point, creating a lower low or higher high. The broken level then becomes a potential retracement target where we expect price to return.

Difference Between an order block and breakers

Key Differences Explained

Formation Process

Order blocks form from the last opposing candle before a strong directional move (the final bearish candle before bullish momentum or vice versa). Breakers form when an original swing point that launched a move gets broken by price returning through that same level, creating the opposite extreme.

Visual Identification

Order blocks appear as individual candles or a small series of candles that preceded a significant move. Breakers appear as horizontal levels where previous swing highs or lows existed before being violated.

Market Context

Order blocks represent areas where institutional orders likely accumulated before a breakout. Breakers represent previously broken structure that now serves as retracement magnets after the break created a new market structure.

Trading Psychology

Order blocks capitalize on institutional footprints left behind before major moves. Breakers exploit the tendency for price to return to recently broken levels, often involving liquidity grabs that trap retail traders.

Entry Timing

Order blocks require waiting for price to return to the originating candle area for entry. Breakers require waiting for price to retrace back to the broken swing level after it has been violated.

Risk Management

Order blocks use stops beyond the block boundary since the zone should hold. Breakers use stops beyond the breaker zone to protect against further manipulation around the broken level.

Both serve as high-probability reversal zones but represent different market dynamics and structural elements.

Breakers and Order Block Pros and Cons

Both breakers and order blocks are straightforward to identify on charts and relatively simple to learn for new traders.

Order Block Advantages

Order blocks demonstrate superior reliability with lower failure rates compared to breakers

They occur more frequently across different timeframes, providing traders with abundant opportunities

These setups offer excellent risk-to-reward ratios since the last opposing candle creates a clear, defined zone for entries

Stop loss placement becomes intuitive as traders can position stops just beyond the order block boundary

Since order blocks typically form at significant swing points, they naturally align with key market structure, making risk management more precise and predictable

Breaker Limitations

While breakers can be powerful setups, they carry higher uncertainty regarding retracement depth

Price may extend significantly beyond the expected breaker level before reversing, making position sizing and stop placement more challenging

The broken swing point doesn’t always provide as clear-cut a boundary as order blocks do

Breakers require the extra step of waiting for the original level to be broken before becoming valid, which can lead to missed opportunities or false signals

Overall Assessment: Order blocks generally provide more consistent and manageable trading setups due to their clearer boundaries and more predictable price behavior, while breakers require more experience to trade effectively due to their variable retracement patterns.

Ready to Master Smart Money Trading?

Take your trading to the next level with our comprehensive Smart Money Trading Course Bundle

Learn More