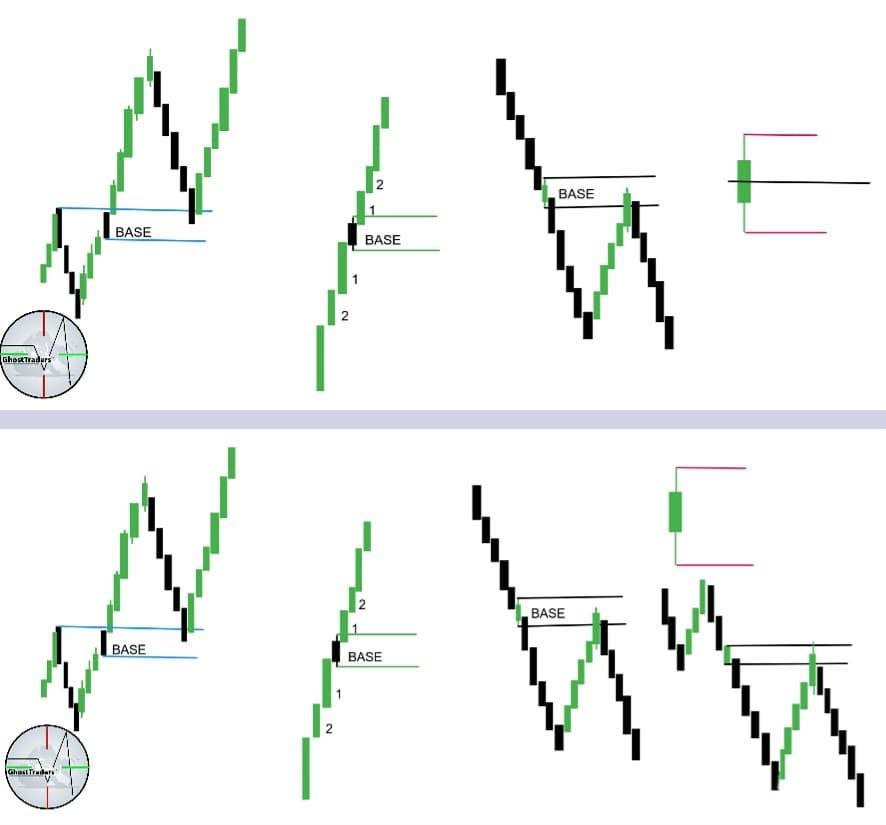

A base candlestick is a single candlestick that temporarily disrupts the prevailing market momentum by appearing in the middle of a sequence of at least four consecutive candlesticks in the opposite direction. There are two types of base candlesticks:

- A bearish base in forex is formed when a bullish candlestick appears between four consecutive bearish candlesticks.

- A bullish base in forex is formed when a bearish candlestick appears between four consecutive bullish candlesticks.

This initially indicates trend continuation, followed by a likely retracement before the price resumes its original direction. Note: A retracement and a reversal are not the same—do not confuse the two.

Retracement vs. Reversal (Brief Explanation)

- A retracement is a temporary pullback within a dominant trend before the price continues in the same direction.

- A reversal is a complete change in trend direction, where the market shifts from bullish to bearish (or vice versa).

Retracements are short-term corrections, while reversals signal a longer-term shift in market structure.

How to Trade Base Candlesticks in Forex

There are different ways to trade base candlesticks in forex, depending on the type of base. Base candlesticks serve as continuation patterns that traders use to identify potential entry positions.

How to Trade a Bearish Base

To trade a bearish base, traders wait for the base to form completely and then wait for a retracement into the bearish base. Once the price reaches the bearish base, traders can open sell positions.

Stop Loss Placement:

- Stop losses should be placed above the wicks of the bearish base candle.

- Before placing your stop loss, look for a potential fair value gap nearby or an order block that the price might reach.

How to Trade a Bullish Base

To trade a bullish base, traders wait for the base to form completely. Then, they wait for a pullback or retracement to the bullish base. Once the price reaches the bullish base again, traders can open buy positions.

Stop Loss Placement:

- Stop losses should be placed below the wicks or the low of the bullish base candle.

- Consider nearby support levels or an order block for potential stop-loss placement.

Trading base candlesticks requires patience and precision. By identifying these structures and using proper risk management, traders can increase their chances of executing high-probability trades.

Conclusion

Trading base candlesticks provide a strategic approach to identifying continuation patterns in the forex market. Whether trading a bearish base or a bullish base, patience is key—waiting for a proper retracement before entering ensures higher probability trades. Stop losses should be placed carefully, considering wicks, fair value gaps, and order blocks to manage risk effectively. By mastering base candlestick trading, traders can refine their entries and improve their overall market precision.