WHAT IS FX TRADING?

FX trading is the practice of buying and selling currencies in the foreign exchange market, where participants exchange one nation’s currency for another based on fluctuating exchange rates.

📈 The World’s Largest Financial Market

This global marketplace operates as a decentralized network of banks, brokers, corporations, and individual traders, facilitating currency exchanges for various purposes, ranging from international commerce to speculative investment.

To understand FX trading fundamentally, imagine you’re planning a trip from the United States to Europe. When you exchange your US dollars for euros at the airport, you’re participating in a basic form of foreign exchange. However, professional FX trading operates on a much larger scale and with more sophisticated strategies.

The currency exchange marketplace represents the most expansive financial arena globally, where trillions of dollars change hands each trading day. Unlike stock markets that operate during specific hours, the FX market functions continuously throughout the week, opening in Sydney on Sunday evening and closing in New York on Friday afternoon.

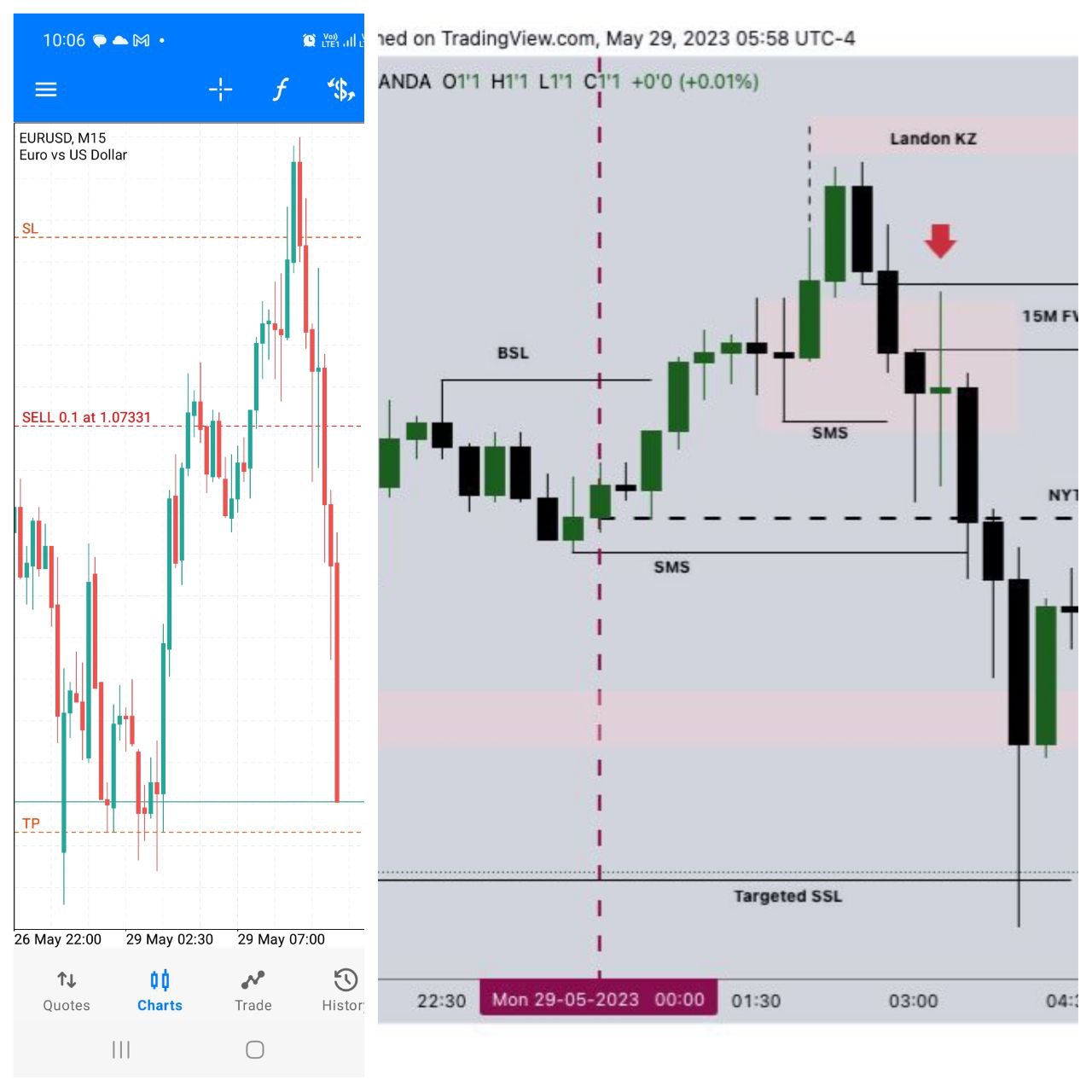

Currency pairs form the foundation of FX trading. Major pairs like EUR/USD (Euro against US Dollar) or GBP/JPY (British Pound against Japanese Yen) represent the most frequently traded combinations.

📊 How To Trade FX?

Trading begins with understanding that successful market participation requires systematic preparation rather than impulsive decision-making. Picture trading as learning to pilot an aircraft – you wouldn’t attempt to fly without proper training, understanding weather patterns, or knowing emergency procedures.

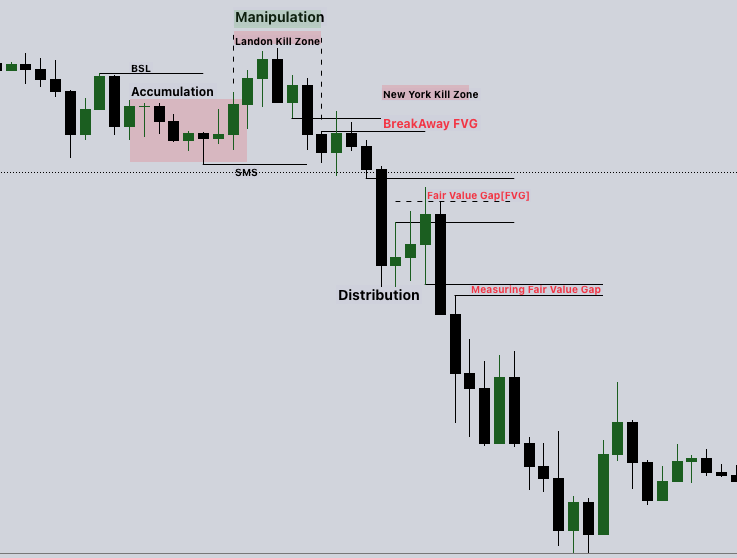

The foundation of trading starts with developing a structured approach to market analysis. This involves learning to read price charts, understanding market psychology, and recognizing patterns that indicate potential price movements.

Next, you must establish a trading plan that defines your entry and exit criteria. This plan functions like a roadmap, guiding your decisions when emotions run high during volatile market conditions.

🛡️ Risk Management: The Foundation of Success

Risk management represents perhaps the most crucial aspect of trading success. The fundamental principle centers on capital preservation rather than profit maximization. Professional traders understand that protecting their trading capital is far more important than hitting home runs on individual trades.

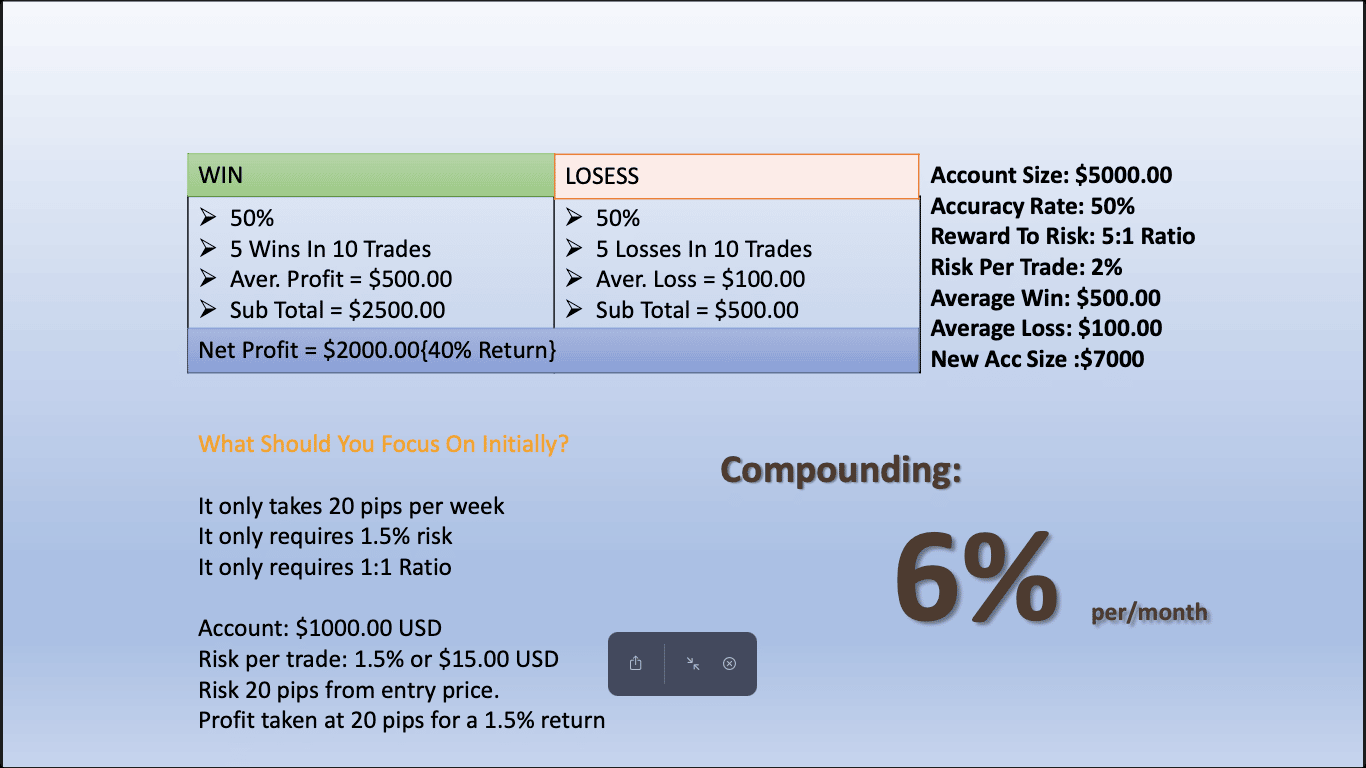

The golden rule involves never risking more than one to two percent of your total trading account on any single position. This conservative approach ensures that even during inevitable losing streaks, your account remains intact and capable of recovery.

Skilled traders typically target returns of five to ten percent per month. This might initially seem modest, but consider the mathematical power of compound growth. A consistent eight percent monthly return transforms into more than doubling your account annually.

If targeting five to ten percent monthly returns feels insufficient for your financial goals, this signals an undercapitalization problem rather than a strategy issue. The solution lies in proprietary firm funding rather than reckless risk management.

🧠 Understanding Market Psychology

Understanding market psychology becomes increasingly important as you progress. The market is a complex web of intentions, creating unpredictability that no one can fully grasp. This uncertainty isn’t something to fear but rather to embrace as the source of all trading opportunities.

Successful trading requires adopting probabilistic thinking. Trading is a game of probabilities, not certainties. Rather than trying to predict specific outcomes, you focus on identifying favorable probabilities and letting the law of large numbers work in your favor.

Every trade exists as an independent event, unconnected to your previous successes or failures. The market has no memory, and the outcome of one trade does not influence the next.

🎓 Master Trading with GhostTraders

To truly master trading, you need guidance from experienced professionals who understand institutional trading methods. This is where GhostTraders becomes invaluable for your educational journey.

Their approach focuses on institutional trading principles rather than outdated retail methods. The Smart Money Trading Course teaches advanced concepts like order blocks, fair value gaps, and liquidity manipulation.

Begin your journey by exploring their comprehensive course offerings, where you can access both free and premium content. For personalized guidance, consider their mentorship program.

Start Your FX Trading Journey Today

Ready to transform your trading approach with institutional strategies?

Explore GhostTraders courses and discover the same methods used by professional traders worldwide.