In trading, patterns tell powerful stories about where the market has been and where it may be going. Two of the most fundamental patterns you will encounter are higher highs and lower lows. These terms are often used when analyzing market trends, and mastering them can dramatically improve your decision-making as a trader.

Whether you are trading forex, stocks, or cryptocurrencies, understanding higher highs and lower lows gives you clarity in identifying bullish or bearish momentum.

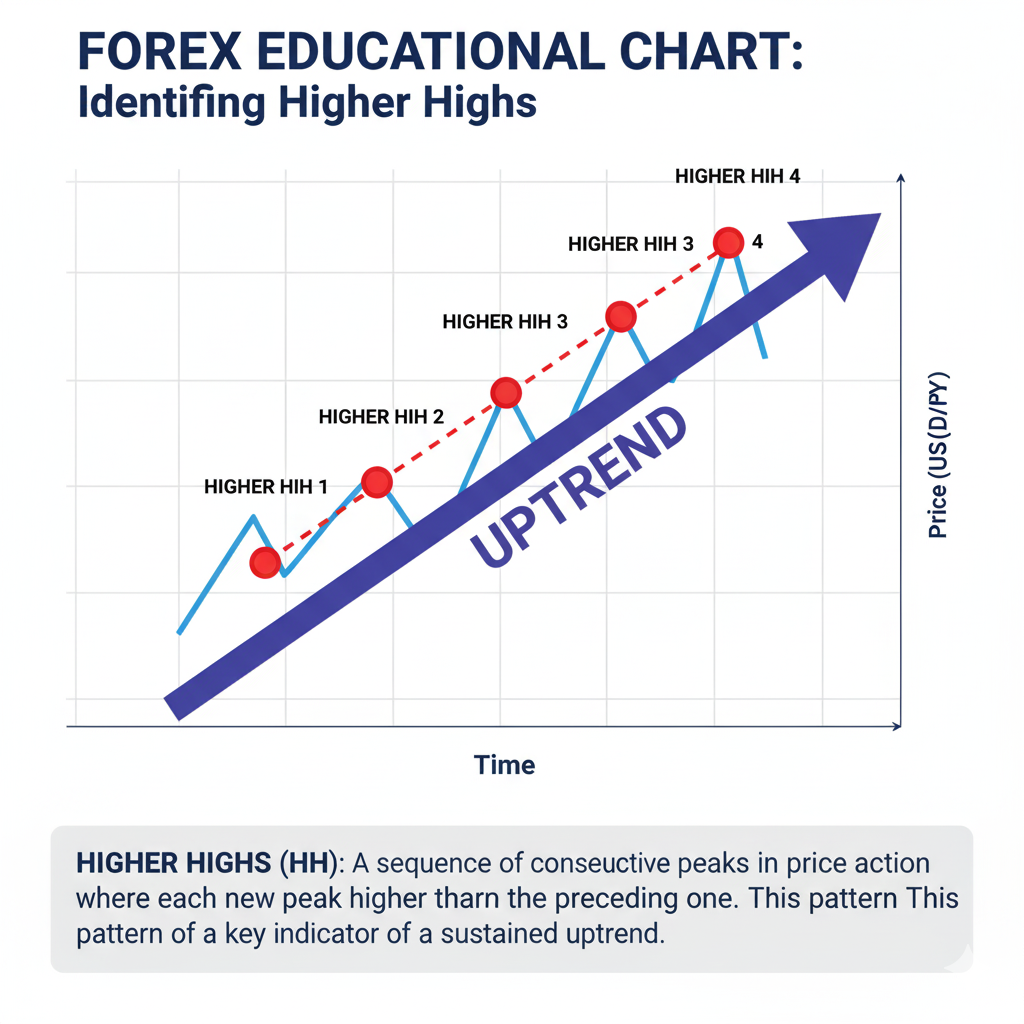

What Are Higher Highs?

Higher highs are a series of price peaks in a chart where each new peak is higher than the previous one, signaling an uptrend or bullish market. This pattern indicates that buying pressure is strong, and the asset’s price is consistently rising, which can attract more buyers and create further upward momentum

This signals:

- Buyers (bulls) are in control.

- Demand is stronger than supply.

- The trend direction is upward.

Example of Higher Highs

Imagine the EUR/USD pair rises to 1.0800, pulls back to 1.0700, then climbs again to 1.0850. The new peak at 1.0850 is a higher high compared to 1.0800, showing bullish strength.

Traders often pair this with higher lows (when each dip bottoms out higher than the previous dip) to confirm a bullish trend.

What Are Lower Lows?

A lower low is the opposite. It occurs when the price forms a new bottom that is lower than the previous one. Each time the market falls, it dips further than before.

Lower lows are a technical analysis pattern where a security’s price falls to a new low that is below its previous low. This indicates a downtrend, showing that sellers are dominant and the asset’s value is likely to continue decreasing. Traders look for lower lows to confirm bearish sentiment, make decisions on when to exit long positions, or consider entering short positions

This signals:

- Sellers (bears) are in control.

- Supply outweighs demand.

- The trend direction is downward.

Example of Lower Lows

Suppose Bitcoin falls from $30,000 to $29,000, bounces up slightly, then drops again to $28,500. The move to $28,500 creates a lower low compared to $29,000, confirming bearish momentum.

When lower lows are paired with lower highs (each recovery fails to reach the level of the previous one), this confirms a bearish trend.

Why Higher Highs and Lower Lows Matter

These patterns form the foundation of trend analysis. Without recognizing them, you may trade against the prevailing trend, increasing your risk of losses.

- Bullish trends = Higher highs and higher lows.

- Bearish trends = Lower lows and lower highs.

- Sideways markets = Neither pattern dominates, indicating consolidation.

Understanding this structure helps traders:

- Spot entry and exit opportunities.

- Place stop-loss orders with precision.

- Align with the dominant market trend rather than fighting it.

Practical Trading Tips

- Combine with Indicators

Use moving averages, RSI, or MACD alongside price structure for stronger confirmations. - Timeframe Matters

A bullish trend on a 5-minute chart may be insignificant compared to a bearish trend on the daily chart. Always analyze multiple timeframes. - Wait for Confirmation

One higher high or lower low does not make a trend. Look for a series of them before acting. - Risk Management First

Even if the structure points in your favor, unexpected news or volatility can reverse trends. Always manage your risk.

Key Takeaway

Higher highs and lower lows are not just terms; they are the very language of market trends. Traders who master this concept can identify whether the market is in an uptrend, a downtrend, or moving sideways. By combining this price action knowledge with solid risk management, you set yourself apart from traders who rely on guesswork.

At GhostTraders, we believe the foundation of profitable trading begins with mastering price action basics. Recognize the story the market is telling through its highs and lows, and you will trade with more confidence and precision.