Definition

Pips are currency price changes in forex. The term “pips” stands for “percentage in points”.Forex pairs (like GBP/USD) change by micro units throughout the trading day and pips indicate this price movement in forex pairs. you can calculate pips using trading platforms like Metatrader or a charting platform like TradingView which has built-in tools to calculate pips(we have placed videos below showing how to calculate using each platform).

Pips represent 1/100ths of a percentage and are defined as basis points. Currency pairs have four digits. Hence, if the price of USDZAR decreases by 0.01%, it is a negative movement of one pip and a five-pip increase would be equivalent to an increase of 0.05%.

In forex, pip values are also used to determine profit and loss. For example, buying USD/ZAR at 17.0037 and cashing out at 17.0067 will generate a 30 pip gain. The value of a pip depends on the forex pair, for example, 1 pip per standard lot size of 1 is equal to 10 USD in GBP/USD Pair whilst it’s equal to 0.551 USD on EUR/ZAR. You can calculate the value of the pip using this tool:

How To Calculate Pips On MetaTrader 4(MT4) and MetaTrader 5(MT5)

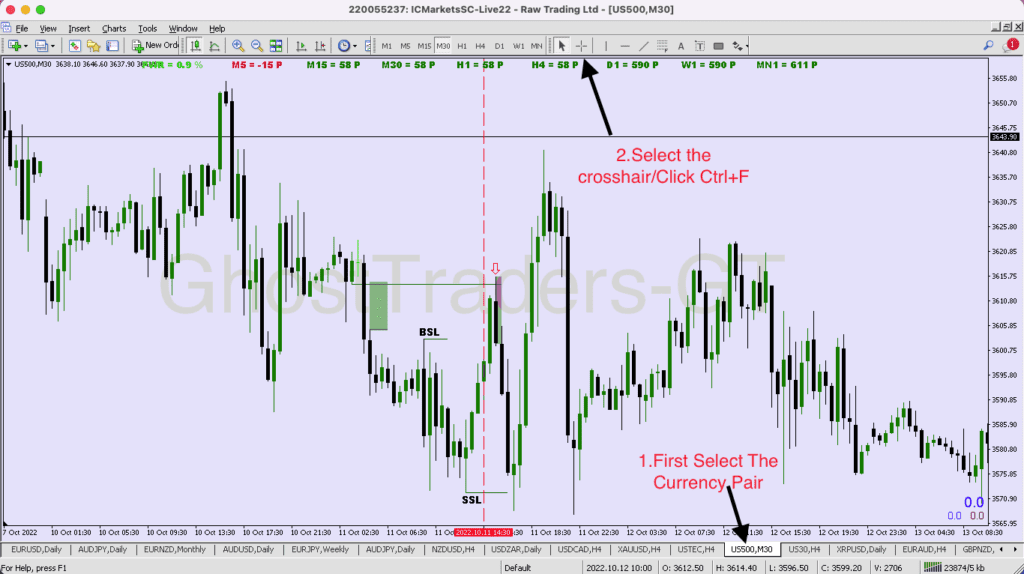

You can calculate the number of pips in MetaTrader 4 by using the crosshair. by default, MetaTrader 4 will be on the cursor therefore you will have to switch by navigating to the crosshair and clicking it then left-click and hold while moving your mouse from the entry-level to the exit level or from the entry-level to the stop loss to measure how much is your risk.

In This video, I will show you How To Calculate Pips In MetaTrader 4. In Metatrader 4 pips are measured in points therefore after calculating the number of pips in points divide by ten to get the actual number of pips.

how to measure pips on Tradingview

You can calculate the number of pips in tradingview using a measurement tool, price range calculator, and long and short position calculator. In This Video Below, I will show you How To Calculate Pips On TradingView in three ways

What’s the difference between pips, points, and ticks

In the intricate realm of finance, precise terminology is paramount for accurately gauging price fluctuations. Three terms often used interchangeably but with distinct meanings, play a crucial role in this understanding: points, ticks, and pips.

Point:

- Represents the smallest whole-number price increment change.

- They are primarily utilized in futures markets, denoting changes on the left side of the decimal.

- Example: A futures contract shifting from $100 to $101 constitutes a 1-point change.

Tick:

- Signifies the smallest possible price movement to the right of the decimal.

- Applicable across various markets, including futures, options, and some stocks.

- Values may differ; for instance, some futures contracts move in 0.01 increments, while others move in 0.25.

- Illustration: A stock priced at $10.50 experiencing a shift to $10.51 signifies a single tick.

Pip:

- An abbreviation for “percentage in point,” primarily associated with currency pairs’ exchange rates.

- Typically denotes the smallest price change in the fourth decimal place.

- Example: The EUR/USD pair moving from 1.2345 to 1.2346 represents a 1-pip change.

Additional Points:

- In forex, “points” may also refer to the fifth decimal place, creating potential confusion with pips.

- While “tick” commonly denotes individual price movements, it can also reference the entire transaction log in specific contexts.

- Selecting the appropriate term hinges on the specific market and context.

By comprehending the disparities between pips, points, and ticks, you empower yourself to adeptly track price movements and make informed financial decisions. Remember, clarity in terminology is the bedrock of financial acumen.

The Ideal Number of Pips A Trader Should Target

The ideal number of pips a trader can target per trade is 20-30 pips. if you are a swing trader or position trader you can target 100 pips and above but always pay yourself when the price reaches 30 pips then leave partials running to your targeted price level.

It would help if you always had your stop loss in profit in case price retraces too much. for example, if price moves 50 pips in your favor move stop loss and secure at least 25-30 pips. learn to pay yourself first as a trader.

Learn From our Freemium and Premium Trading Course