As a trader in South Africa, the allure of quick gains has often drawn me towards the vibrant world of cryptocurrency trading. But, like many of you, I’ve traversed the volatile waters of both crypto and forex markets, learning to navigate with a mix of caution, strategy, and a bit of humor about my missteps along the way.

The Lure of Cryptocurrencies

Crypto trading, I must admit, is like riding a rollercoaster with tickets to both heaven and hell. The promise of high returns in a blink can be intoxicating. I’ve seen coins skyrocket in value within minutes, giving me that adrenaline rush that is both terrifying and exhilarating. This volatility, while a double-edged sword, has occasionally tipped in my favor. Imagine the thrill when a coin you’ve invested in, perhaps on a whim after too much coffee, suddenly decides to moonshot!

Moreover, the lower transaction fees on crypto platforms compared to traditional forex markets are like a small pat on the back after each trade, helping me keep more of my hard-earned gains.

The Information Abyss

However, diving into the crypto market often feels like being handed a map where half the landmarks are missing. Information scarcity is a real beast here. I’ve spent countless hours sifting through forums, news, and data aggregators like CoinGecko, only to question their reliability. The crypto space is young, and like a toddler, it’s still learning to walk without falling over. This lack of reliable data makes planning for consistent gains as challenging as predicting the weather in Johannesburg during summer.

The Steady Ship of Forex

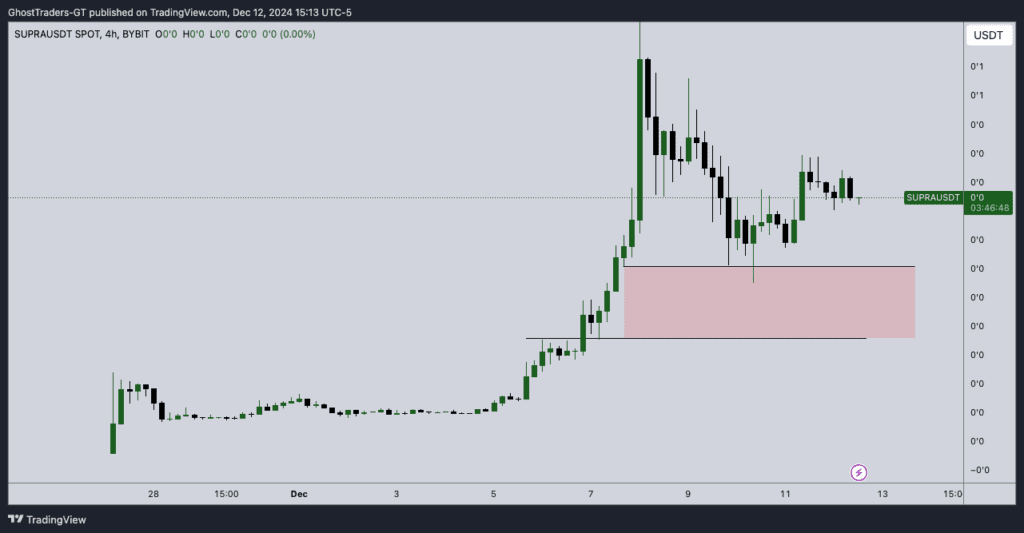

On the flip side, forex trading feels like sailing with a well-equipped vessel. The market is mature, offering a plethora of tools and resources. Platforms like GhostTraders and TradingView are like my personal weather stations, giving me a heads-up on economic events that could affect my trades. Knowing that EUR/USD might wobble between 95 and 217 pips daily provides a comforting predictability, unlike the Wild West of crypto, where markets can be dead calm or a hurricane of activity with little warning.

Trading with Both Feet

I’ve learned to juggle both worlds, using platforms like ICMarkets where I can switch from forex to crypto with ease. This flexibility is crucial for someone like me who enjoys the thrill of crypto but relies on the steadiness of forex for that consistent bread and butter.

Conclusion: Where I Lay My Hat

If I’m being brutally honest, while crypto can make you feel like you’re on top of the world or at its bottom, forex offers a more reliable path to steady returns. It’s like choosing between a high-stakes poker game and a well-played chess match. Yes, crypto has its moments of glory, but for those realistic, consistent profits? My vote goes to Forex, with its regulated environment and clearer skies for navigation.

So, for fellow traders out here in ZA or anywhere else, remember: whether you’re chasing the crypto dragon or sailing the forex seas, it’s all about strategy, information, and a dash of humor to keep you sane in this wild, wild world of trading. Here’s to hoping your trades are as successful as your next braai!