The Central Bank Dealers Range (CBDR) is a pivotal concept in smart money trading, focusing on the price behavior that unfolds during the start of a trading day or session. The CBDR helps traders understand how large financial institutions—including central banks—create liquidity and manipulate the market within a well-defined range. By mastering this range, traders can anticipate market direction, avoid false moves, and trade with institutional flow.

What is the Central Bank Dealers Range (CBDR)?

The Central Bank Dealers Range (CBDR) refers to a specific time-based range that marks institutional activity in the early hours of a trading session. During this period, large institutions—including central banks, market makers, and institutional dealers—enter and adjust their positions, setting the groundwork for price movements throughout the day.

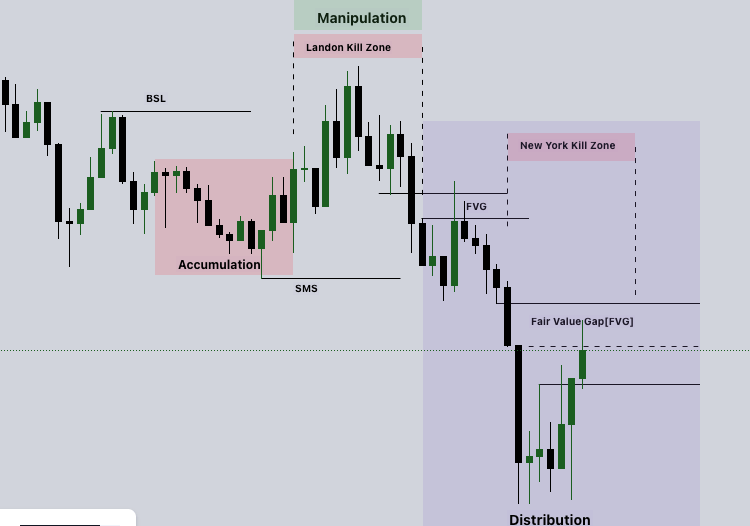

This range typically includes:

- Accumulation of Orders: Institutions consolidate positions before driving price direction.

- Liquidity Hunts: False breakouts and stop-hunts are common within the CBDR to generate liquidity.

- Session Bias Establishment: The price behavior during the CBDR often provides clues about the daily market bias—whether the market will trend upward, downward, or stay in a range.

How Institutions Use the CBDR

Central banks and other large institutions use the CBDR to accumulate positions, gather liquidity, and assess market conditions before taking the market in a specific direction. For smart money, the CBDR serves as a time to manipulate price briefly—triggering stop-losses or drawing in retail traders on the wrong side of the market.

Here’s how it works:

- Order Placement: Institutions place large orders without causing drastic moves in the market.

- False Breakouts: They push price into liquidity zones (above highs or below lows) to trigger stop-hunts.

- Setting the Day’s Direction: After gathering liquidity, the market often breaks out of the CBDR, setting the tone for the rest of the trading session.

How to Identify the CBDR on a Chart

The CBDR is typically based on a fixed time window during the start of major sessions—often between 2:00 AM and 5:00 AM New York time or during the Asian session. This window marks the early institutional activity that influences price direction in the London and New York sessions.

Here’s how to mark the CBDR on your chart:

- Select the Relevant Period:

- For the New York session, mark the range from 2:00 AM to 5:00 AM (EST).

- For the London session, use the Asian session range (e.g., 11:00 PM to 2:00 AM GMT).

- Identify the High and Low of the Range:

Mark the highest and lowest points within the time window. These levels represent the CBDR boundaries. - Watch for Price Behavior Around the Range:

The market will often make a false breakout from the CBDR before setting the true direction for the session. This is where liquidity hunts occur.

How to Trade the CBDR Effectively

Once you’ve identified the CBDR, the next step is to trade with the institutional flow by anticipating how the market will behave around the range. Below are two common strategies for trading the CBDR.

Strategy 1: CBDR Liquidity Grab Setup

A common tactic institutions use is to trigger a liquidity grab—pushing price outside the CBDR temporarily to trap retail traders. Once liquidity is collected, price reverses and moves in the intended direction.

How to Trade the Liquidity Grab:

- Mark the CBDR High and Low: Identify the range during the early session.

- Wait for a False Breakout: Let the price break above or below the CBDR boundary to trigger stops and collect liquidity.

- Enter on Reversal: Once price reverses and re-enters the range, take a position in the opposite direction of the initial breakout.

- Stop-Loss and Target: Place your stop-loss just beyond the liquidity zone and target the next key level, such as the previous session’s high/low or a significant support/resistance area.

Strategy 2: CBDR Breakout Continuation Setup

In some cases, after the accumulation within the CBDR, institutions drive the price in one direction without a significant reversal. This creates a breakout from the CBDR that leads to a continuation trend throughout the session.

How to Trade the Breakout:

- Identify the CBDR Range: Mark the high and low points from the selected time window.

- Wait for a Clean Breakout: If the price breaks out without re-entering the range, this signals a potential continuation trade.

- Enter on Retest: After the breakout, wait for a retest of the range boundary to confirm the trend. Enter the trade after confirmation.

- Stop-Loss and Target: Set your stop-loss below the breakout candle (for longs) or above it (for shorts). Aim for key levels like the next session high/low or Fibonacci extensions for profit-taking.

Using CBDR with Other Smart Money Concepts

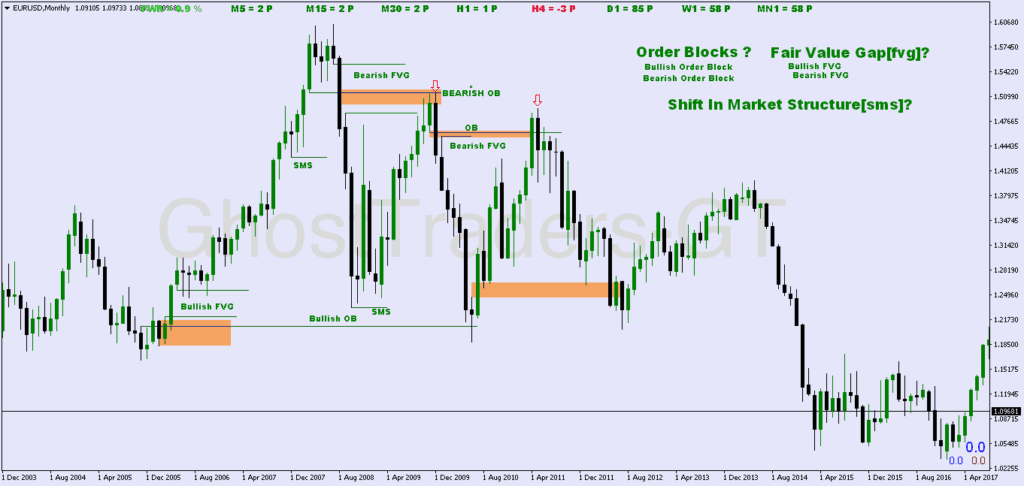

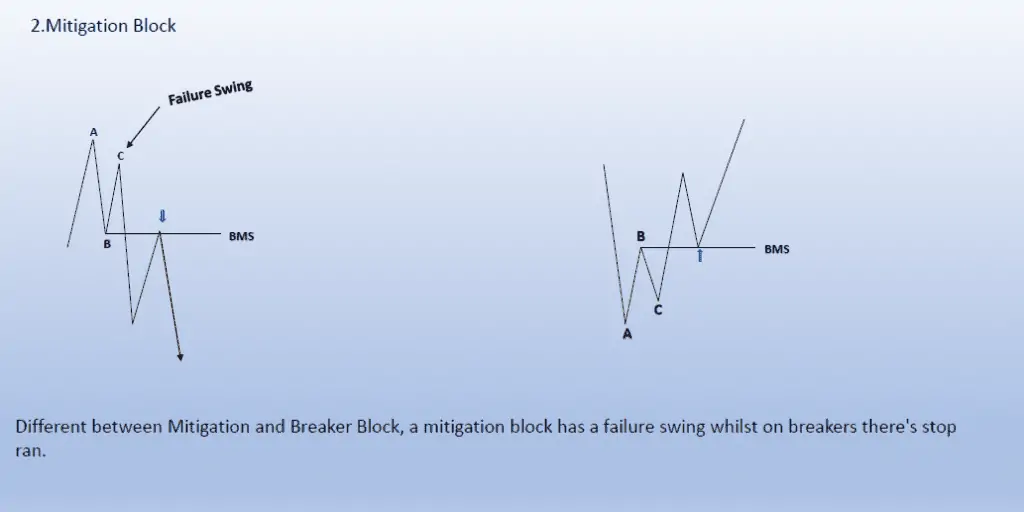

Combining the CBDR with other smart money tools—such as order blocks, mitigation blocks, and market structure shifts—can improve your chances of identifying high-probability setups.

- CBDR + Order Blocks:

- Look for order blocks formed near the CBDR boundary. If price retests the order block during the session, this creates a strong entry point.

- CBDR + Market Structure Shifts (MSS):

- If the market structure shifts immediately after the CBDR, it signals that smart money has set the day’s bias. Use MSS to confirm the new trend direction.

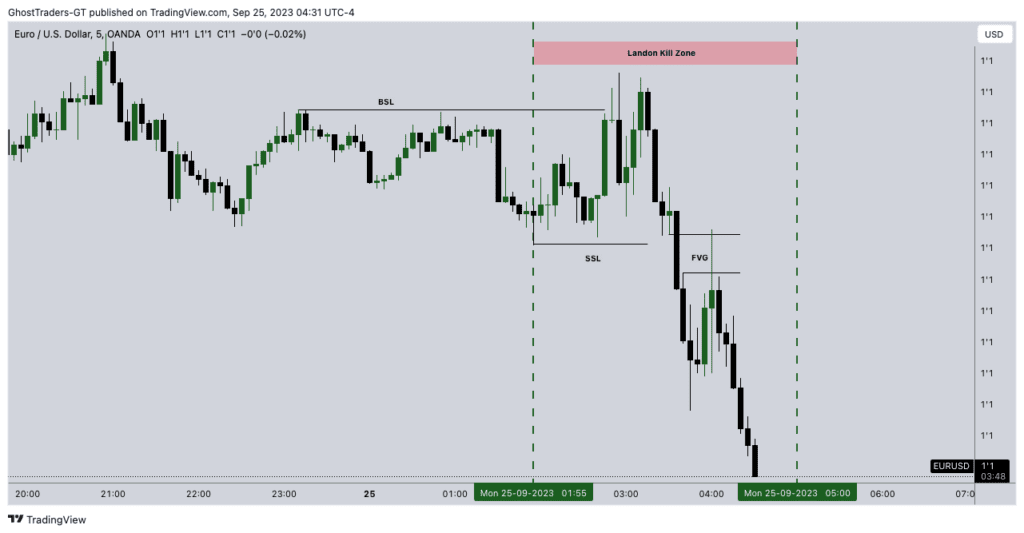

- CBDR + Kill Zones:

- Align your CBDR strategy with the London or New York Kill Zone to trade during peak liquidity periods for stronger moves.

Example of Trading the CBDR

Let’s walk through an example of how to trade the CBDR on a EUR/USD 15-minute chart.

- Identify the CBDR Range:

During the Asian session (2:00 AM to 5:00 AM EST), EUR/USD consolidates between 1.0950 and 1.0970. - Watch for a False Breakout:

At 6:00 AM EST, price spikes above 1.0970, triggering retail buy orders. However, the breakout fails, and price quickly drops back inside the CBDR. - Enter the Trade:

Once the price re-enters the CBDR range, enter a short position at 1.0965, with a stop-loss above the spike at 1.0980. - Take Profit:

Target the next support level at 1.0925, offering a 1:3 risk-to-reward ratio.

Common Mistakes to Avoid

- Entering Too Early:

Avoid entering trades before the CBDR ends. Patience is key—wait for a liquidity grab or breakout before committing. - Ignoring the Market Context:

Always trade the CBDR in the context of the broader trend. A CBDR setup aligned with the daily trend has a higher probability of success. - Overleveraging:

Even with high-probability setups, proper risk management is essential. Use small position sizes and tight stop-losses to protect your capital.

Conclusion

The Central Bank Dealers Range (CBDR) is a powerful tool for identifying high-probability day trading setups by tracking how institutions manipulate price early in the session. By understanding the dynamics within the CBDR—such as liquidity grabs, false breakouts, and session bias shifts—traders can position themselves on the right side of the market.

Combining the CBDR with order blocks, mitigation blocks, and kill zones enhances your ability to trade alongside institutional order flow. Stay patient, wait for confirmation, and align your trades with smart money flows to improve your results.

With practice, mastering the CBDR can elevate your day trading strategy, giving you an edge in markets where timing and precision matter the most.