Intro

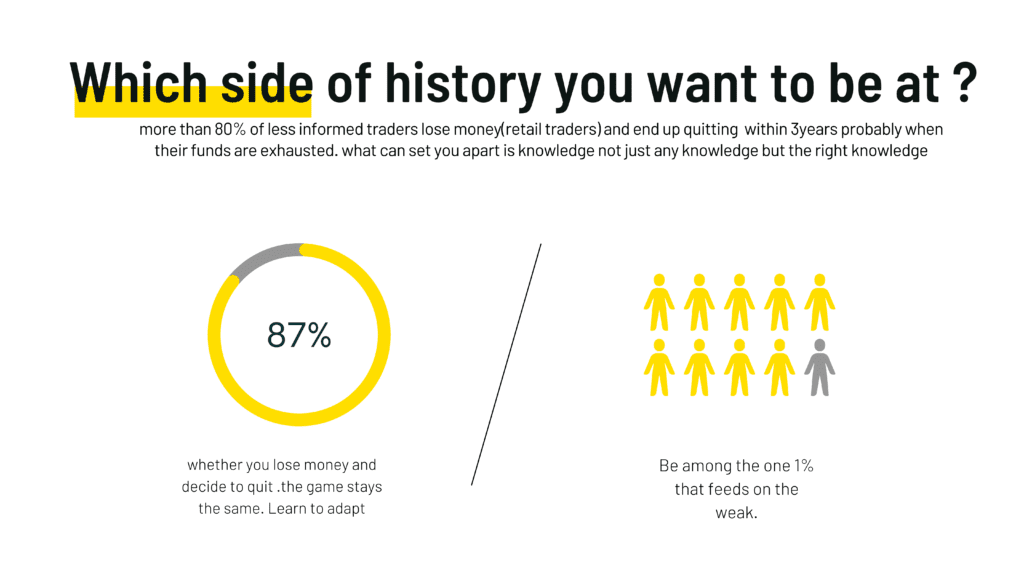

Growing a small trading account without high-risk strategies is a challenging but achievable goal. A common goal among Forex traders is aspiring to grow a small trading account into a substantial one. However, it’s important to be cautious to avoid the pitfalls of excessive risk-taking. This blog post explores strategies and principles that help traders achieve account growth without exposing themselves to undue risk.

What You Need to Avoid On Small Trading Account:

1. Rushing for Massive Gains:

One of the most common mistakes traders make when aiming to grow their accounts quickly is attempting to make massive gains in terms of pips or percentage returns. While substantial profits are tempting, rushing into trades can lead to impulsive decisions and high-risk exposure.

2. Large Risks for Large Returns:

The belief that taking on substantial risks will yield equally substantial returns is a risky misconception. Overexposing your account to risk can result in catastrophic losses that are challenging to recover from.

3. Underestimating Small Risk-Defined Trades:

Some traders assume that taking small, risk-defined trades won’t significantly contribute to account growth. This misconception can lead to missed opportunities and undervaluing the power of consistent, low-risk trading.

4. Sacrificing Equity for Poor Planning:

Poor planning or a lack thereof can lead traders to make decisions that sacrifice their trading equity. This can include overtrading, failing to set stop-loss orders, or neglecting risk management strategies.

Having a long-term mindset and using the forex compounding calculator can help you visualize future gains in the long Here is the forex compounding calculator to help you visualize your potential gain based on your equity and how much you are targeting per month.

Compounding Calculator

Future Value:

| Period | Starting Balance | Total Gain | Ending Balance |

|---|

What You Need to Aim For:

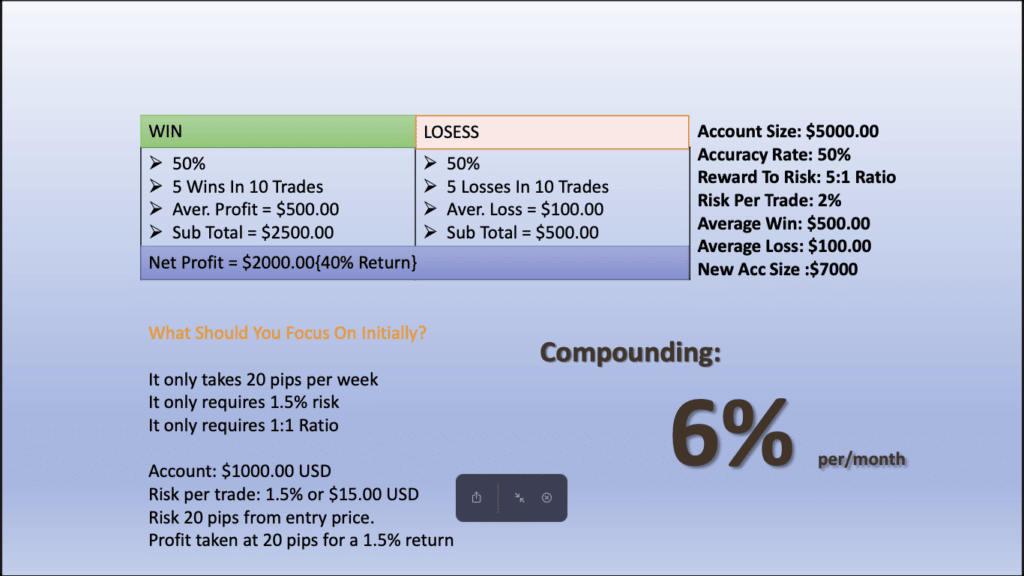

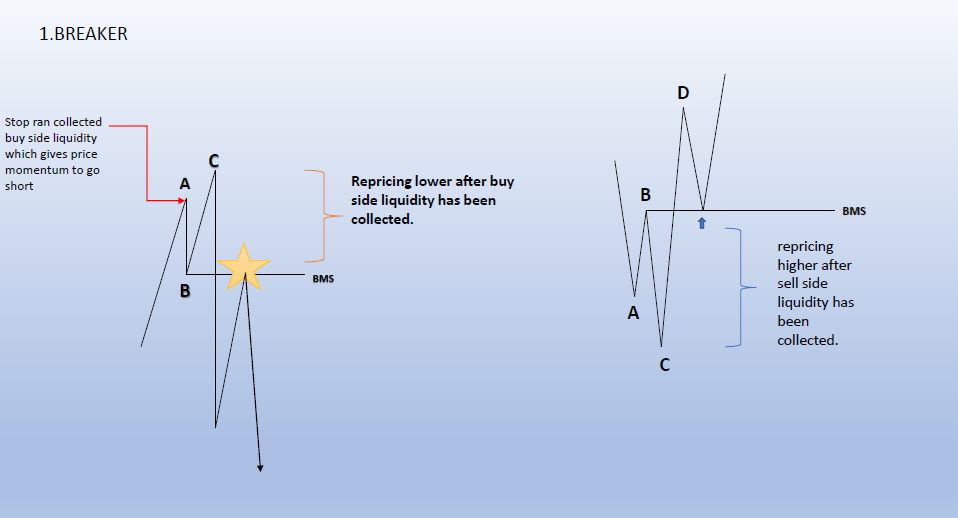

1. Realistic Reward Risk Models:

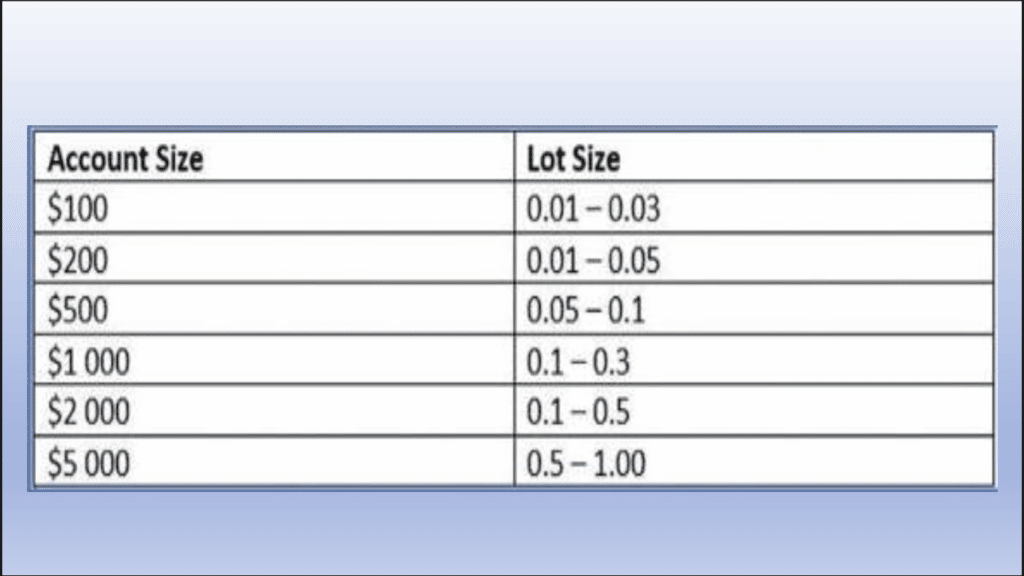

To grow a small account steadily, focus on developing a realistic reward-to-risk model for your trades. This involves setting achievable profit targets while limiting potential losses through well-placed stop-loss orders.

2. Risk Management Growing Small Accounts Without High-Risk:

Respect for risk management is paramount in the world of trading. Place greater emphasis on managing risk effectively rather than solely pursuing high rewards. Consistently following sound risk management principles can help protect your account from significant drawdowns.

3. Favorable Reward-to-Risk Ratios:

Identify trade setups that offer a reward-to-risk ratio of at least three-to-one or higher. These setups provide a cushion against losses and can significantly contribute to account growth.

4. Impactful Reward-to-Risk Setups for Growing Small Trading Accounts Without High-Risk:

Frame your trading strategies to focus on reward-to-risk setups that have minimal impact on your account if they are unprofitable. This approach ensures that even losing trades don't severely dent your account balance.

Conclusion:

Growing a Small Trading Accounts Without High-Risk strategies is a challenging but achievable goal. By avoiding impulsive actions, respecting risk management, seeking favorable reward-to-risk ratios, and framing setups with minimal impact in case of losses, traders can steadily build their accounts over time. Remember, patience and discipline are your allies on the journey to sustainable account growth in the Forex market.