Forex trading, short for foreign exchange trading, involves buying and selling foreign currencies to make a profit. This is done by speculating on the relative strength of different currencies, typically in pairs like the euro and the U.S. dollar. The objective is to purchase currencies at lower prices and sell them at higher prices to generate a profit.

Forex trading operates around the clock, 24 hours a day, five and a half days a week. It commences in Australia, progresses through Europe, and concludes in North America, with market sessions overlapping during the trading day.

Forex Trading, while sharing some similarities with the stock market, has distinct features. Instead of simply buying one currency and waiting for its value to increase, forex traders deal in currency pairs.

The most common currency pairs involving the U.S. dollar are EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD, but over 30 pairs are traded daily.

Forex trading is inherently speculative. Traders select a currency pair and speculate on how much of one currency they can purchase with the other in the pair. For instance, when buying EUR/USD, they anticipate that they can acquire more euros at a lower price in USD now than in the future. If the euro’s value rises, the trader profits; if it falls, they may incur a loss.

forex trading in the context of smart money trading?

Forex trading, in the context of smart money, is the practice of buying and selling foreign currencies with a focus on understanding and following the strategies employed by major institutional participants in the financial markets. Unlike retail traders, who often rely on technical and fundamental analysis, smart money trading involves recognizing and aligning with the actions of these influential players.

In smart money forex trading, understanding the dynamics of price delivery algorithms is crucial. These algorithms are used by institutional traders to manipulate and control prices by seeking liquidity either on the sell or buy side of the market. The key goal of smart money trading is to identify shifts in market structure, which can provide valuable insights into the type of institutional order flow, whether it’s bearish or bullish. you can learn from our freemium trading course.

To excel in forex trading within the smart money framework, traders focus on concepts such as order blocks, fair value gaps, power of three (PO3), order flow trading, and liquidity voids. These concepts enable traders to anticipate and profit from the strategic moves made by major participants in the forex market. you can learn these concepts on our premium and freemium courses

In essence, smart money forex trading is about gaining a deeper understanding of the market’s inner workings and aligning your trading decisions with the intentions of institutional players. This approach aims to give traders an edge in an environment where knowledge and strategy can significantly impact trading success.

Pros of Forex Trading:

- High Liquidity: The forex market is the most liquid financial market globally, making it easier to buy and sell currencies at any time.

- Accessibility: You can trade forex 24/5, allowing flexibility to fit around your schedule, which is especially advantageous for entrepreneurs like yourself.

- Diversification: Forex allows you to diversify your investment portfolio, as it’s independent of the stock market.

- Leverage: Forex trading offers high leverage, potentially amplifying your profits, but be cautious as it also increases potential losses.

- Profit Potential: With skill and strategy, substantial profits can be made in the forex market.

Cons of Forex Trading:

- High Risk: The forex market is highly volatile, and losses can happen quickly, which might not align with your passion for entrepreneurship.

- Emotional Stress: Emotional discipline is crucial; stress can be significant, especially in unfavorable market conditions.

- Complexity: Forex trading is not easy to master. It requires a deep understanding of the market, analysis, and risk management.

- Costs: Broker fees, spreads, and overnight swap rates can eat into your profits.

- Scams: The forex industry has its share of fraudulent brokers and scams. Careful research is essential.

Most common forex terms:

PIPs: PIPs, short for “percentage in point” or “price interest point,” represent the smallest unit of measurement in forex trading.

Leverage: Leverage empowers retail traders to control a larger sum of money with a smaller investment. For instance, a common leverage ratio is 50:1, allowing you to control $50 for every $1 invested. While it facilitates entry for smaller investors, it also increases risk. Without leverage, you’d need the entire investment amount, but with it, you can trade with less capital.

Margins: Leveraged trading magnifies potential profits, but traders must still have sufficient funds to cover their positions. This collateral is referred to as margin, and the specific rates vary depending on the currency pairs being traded.

Forex Account: A forex account is essential for currency trading. There are three primary types:

- Micro Forex Accounts: These allow trading up to $1,000 worth of currencies in one lot.

- Mini Forex Accounts: Permit trading up to $10,000 worth of currencies in one lot.

- Standard Forex Accounts: Enable trading up to $100,000 worth of currencies in one lot.

Ask: The ‘ask’ (or ‘offer’) price represents the lowest amount at which you’re willing to buy a currency.

Bid: The ‘bid’ price is what you’re willing to sell a currency for.

Contract for Difference (CFD): A CFD is a derivative instrument that permits traders to speculate on currency price movements without owning the actual underlying asset.

The Best Forex Trading Strategy: Smart Money Trading

Forex trading is a dynamic and complex world, where traders strive to gain an edge and maximize their profits. While various strategies and approaches are employed, one stands out as a tried-and-true method for consistent success: Smart Money Trading. In this article, we’ll explore why smart money trading is widely considered the best forex trading strategy.

Unveiling the Smart Money Strategy

Smart money trading, often referred to as institutional trading, is a strategy that centers around understanding and mirroring the actions of major institutional participants in the forex market. These players have the capacity to influence and control price movements, and savvy traders seek to align themselves with these actions for a competitive advantage.

The Role of Price Delivery Algorithms

At the core of smart money trading are price delivery algorithms. These sophisticated algorithms are used by institutional traders to seek liquidity either on the sell or buy side of the market. By identifying which side of the market price is collecting liquidity from, traders can anticipate the direction of the market. This insight into order flow, whether bearish or bullish, is invaluable for traders.

Key Concepts of Smart Money Trading

- Order Blocks: Order blocks are pivotal reversal points where major players leave their orders in the form of buy or sell limits. Recognizing these can provide critical entry and exit signals.

- Fair Value Gaps: Fair value gaps are ranges in price delivery, often leading to one-directional price movements. Smart money traders utilize these gaps as strategic entry points.

- Power of Three (PO3): PO3 encompasses three crucial phases – accumulation, manipulation, and distribution. Understanding these phases allows traders to make informed decisions.

- Order Flow Trading: Traders employ order flow analysis to determine the market’s directional bias and identify significant liquidity pools.

- Liquidity Voids: Liquidity voids occur when price rapidly moves in one direction, followed by a retracement. Recognizing these voids can help traders time their entries.

Why Smart Money Trading Excels

- Predictive Power: By understanding the intentions of institutional players, smart money traders can anticipate market movements and align their positions accordingly.

- Risk Management: Smart money trading provides tools and insights that aid in effective risk management, allowing traders to protect their capital.

- Consistency: The systematic approach of smart money trading, with a focus on clear indicators and strategies, enhances consistency in trading.

- Competitive Edge: In a highly competitive forex market, smart money traders have an edge by being informed about the intentions of institutional participants.

- Adaptability: Smart money trading concepts can be applied to various time frames and currency pairs, making it versatile and suitable for different trading styles.

While there are numerous forex trading strategies available, smart money trading stands out as the best option for those seeking consistent profitability. By understanding the inner workings of the market and aligning with the actions of institutional players, traders can gain a significant advantage.

Smart money trading offers a systematic and comprehensive approach that not only enhances trading success but also provides valuable insights into the intricate world of forex trading. If you’re looking to elevate your trading game, consider smart money trading as your go-to strategy.

Forex Trading Platforms

1.cTrader

cTrader is a comprehensive trading platform designed for forex and CFD brokers to provide to their traders. This platform offers a wide range of features to accommodate various investment preferences. It is a prominent multi-asset forex and CFD trading platform known for its extensive charting tools, advanced order types, level II pricing, and swift trade entry and execution.

Notably, cTrader boasts a user-friendly interface and is seamlessly integrated with advanced backend technology. It is accessible across desktop, web, and mobile devices. Traders can access cTrader through their chosen brokers, and one of the highly-rated brokers supporting cTrader is IC Markets.

cTrader is a free trading platform that is available to all traders and offers a wide range of advanced features. One of its most notable features is that it provides access to many of the similar premium features found in TradingView but without the associated cost. Additionally, cTrader offers a variety of other features and is recognized for its advanced capabilities, which even surpass those of Metatrader 4 and 5.

2. Tradingview

TradingView is a popular online platform for charting and technical analysis used by traders and investors. It offers a wide range of charting tools, indicators, and drawing features to help users analyze financial markets. Traders can access a basic version of TradingView for free, while premium features are available through subscription. It’s widely appreciated for its user-friendly interface and the ability to share and discuss trading ideas with a global community of traders.

3. Metatrader 4 and 5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular trading platforms widely used by forex and CFD traders. MT4 is known for its simplicity and user-friendly interface. It offers a variety of technical indicators and automated trading options through Expert Advisors.

MT5, on the other hand, is the successor to MT4 and provides additional features such as more timeframes, more technical indicators, an economic calendar, and support for trading a broader range of instruments beyond just forex.

Both platforms are offered by many brokers and are favored for their powerful charting capabilities and analytical tools. Traders can choose between MT4 and MT5 based on their specific trading needs and preferences.

Is forex trading profitable?

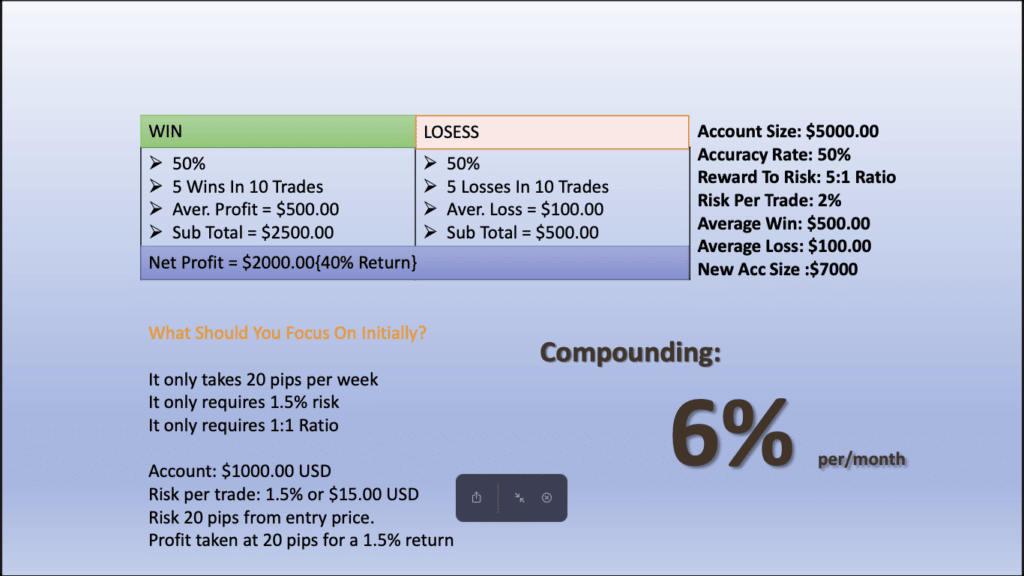

Forex trading can indeed be profitable, but it’s important to note that it’s a highly volatile market where the potential for gains is matched by the risk of substantial losses. Success in forex trading demands discipline and rigorous risk management. Utilizing tools like a forex drawdown calculator and profit compounding calculator can aid traders in pursuing steady, long-term gains while navigating the inherent market volatility.

How much money do I need to start trading?

The amount of money needed to start trading in forex varies among platforms, with some allowing micro trades starting as low as $1. Typically, a minimum investment of $100 to $500 is common. Your initial investment should align with your trading strategy. It’s important to note that $100 may not suffice for full-time trading. For undercapitalized traders, prop firm trading can be an ideal solution. Attempting to double a small account with unrealistic expectations can lead to frustration, as even a 10% profit on a $100 account may not cover basic expenses. In contrast, hedge funds and banks often target more modest gains, such as 5-10% per year.

How can I open a Forex trading account?

Opening a Forex trading account is a straightforward process. Begin by selecting a reputable platform or broker. You’ll be required to provide basic identification information, create a username and password, and link a bank account to fund your trades.

Many platforms offer a training mode, allowing beginners to practice trading without risking real money. Once you feel confident with how the account operates, you can start trading. As a recommendation, we have had a successful experience with IC Markets for over a decade without any issues. They offer valuable features such as live chat support, which is crucial when selecting a broker, and boast a Trustpilot rating of 4.8.