what is institutional Order Flow trading?

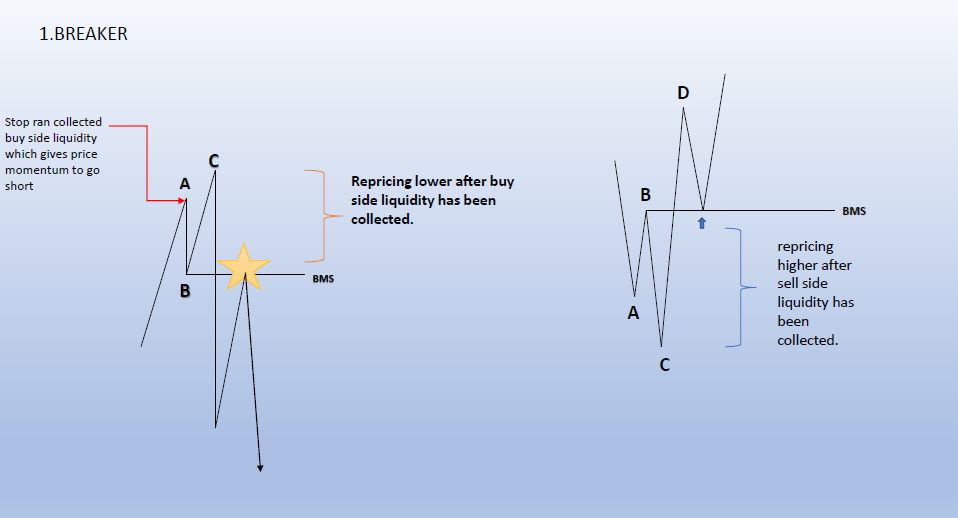

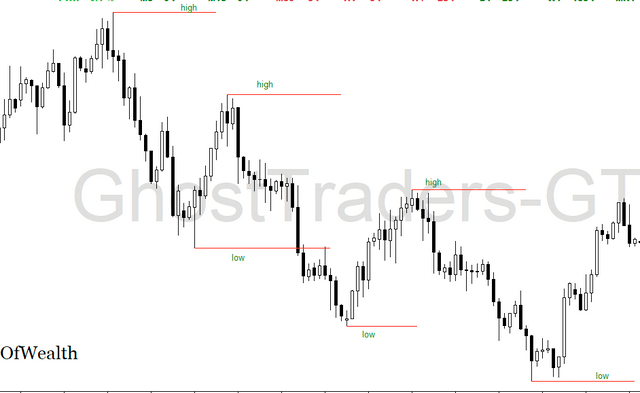

Order Flow Trading is a concept that sheds light on the directional bias of the market, revealing where significant participants manipulate prices to go. This manipulation often targets resting liquidity pools, which are found at previous highs and lows in the form of stop losses or pending orders. For instance, when price accumulates liquidity at previous lows, it might indicate a bearish market structure. Retail traders commonly use order flow to discern the market’s directional bias.

Types of Institutional Order Flow and Trading Approaches

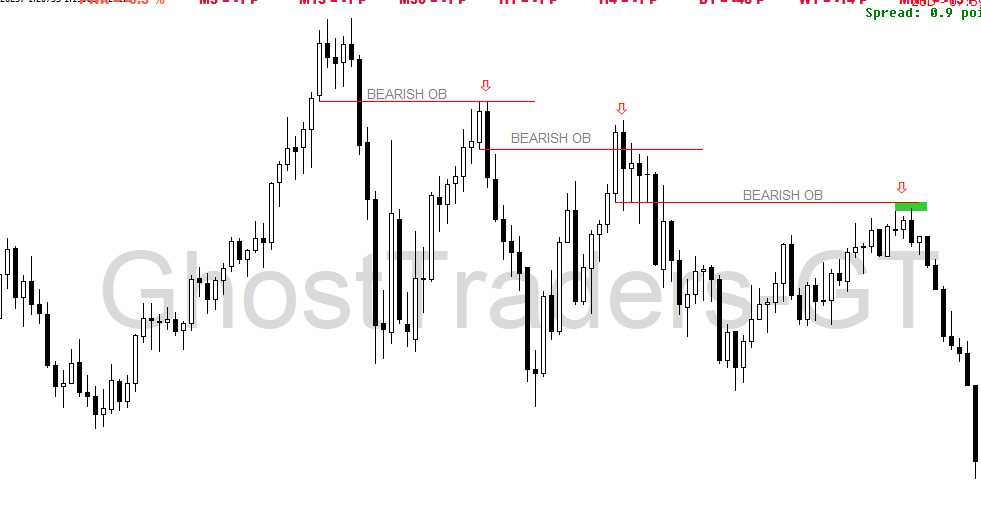

A bearish institutional order flow anticipates price-seeking sell-side liquidity. In this scenario, constructing trading setups using bearish order blocks can be highly effective. Since price tends to gather sell-side liquidity during bearish institutional order flow, bullish order blocks are more likely to falter as price gathers sell-side liquidity at previous lows, reinforcing the bearish sentiment. When the market structure is bearish, focus on bearish order blocks and fair value gaps for entry points.

Conversely, a bullish institutional order flow expects price to pursue buy-side liquidity. Creating trading setups using bullish order blocks and fair value gaps becomes advantageous in this context. Just as with bearish order flow, bullish order blocks are prone to failure during bullish institutional order flow as price accumulates buy-side liquidity at previous lows. When the market structure is bullish, concentrate on bullish order blocks for entry opportunities.

Bullish and Bearish Order Blocks Defined

Bullish and bearish order blocks are characterized by their impact on price movements. A bearish order block is identified when price reaches a certain level and experiences a decline or short-selling activity. Conversely, a bullish order block occurs when price reaches a level and sees a long position being established.

The nature of price reactions determines whether an order block is considered bullish or bearish. In essence, the final up candle before a downward move forms a bearish order block, while the final down candle before an upward move forms a bullish order block.

Understanding Fair Value Gaps

Fair Value Gaps (Fvg) occur when price departs from a specific level with minimal trading activity and exhibits a one-directional price movement with little or no retracement. Fvg can present valuable trading opportunities, especially when combined with order blocks and order flow. These gaps signify a potential shift in market sentiment and direction.

Limitations of Order Flow Trading

Order flow trading is not without its challenges. It requires a substantial learning curve and consistent practice to master. Additionally, it can be susceptible to market noise, making it difficult to identify reliable trading signals.

However, with dedicated backtesting and hands-on experience, these challenges can be overcome. Building pseudo-experience through backtesting can assist in grasping the intricacies of order flow trading. It’s crucial to understand concepts like fair value gaps and order blocks for entry purposes, once the directional bias has been identified.

Key Takeaways for Successful Order Flow Trading

- Choose the Right Timeframe: Begin by observing daily order flow. If it’s unclear, switch to H4 and H1 for a clearer perspective. Higher time frames like weekly and monthly should be considered for setups with longer horizons.

- Directional Bias: An understanding of order flow provides you with a directional bias of the market. This is crucial for making informed trading decisions.

- Consider Multiple Timeframes: Weekly and monthly order flow can impact smaller timeframes. While focusing on daily setups, periodically check weekly and monthly order flow to account for broader influences.

By integrating these key takeaways into your trading strategy, you can leverage order flow concepts to enhance your trading decisions and potentially achieve better outcomes.

this video will focus on order blocks/, fair value gaps, liquidity pools, liquidity voids, and order flow.

This video mainly focuses on order blocks and institutional order flow. This video is taken from a one-on-one Zoom session. The main focus of this session was smart money trading. This was mainly focused on order flow and how we can combine everything with fair value gaps, order blocks, liquidity pools, and liquidity voids. But in this session, we didn’t discuss identifying an Order block and Institutional Order flow

In Summary: Mastering Order Flow Trading

Order Flow Trading is a powerful concept that unveils the directional bias of the market, revealing where significant players influence prices. This manipulation often targets resting liquidity pools, such as stop losses or pending orders at previous highs and lows. Retail traders use order flow to discern market direction.

Understanding different types of institutional order flow is pivotal. A bearish order flow indicates sell-side liquidity seeking, while a bullish order flow points to buy-side liquidity. Constructing trading setups using order blocks aligns with these flows. Bearish order blocks shine during bearish flow, and bullish order blocks thrive during bullish flow. This strategic approach takes advantage of liquidity accumulation and depletion.

Bullish and bearish order blocks are defined by their impact on price movement. A bearish order block occurs when price reaches a level and experiences decline, while a bullish order block follows a level with a long position establishment. These blocks provide insights into market sentiment.

Fair Value Gaps (Fvg) mark departures from levels with low trading activity. When coupled with order blocks, they create trading opportunities. However, order flow trading has limitations. It demands dedication to learn and master, and market noise can impede signal identification. Overcoming these challenges requires backtesting and experience accumulation.

Key takeaways for successful order flow trading include choosing the right timeframe, understanding directional bias, and considering multiple timeframes. An in-depth grasp of order flow aids in making informed trading decisions. Weekly and monthly order flow must be factored into daily setups for a comprehensive view.

Ultimately, mastering order flow trading equips traders with the ability to navigate markets with precision. By understanding the nuances of order flow, one can seize opportunities, predict market movements, and achieve better trading outcomes.

related post: fair value gaps, order blocks, and order flow and weekly trading ideas: Instagram Courses: Institutional trading