Support and resistance levels are fundamental concepts in technical analysis, providing traders with crucial insights into potential price reversals. Mastering these levels can enhance decision-making and improve trading strategies.

What is Support?

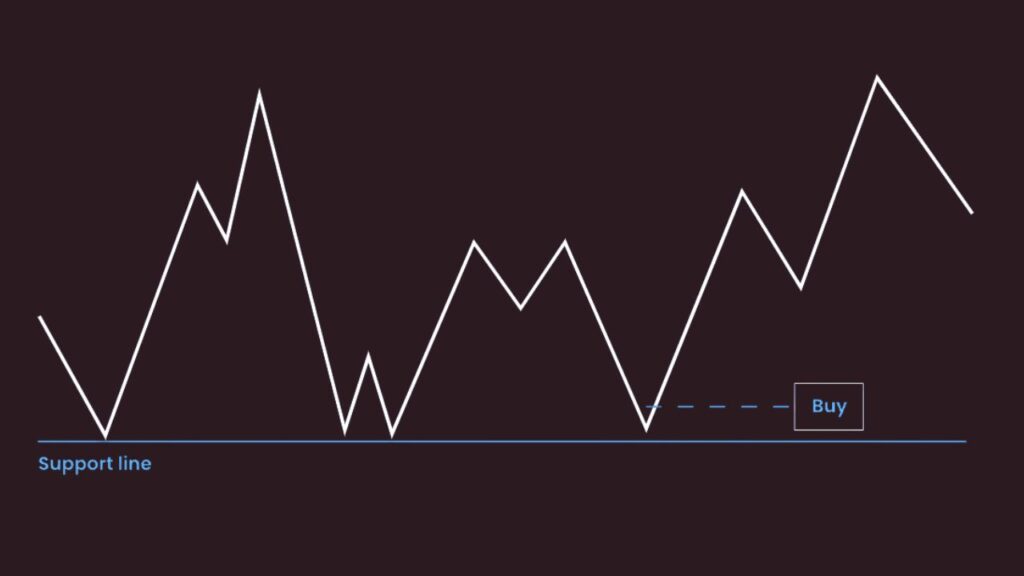

Imagine a market in decline, where the price of an asset seems to be falling indefinitely. Suddenly, it hits a price point where it consistently bounces back up. This price is known as a support level. Here, the buying interest becomes strong enough to outstrip selling pressure, causing the price to rebound. Support levels can be identified during both bearish (downward) and bullish (upward) trends where they act as a ‘floor’ for the price.

- In a Bear Market: Support is where the price tends to halt its decline, providing an opportunity for buyers to step in, believing the asset is undervalued.

- In a Bull Market: As the price ascends, new support levels form at higher points, reflecting growing confidence or value perception among buyers.

What is Resistance?

Conversely, resistance is where the upward price movement pauses or reverses. When an asset’s price approaches this level, sellers dominate, pushing the price back down. This level can be thought of as a ‘ceiling’:

- In a Bull Market: Resistance levels test the enthusiasm of buyers as prices approach this ceiling, often leading to a sell-off if the resistance holds.

- In a Bear Market: Even in a declining market, resistance can form, where sellers feel the price has risen sufficiently to sell, thereby capping any upward surge.

The Significance of Support and Resistance

These levels are more than just points on a chart; they are pivotal in trade strategy formulation:

- Entry and Exit Points: Traders might buy near support levels anticipating an upturn or sell near resistance expecting a downturn.

- Breakouts and Breakdowns: When a price decisively moves through these levels, it often signals a new trend, offering trading opportunities aligned with this new momentum.

Major vs. Minor Levels

Not all support and resistance levels carry the same weight:

- Minor Levels: These might offer temporary halts in price movement but are less likely to cause significant reversals.

- Major Levels: When breached, they can lead to substantial shifts in market direction, known as breakouts, which can be lucrative for traders if anticipated correctly.

The Dynamic Nature of Support and Resistance

An intriguing aspect of these levels is their ability to switch roles:

- Support to Resistance: A previous support level can become a resistance if the market sentiment shifts, and vice versa. This phenomenon underscores the market’s memory and can guide traders in predicting future price actions.

Strategic Trading with Support and Resistance

While these levels are invaluable, they are not infallible:

- Trading Strategies: Buying on support or selling at resistance can be effective, but traders must also prepare for breakouts, where prices move past expected levels.

- Risk Management: Always consider that markets are influenced by numerous unpredictable factors; hence, risk management strategies should accompany any reliance on support and resistance.

Personal Insights on Trading with Support and Resistance

From personal experience, while support and resistance are fundamental, they might not suffice for everyone. Some traders, including myself, have found more success with Smart Money Concepts, which delve into price action from the perspective of institutional players. However, for those starting or struggling with these basic concepts, mastering support and resistance could still provide a solid foundation. For those interested in exploring beyond traditional analysis, comprehensive yet straightforward courses on Smart Money Trading Courses could be beneficial.