Last updated on November 22nd, 2022 at 03:25 pm

Forex trading can be a lucrative way to make money, but it’s imperative to understand the basics before you get started. This guide will teach you the basics of forex trading, including choosing a broker, placing orders, and managing your risks. You will also learn about some of the most popular currencies traded in the forex market. With this information, you will be ready to start trading forex like a pro.

Introduction to Forex Trading

The act of purchasing and selling currencies with the intention of making a profit is known as forex trading. It is one of the most popular forms of trading in the world, with millions of dollars worth of currency changing hands every day.

If you are new to forex trading, then this guide is for you. We will give you an overview of what forex trading is, how it works, and some tips and strategies for getting started.

What is Forex?

The market where foreign currencies are traded is known as forex or foreign exchange. Whether they realize it or not, currencies are significant to the majority of people around the globe because they must be traded in order to conduct international trade and business. The forex market is the largest and most liquid market in the world, with trillions of dollars traded each day.

There is no centralized location for the forex market – it is a truly global market, with traders and investors from all around the world participating in it. Because of this, forex prices can be very volatile, moving rapidly up and down in response to news and events that affect the currencies being traded.

Forex exists so that a lot of money can be traded for the same worth in one more cash at the ongoing business sector rate.

A portion of these exchanges happens on the grounds that monetary foundations, organizations, or people have a business need to trade one cash for another. For instance, an American organization might exchange U.S. dollars for Japanese yen to pay for a stock that has been requested from Japan and is payable in yen.

The Different Types of Forex Markets

When it comes to forex trading, there are three different types of markets that you need to be aware of. These are the spot market, the forward market, and the futures market. Each one of these has its own distinct characteristics and each one can be traded in different ways.

The spot market is the most common type of forex market. This is where currencies are traded at their current prices. The prices in the spot market are based on supply and demand and are always changing. This makes it a very volatile market which can be both good and bad for traders.

The forward market is where currencies are bought and sold for delivery at a later date. The price in the forward market is based on an agreement between the two parties involved and is not affected by changes in the spot market. This means that it is a much more stable market but it is also less liquid.

The futures market is similar to the forward market but with one key difference. In the futures market, contracts are bought and sold for delivery at a set date in the future. The price of the contract is based on the current price of the currency in the spot market but it is also affected by interest rates and other factors.

The Advantages and Disadvantages of Forex Trading

Forex trading is the practice of buying one currency and selling another at the same time. Currency trades take place through a broker or dealer in pairs. The most popular currency pair in the world, for instance, is the euro and the dollar (EUR/USD). Forex trading is done in order to make a profit by exchanging one currency for another that has a higher rate of return.

There are many advantages of forex trading. Perhaps the biggest advantage is that it is a very liquid market, meaning that currencies can be bought and sold at any time during the day. This is unlike other markets such as stocks and commodities, which can only be traded during certain hours of the day. Another advantage of forex trading is that it allows you to leverage your investment, meaning you can control a large amount of currency with a relatively small amount of money. This can lead to large profits if done correctly, but can also lead to large losses if done incorrectly.

There are also some disadvantages of forex trading to consider before getting started. One of these is that it is a very volatile market, meaning that prices can fluctuate rapidly and unexpectedly. This can lead to large losses if you are not careful.

How to Start Trading Forex

The right strategy and a proper risk management plan are essential to trading forex successfully. You can start trading forex by following these steps.

1. Learn about forex: Forex trading is not complicated, but it does require specialized knowledge. The forex industry can be difficult to navigate, especially with the proliferation of trading courses and gurus. Do your research and find a mentor who can help you navigate and reach profitability.

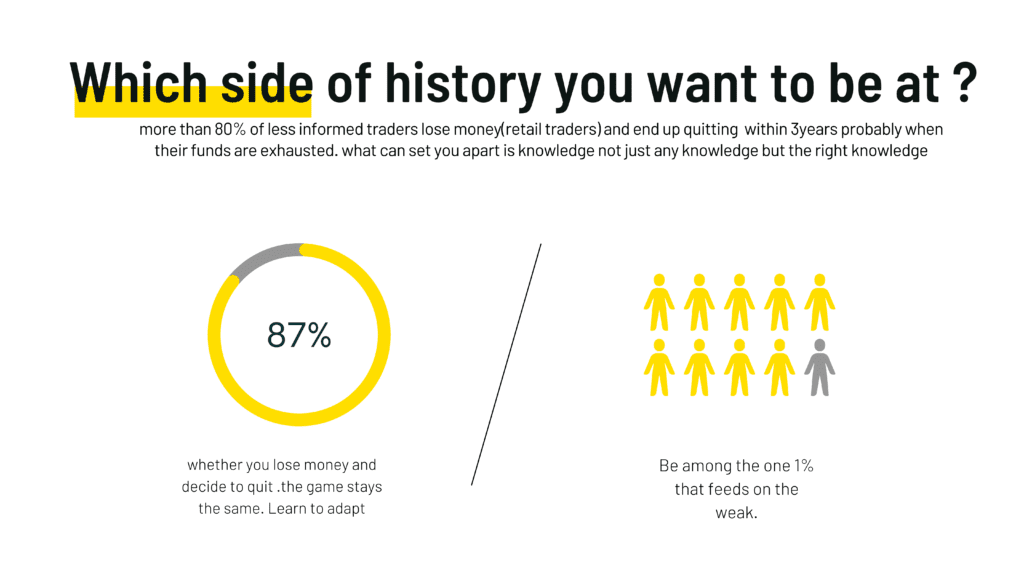

In spite of paying several mentors and buying courses with my scholarship money, I was only able to learn forex and trade successfully from one man. Trading forex requires discipline, and if you fail to be disciplined, you will not succeed.

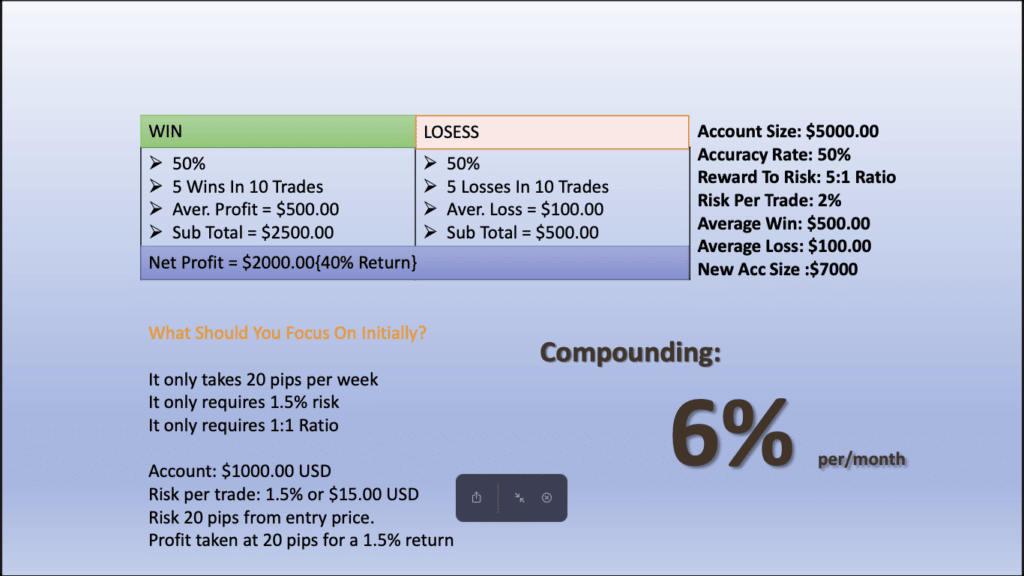

When you’re ready to start trading, it’s important to set up a trading plan. This should include your goals, your risk tolerance, and your strategies for entering and exiting trades. Once you have a plan in place, you can start testing it out with small amounts of real money to see how it works. professional traders risk less than 2% per trade while targeting 5-20% per month depending on how consist is their trading strategy is.

2. Set up your forex trading account: As a beginner, you should start with a demo account and practice without risking live funds. Review platforms like Trustpilot can help you find the right broker. Since I have been using ICmarkets for more than a decade, and have never had any problems, I recommend them based on their 4.9 stars on Trustpilot.

The type of account you choose will determine whether you’ll pay a commission or not. If you opt for a zero spread account, you’ll have to pay a commission, but if you opt for a spread account, there’s no commission to pay (the broker will earn money from the difference between the buying and selling prices in this case).

3. Trading Strategy:

Trading strategies determine your success. The price delivery algorithm is designed to seek liquidity in the market, therefore I don’t expect you to understand support and resistance, Elliott waves, wedges, indicators, breakout strategies, or forex modification strategies. and they will frustrate you until you quit forex.

Consider institutional trading concepts like order block trading, order flow trading, and fair value gap trading. These concepts will help you understand what large funds do.

How to make money trading forex

In order to make money trading forex, you need a solid trading strategy and a proper risk management plan. A risk of less than 2% of your equity per trade is ideal.

Everyone can make money trading forex as long as they commit to learning the necessary trading skills. being realistic and not emotional towards trading is one of the most undermined trading skills that few individuals have.

Investing in foreign exchange (Forex) has become increasingly popular among individuals. There are plenty of investment opportunities out there, but Forex trading has a number of advantages that other options do not. The purpose of this article is to explain how to make money trading forex and focus on other trading aspects.

Many people are drawn to forex trading because of the potential to make a lot of money quickly. However, this potential also comes with a lot of risks. In order to be successful, you need to have a solid plan for managing the risks associated with forex trading. This article will provide some tips on risk management and we also have tools to help you.

1. Market knowledge

In forex trading, market knowledge is key to success. By staying up-to-date on market news and

trends, you can make informed decisions about your trades. This can help you minimize your

risks and maximize your profits.

There are various ways of remaining informed about the forex market. You can read financial news websites, subscribe to newsletters, or follow other traders on social media. by staying informed about the market and news calendar, you can make better decisions about your trades and protect your investment.

Trading News is for the less informed crowd that will always fall victim to gambling. trading news events is gambling as prices can be manipulated in both directions.

Traders shouldn’t avoid or be careful of the month of august as prices tend to be choppy or not clear. This makes it difficult for traders to be consistent in that period. secondly, traders should avoid trading for almost a week after long-range candles caused by major economic events such as but not limited to the unemployment rate.

2. Start with a demo account

If you’re new to forex trading, it’s important to start with a demo account so that you can get a

feel for how the market works without risking any real money. This will allow you to learn about

different currency pairs, how to place orders and how to manage your risk. Once you’re

comfortable with the demo account, you can start trading with a live account.

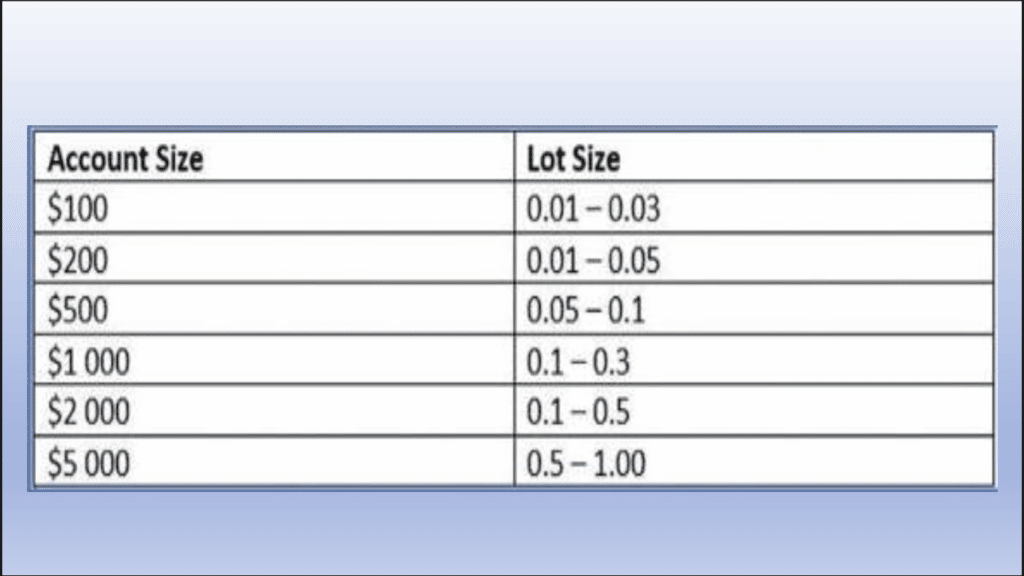

The fact that you did well on your demo account, doesn’t mean you will do well on a live account. the difference is that on real trading account emotions are involved unlike in a demo therefore I will recommend funding your first live account with at least $50-100 using a lot size 0.01-0.05

3. Avoid trading with high leverage

When it comes to forex trading, one of the most important things to keep in mind is risk management. This is especially true when it comes to leverage, which can be both a blessing and a curse.

While high leverage can help you maximize your profits, it can also lead to huge losses if you’re not careful. That’s why it’s important to only use reasonable leverage.don’t over-leverage yourself it doubles an edge sort that can hurt your trading equity. check our tools to help you make informed decisions.

4. Choose a profitable risk-to-reward ratio

There are a number of different ways to approach risk management in forex trading, but one of the most important is to choose a profitable risk-to-reward ratio. This ratio is simply the amount of money you are willing to risk in order to make a certain amount of money. For example, if you are willing to risk $100 in order to make $500, then your risk-to-reward ratio would be 1:5.

There is no perfect risk-to-reward ratio, and what works for one trader may not work for another. Ultimately, it is up to each individual trader to decide what level of risk they are comfortable with and what they are hoping to achieve in their trading.

Trading Psychology |Self-Evaluation Questions?

- How many trades did I take before blowing my account?

- And among those trade shows many trades did I get right and how many trades did I get wrong?

- How many pips did I make per trade and how pips did I lose per trade?

- What was the reason I took the trade? and what was the reason it went against me? was it an early entry caused by fear of missing out?

- Did I check the directional bias of the market at least using a daily, H4, or H1 time frame? If so then what went wrong? did I check liquidity pools if so? Then what might be the problem? did I check the dollar index? if so then what was the directional bias of the dollar index and were there any resting liquidity pools?

- What was the directional bias on the dollar index and what was the directional bias on the trade you took a loss?

- Was the dollar index at a significant level before you make your entry?

Learn to be calm and reflect on your trading results during weekends this will help you improve your trading psychology. always have your checklist before taking any trade don’t do things blindly so. forex trading psychology is one of the most underrated skills yet affects a lot of traders and the big participants in the market will always capitalize on that through price manipulation.

Get Started

Get Started with Freemium Trading Course, and Learn how to trade forex.

Advanced Qml (Quasimodo) Trading Course

This Trading course focuses on the core concepts of Qml trading with institutional trading,it is suitable for both beginners and experienced traders.

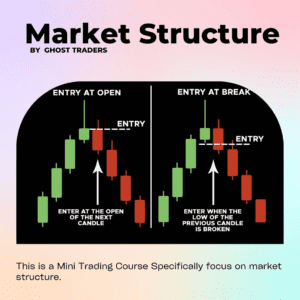

Market Structure in trading forex[ mini-course]

This is a mini course specifically focuses on market structure.it is suitable for both beginners and experienced traders.

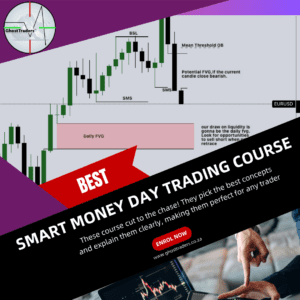

Smart Money Day Trading Course

The Best Day Trading Course, you will ever Need to Be a Successful Day Trader. In This course, we have put together the day trading formula that we are using. The Prerequisite To This Course is the "Institutional Trading Elite Course".

Free | Freemium Trading Course

This is the best trading course to get you started in trading mainly on smart money trading concepts such as fair value gaps, order blocks, and other concepts such as Quasimodo trading concepts. This might be the start of something big, enroll now for free and start learning.

Smart Money Trading Basics

This Trading course focuses on the core concepts of institutional trading, it's an intermediate course therefore we recommend an elite course if you want to go deep into institutional trading.

Smart Money Trading Course

The Best Institutional Trading Course, you will ever Need to Be a Successful Trader. In This course, we have put together the secret trading formula that we have been using in Trading For 10 years.

From Novice to Master Trader: The 10-Year Blueprint. This course transcends traditional trading education. Learn the proven institutional framework that will transform your trading approach and unlock consistent profitability.

Important Links: Courses, Mentorship, YouTube Channel