In smart money trading, breaker blocks and mitigation blocks are essential concepts that help traders identify high-probability entry zones where institutional traders have executed large orders. While these two types of blocks serve distinct roles in market structure, they are often confused. Understanding the key differences between breaker blocks and mitigation blocks allows traders to align with institutional flows and avoid getting trapped in false moves.

This article will explore what breaker blocks and mitigation blocks are, how they differ, and how to trade them effectively.

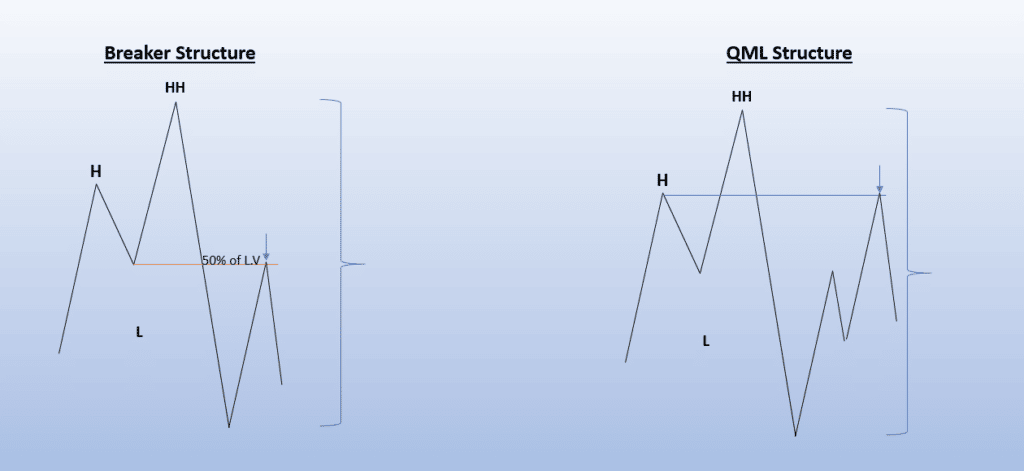

What is a Breaker Block?

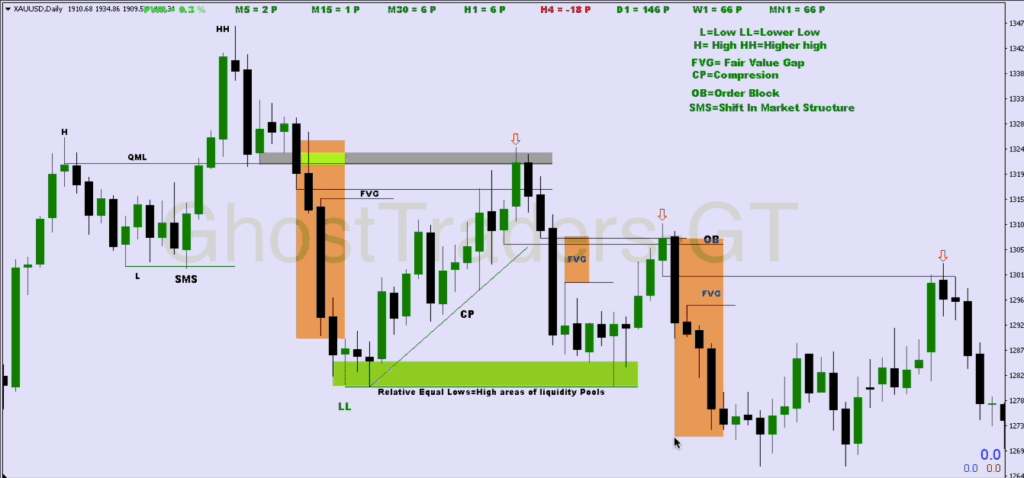

A breaker block forms when the market breaks through a key level of support or resistance that had previously acted as a turning point. The shift in market structure (break of structure or BOS) creates an opportunity for institutional traders to trap retail traders who were positioned incorrectly.

After the break, price often returns to retest the broken level, now acting as support (in the case of a previous resistance) or resistance (in the case of a previous support). This retest confirms the shift in market sentiment and provides a high probability entry point for traders.

Characteristics of a Breaker Block:

- Occurs at a Break of Structure (BOS): A breaker block is created when price breaks a key high or low.

- Retest After Breakout: After the breakout, price often returns to the block to confirm the new trend direction.

- Reversal or Continuation: The breaker block signals a trend continuation or reversal, depending on the context of the structure break.

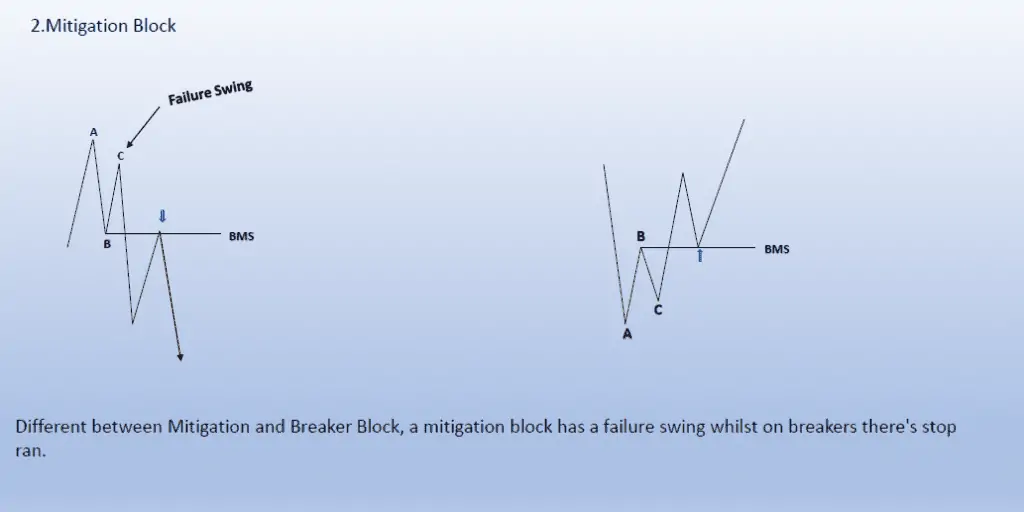

What is a Mitigation Block?

A mitigation block forms when institutions return to rebalance or mitigate previous inefficient trades. This occurs when an earlier move is caused by institutional orders left behind imbalances or unfilled liquidity zones, which the market later corrects by revisiting the original area. Mitigation blocks allow smart money to adjust or mitigate their positions without significantly disrupting the trend.

Mitigation blocks usually occur after sharp impulsive moves, where price retraces to the block before resuming the original trend.

Characteristics of a Mitigation Block:

- Corrects Price Imbalances: Mitigation blocks are used to rebalance areas where price moved too quickly, leaving gaps or inefficiencies.

- Holds the Trend: Once mitigated, the market typically continues in the same direction as the original move.

- Formed Near Consolidation Zones: Mitigation blocks often appear near order blocks or other institutional levels.

Key Differences Between Breaker Blocks and Mitigation Blocks

| Aspect | Breaker Block | Mitigation Block |

|---|---|---|

| Purpose | Confirms a trend shift through a break of structure (BOS). | Rebalances or mitigates previous inefficient trades. |

| Market Behavior | Breaks a key level and retests it as support or resistance. | Retraces to an area of imbalance before continuing the trend. |

| Trend Direction | Can signal a reversal or continuation. | Typically aligns with the original trend. |

| Timing | Forms at major breaks of structure. | Occurs after impulsive moves to correct imbalances. |

| Trade Opportunity | Entry on retest of the breaker level. | Entry when price mitigates the imbalance and resumes the trend. |

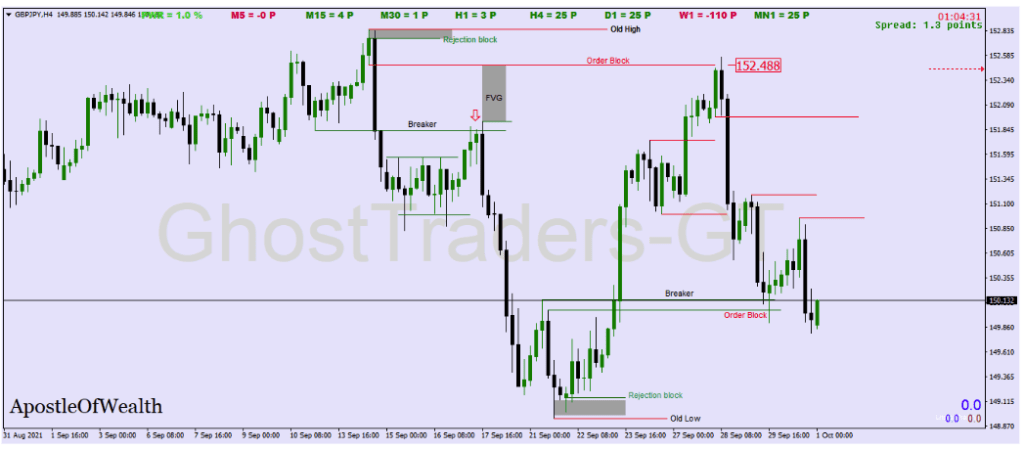

How to Trade Breaker Blocks

When trading breaker blocks, your objective is to capitalize on the trend shift caused by a break of structure. The trade entry occurs after the retest of the broken level, confirming the new trend.

Steps to Trade a Breaker Block:

- Identify the Break of Structure: Look for a break of a recent swing high or low to confirm a shift in market sentiment.

- Mark the Breaker Block: The last consolidation zone or candle before the break becomes the breaker block.

- Wait for Retest: After the breakout, wait for the price to return to the block for confirmation.

- Enter on Rejection: Look for a rejection candle (like a pin bar) or a change in market structure at the breaker block to enter the trade.

- Set Stop-Loss: Place your stop-loss just beyond the breaker block to protect against false moves.

- Target Next Key Levels: Use Fibonacci extensions or previous highs/lows as profit targets.

Example:

In a bullish breaker block scenario, price breaks above resistance and then retests the block. Upon confirmation with a bullish candle, enter long, aiming for the next resistance level.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

How to Trade Mitigation Blocks

Mitigation blocks offer a chance to enter trades in the direction of the original trend after the market has corrected its previous imbalances. The key is to wait for price to revisit the mitigation block and confirm the continuation of the trend.

Steps to Trade a Mitigation Block:

- Identify the Impulsive Move: Look for a sharp move that leaves behind a gap or imbalance in price.

- Mark the Mitigation Block: Use the last consolidation zone before the impulsive move as your mitigation block.

- Wait for Price to Retrace: Let price revisit the block to correct the imbalance.

- Enter on Reversal Signal: Enter when price shows signs of respecting the mitigation block (e.g., bullish or bearish engulfing pattern).

- Set Stop-Loss: Place your stop-loss just beyond the block to manage risk.

- Ride the Trend: Target the next major level in the direction of the original move.

Example:

In a bearish mitigation block setup, price drops sharply, then retraces to the mitigation block. Once price shows bearish rejection, enter a short trade, aiming for the next support level.

When to Use a Breaker Block vs. Mitigation Block

Choosing between a breaker block and a mitigation block depends on the market context and your trading objective.

- Use a Breaker Block When:

- You are looking to trade a trend shift or reversal.

- A key level has been broken, and the market is likely to retest it.

- You want to confirm a new trend direction before entering the trade.

- Use a Mitigation Block When:

- You want to trade in the direction of the original trend.

- A sharp, impulsive move left behind an imbalance that needs to be mitigated.

- You are looking for a continuation trade after a retracement.

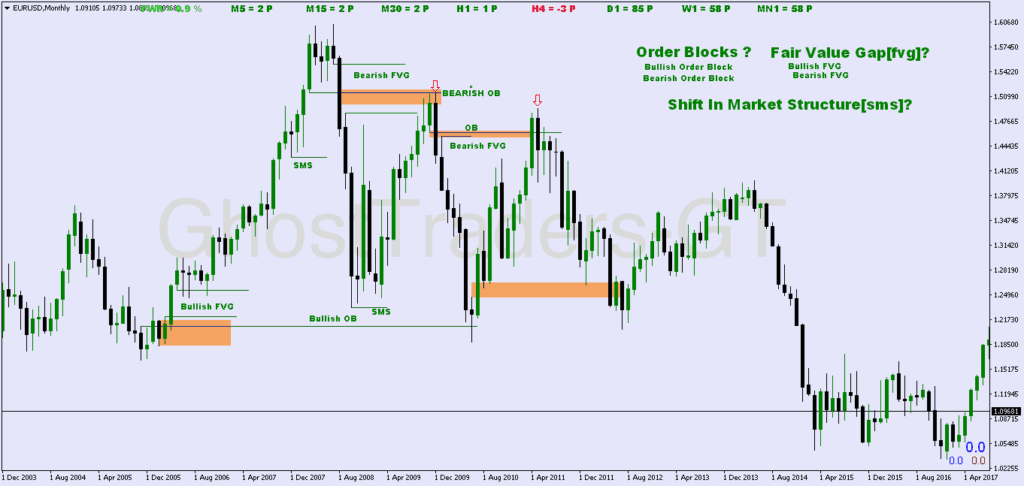

Combining Breaker Blocks and Mitigation Blocks in Trading

In some cases, both breaker blocks and mitigation blocks can appear within the same market structure. For example, a breaker block may signal the start of a new trend, while a mitigation block along the way offers a re-entry opportunity as the trend continues.

Example of Combining Both Blocks:

- Breaker Block Forms: A bullish breaker block forms after price breaks a key resistance level.

- Mitigation Block Opportunity: As the trend progresses, price leaves behind an imbalance. It later retraces to the mitigation block to correct the imbalance.

- Enter on Retest: After price revisits the mitigation block, you can enter a trade to ride the trend continuation.

This combination strategy allows traders to enter the market early using the breaker block and re-enter on pullbacks using the mitigation block.

Conclusion

Both breaker blocks and mitigation blocks are critical tools in smart money trading, each serving a unique purpose. Breaker blocks help traders identify shifts in market structure and enter new trends, while mitigation blocks provide opportunities to trade with the trend by correcting imbalances.

By understanding the differences between these two blocks and learning how to trade them effectively, traders can position themselves alongside institutional order flow and improve their probability of success. The key to mastering these setups lies in waiting for the right conditions, managing risk effectively, and aligning trades with the broader market structure.

With practice, these advanced trading concepts can become powerful tools for capturing trend reversals and continuations in all types of markets.