Last updated on October 16th, 2024 at 11:21 pm

In Forex trading, timing is everything. Traders often focus not just on “where” to trade but also “when” to trade. One of the most popular time-based trading strategies involves the concept of Kill Zones, particularly the London Kill Zone, which represents a window of high market activity during the London session. In this blog post, we’ll delve into what London Kill Zones are, why they matter, and how to trade them effectively.

What Are London Kill Zones?

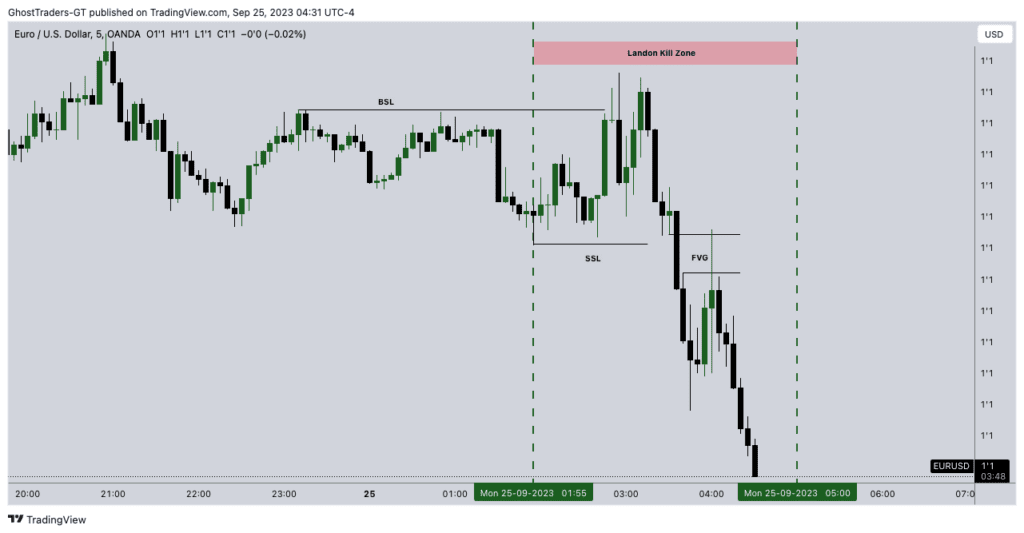

The London Kill Zone refers to a specific time window during the London trading session, known for high market activity and volatility. This time range spans from 2:00 AM to 5:00 AM New York time (EST). During this period, the market often experiences significant price movements, as traders in London—the world’s largest forex hub—begin to engage in the market. It’s a prime time for spotting potential trade setups due to the influx of institutional activity.

Why focus on the London Kill Zone? London is considered one of the largest Forex trading hubs, accounting for a significant percentage of global Forex trading volume. The opening hours of the London session overlap with the close of the Asian session, creating a burst of liquidity and volatility as traders from two major regions interact.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

Time Windows for London Sessions:

- Pre-London (1:00 AM – 3:00 AM EST): This period represents the hour leading up to the official London opening Traders may see volatility as institutional players position themselves for the upcoming session.

- London Open (3:00 AM – 5:00 AM EST): The first two hours after the London market officially opens. This is where the bulk of activity happens, with large price moves as traders place significant trades.

- Late London Session (7:00 AM – 9:00 AM EST): Around this time, there is an overlap between the London and New York sessions. Market volatility may increase again, providing another window of opportunity for traders.

Why London Kill Zones Matter

- Liquidity: The influx of liquidity during these periods, thanks to institutional traders and hedge funds, can create sharp price movements. This is important because higher liquidity usually leads to tighter spreads, making it a more favorable time for retail traders.

- Volatility: Forex pairs, particularly major currency pairs (like EUR/USD, and GBP/USD), tend to show the highest volatility during this session. Traders can capitalize on these price movements for both day trading and scalping.

- Institutional Activity: The early hours of the London session often reflect the strategic moves of institutional traders. By focusing on this window, retail traders can potentially align their trades with larger market participants, increasing the likelihood of profitable trades.

How to Trade London Kill Zones Effectively

To make the most of London Kill Zones, traders need to follow a structured approach. Here’s a step-by-step guide to help you execute trades during these high-impact periods.

1. Identify Key Levels Before the Kill Zone

Before the London session begins, it’s important to mark key support and resistance levels. These are areas where price is likely to react during the Kill Zone window.

- Use the previous day’s high and low as potential areas of interest.

- Pay attention to market structure, identifying areas where price is consolidating or trending.

2. Watch for Breakouts or Fakeouts

The London Kill Zone is known for breakouts or what’s called “fakeouts” (false breakouts). Many times, price will appear to break through a support or resistance level, only to reverse shortly after.

- Breakout Strategy: Wait for the price to break a key level and confirm the breakout by observing a strong volume surge or a follow-through of the price move.

- Fakeout Strategy: Be cautious of false breakouts, which are common in high-volatility environments like the London session. One strategy is to wait for price to break a level and then pull back to re-test the same level before entering the trade.

3. Utilize a Time-Based Indicator

Many traders rely on time-based indicators such as the Kill Zone indicator, which highlights key market hours (like London open) on the price chart. This visual tool helps in pinpointing trades during the high-volume window.

- Time-based indicators or using marked timeframes on your chart helps maintain discipline and ensures that you only trade when conditions are optimal.

4. Focus on Major Pairs

Major Forex pairs (EUR/USD, GBP/USD, etc.) tend to move the most during the London session. These pairs are often the most liquid and provide the clearest setups.

- Avoid exotic pairs or less liquid currencies during this time, as they might not react as predictably to the surge in London session volume.

5. Look for Confluence with Other Kill Zones

An important aspect of Kill Zones is the overlap with other major sessions. For example, the New York-London overlap is known for producing some of the largest moves of the day. When these two sessions overlap (from 7:00 AM to 9:00 AM EST), traders can experience even higher volatility.

- Use this overlap to identify significant price reversals or continuations. The increased volume from two active markets often leads to sharp price movements.

6. Use Stop Loss and Take Profit Strategically

Given the increased volatility, it’s crucial to use stop losses and take profits wisely. Tight stops might be triggered by noise, while large stops might increase your risk. It’s essential to balance risk and reward.

- Consider placing your stop loss just outside the support or resistance levels identified before the session started.

- For take-profit targets, aim for key levels based on prior market structure or the day’s expected range.

7. Be Aware of Economic News

Many high-impact economic reports are released during the London session. Pay close attention to the economic calendar and avoid trading during these news events unless you are experienced with trading news.

- Major economic reports, especially those coming out of the Eurozone or the UK, can cause large spikes in volatility, and trading during these times can be unpredictable.

Conclusion

Trading the London Kill Zone offers a window of high volatility and liquidity, making it a favorite among Forex traders. By focusing on this time frame, traders can take advantage of institutional order flows and market dynamics. However, this requires discipline, planning, and a solid understanding of key levels, market structure, and volatility patterns.

For best results, always back-test your strategies in the London Kill Zone and ensure that your risk management is aligned with the increased volatility of these high-volume trading hours.