Successful trading requires more than just technical analysis—it demands proper timing. Institutional traders strategically place their trades based on specific days of the week and times of the day when liquidity is highest. Understanding these key periods can help retail traders align with smart money flows, improve entry precision, and avoid low-probability setups. This article provides insights into how different days and times influence market behavior and offers practical strategies for optimizing your trade timing.

How the Day of the Week Influences Market Behavior

Markets do not behave the same way every day of the week. Each day carries its rhythms, volatility patterns, and institutional behaviors, which influence price movement. Below is an overview of what to expect on each day and how you can capitalize on these patterns.

Monday: Cautious Start and Range-Building

- Behavior: Mondays typically begin with low volatility, as institutions assess the market direction following the weekend. Market ranges are often formed on Monday, setting key levels for the week ahead.

- Strategy:

- Avoid aggressive trading. Instead, observe how the market reacts to the previous week’s highs and lows.

- Use Monday’s range as a framework for liquidity pools that will likely be tested later in the week.

Tuesday: Confirmation and Breakouts

- Behavior: Tuesday is often the day when directional moves begin, as institutions finalize their positions after assessing Monday’s action. If a breakout from Monday’s range occurs, it often indicates the weekly bias.

- Strategy:

- Look for order block retests or breakout setups based on Monday’s range.

- Align your trades with the emerging trend by entering on retests of breakout levels.

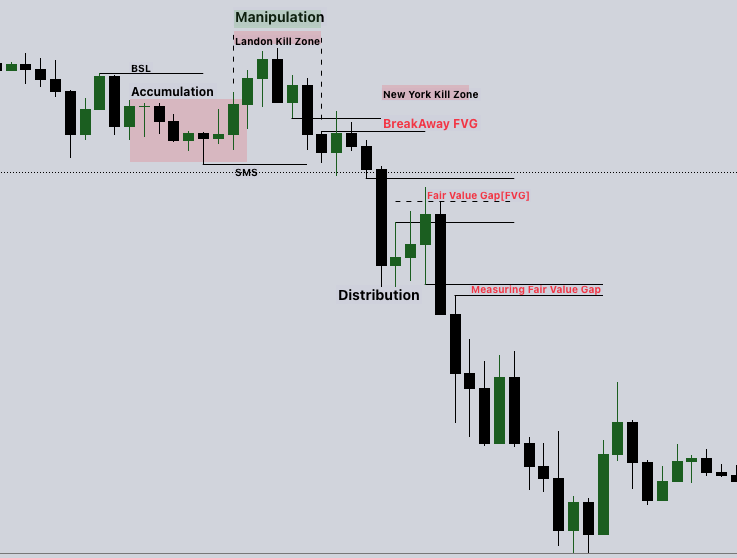

Wednesday: Midweek Reversals and Liquidity Grabs

- Behavior: Wednesday tends to feature midweek reversals—sharp movements designed to trap traders positioned in the earlier trend. It’s also a day when smart money triggers liquidity hunts, creating volatility spikes.

- Strategy:

- Anticipate false breakouts or liquidity grabs targeting Tuesday’s highs or lows.

- Look for market structure shifts (MSS) that confirm the reversal and enter accordingly.

Thursday: Trend Continuation or Final Trap

- Behavior: Thursday often continues the direction established earlier in the week but can also serve as a trap day if institutions plan to shift direction for Friday.

- Strategy:

- Trade trend continuation if the market shows momentum from Wednesday’s action.

- Monitor for potential liquidity sweeps targeting prior highs or lows, which could indicate a shift ahead of Friday.

Friday: Early Volatility and Profit-Taking

- Behavior: Fridays are marked by early-session volatility followed by profit-taking as institutions close positions before the weekend. Trend reversals or consolidations are common in the second half of the session.

- Strategy:

- Trade early in the London or New York session, focusing on continuation moves or kill zone setups.

- Avoid holding trades into the weekend unless you are prepared to manage potential gaps at the next week’s open.

How to Use Time of Day for Precision Trading

The time of day plays a critical role in determining market volatility, liquidity, and trade opportunities. Markets behave differently throughout the day, with institutional players becoming active during specific windows. Below are the key trading periods and strategies to maximize your edge.

Asian Session (11:00 PM – 7:00 AM GMT)

- Behavior: The Asian session typically produces tight ranges, setting the stage for liquidity grabs during the London session.

- Strategy:

- Use the highs and lows of the Asian session as reference points. These levels are frequently tested or broken during the London session.

- Avoid aggressive trades—wait for better setups during the London open.

London Kill Zone (7:00 AM – 10:00 AM GMT)

- Behavior: The London session brings in high liquidity, resulting in sharp price movements. It is common for the market to fake a breakout during the first hour and reverse shortly after.

- Strategy:

- Look for false moves or liquidity grabs during the opening hour.

- Use order blocks and fair value gaps (FVGs) formed during the Asian session for potential entries.

New York Kill Zone (12:00 PM – 3:00 PM GMT)

- Behavior: The New York session either follows the London trend or creates a reversal, especially if economic news releases coincide with this period.

- Strategy:

- Monitor for retracements into London session order blocks or FVGs for high-probability entries.

- Be cautious around major economic news releases—these often cause volatility spikes that can trap retail traders.

London-New York Overlap (12:00 PM – 4:00 PM GMT)

- Behavior: This is the most active trading window, with both European and American markets open. It offers the best opportunities for breakouts or trend continuations due to high liquidity.

- Strategy:

- Focus on trend-following trades during this window.

- Use market structure shifts or retests of key levels for confirmation before entering trades.

Integrating Day of the Week and Time of Day into Your Trading Strategy

Here’s how you can combine day-of-the-week patterns and time-of-day insights to improve your trading results.

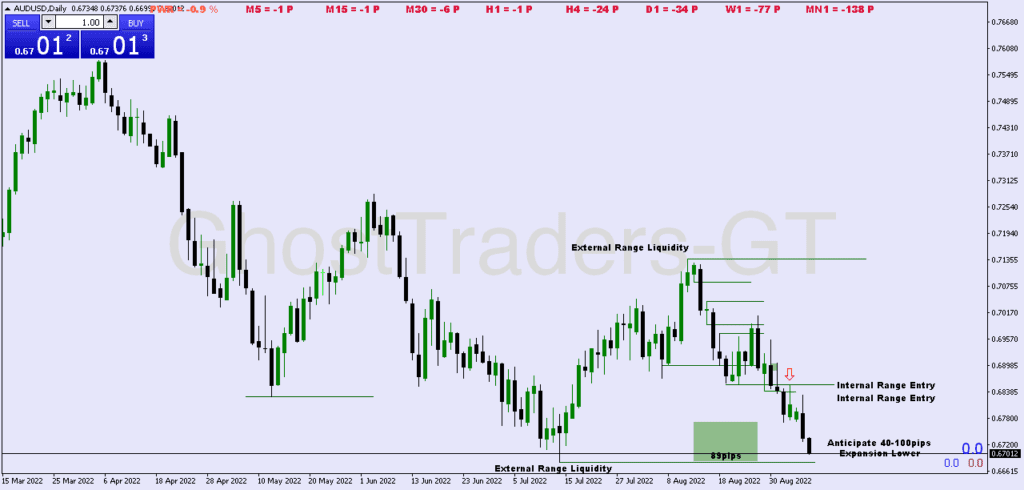

Step 1: Identify the Weekly Bias Early in the Week

- Use Monday’s range to set the framework for liquidity zones.

- Confirm the weekly trend on Tuesday by observing breakouts or trend continuations.

Step 2: Trade Key Levels During Session Openings

- Focus on Asian highs and lows during the London session for potential liquidity grabs.

- Use order block retests from the London session during the New York kill zone for precision entries.

Step 3: Anticipate Midweek Reversals on Wednesday

- Be prepared for sharp reversals or liquidity hunts targeting highs and lows from earlier in the week.

- Look for market structure shifts to confirm the reversal before entering.

Step 4: Ride the Trend on Thursday and Manage Risk on Friday

- If the trend is intact, use Thursday to ride the continuation.

- Trade early on Friday and take profits before the session closes to avoid potential weekend gaps.

Conclusion

Using the day of the week and time of day as part of your trading strategy helps you align with institutional flows, avoid low-probability setups, and improve your overall precision. Each day of the week brings its trading opportunities, with Tuesdays and Thursdays offering the best setups for trend continuation and Wednesdays presenting midweek reversals. By focusing on session timings and kill zones, traders can further optimize their entries and exits, ensuring they trade during the most liquid and volatile windows.

Incorporate these principles into your trading plan, practice patience, and stay disciplined, and you’ll develop the skills to trade with confidence alongside the institutions.