Last updated on August 13th, 2025 at 01:08 pm

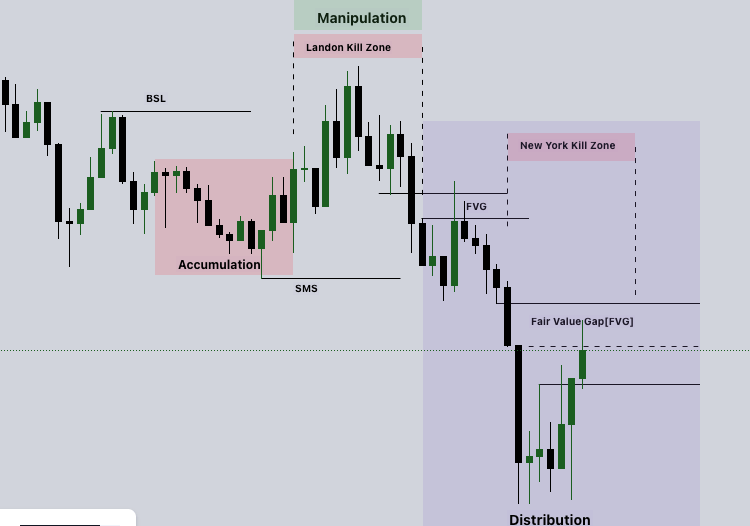

In smart money trading, the concept of kill zones is crucial to understanding market movements and timing trades with precision. Kill zones are specific windows of time when institutional traders (or “smart money”) are most active, leading to the highest levels of liquidity and volatility. By trading during these periods, retail traders can align themselves with institutional order flow, allowing them to capture better trade setups and avoid false moves.

This article will explore two of the most important kill zones in trading: the New York Kill Zone and the London Kill Zone. By understanding when and how to trade during these times, you can significantly improve your results. You can also explore our cool Forex Kill Zone Converter Tool

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

What Are Kill Zones in Trading?

Kill zones are periods during the trading day when institutional traders, banks, hedge funds, and large financial institutions are most active in the markets. These time windows see the highest trading volumes and are often marked by increased volatility and liquidity grabs.

Because institutions drive large portions of market volume, trading during these kill zones allows you to participate in the most significant price moves, taking advantage of the liquidity created by institutional orders. The two most important kill zones are during the opening hours of the London session and the New York session, each representing a period of heightened institutional activity.

- London Kill Zone: Generally occurs between 02:00 AM – 05:00 AM EST( New York Time)when the European markets open and liquidity surges as institutions in the UK and Europe place their orders.

New York time from 02:00 AM to 05:00 AM corresponds to London time from 07:00 AM to 10:00 AM. London is 5 hours ahead of New York during this period in August 2025. So you add 5 hours to New York time to get London time. - New York Kill Zone: Occurs between 7:00 AM – 10:00 AM EST (New York time), when the US market opens, creating a second wave of institutional activity, particularly when it overlaps with the London session.

Understanding these kill zones gives traders a framework for timing their trades based on when smart money is moving the market, rather than relying on random or low-volume market hours.

Why Kill Zones Matter

Kill zones matter because these time windows are when smart money is most likely to manipulate prices. This could mean pushing prices into liquidity zones to trigger stop losses, creating false breakouts, or using high-volume orders to shift market direction.

For retail traders, trading during these periods offers several advantages:

- Liquidity Availability: The higher liquidity during kill zones means orders are filled more efficiently with minimal slippage.

- Volatility: The increased volatility during these windows provides greater opportunities to capture larger price movements in less time.

- Institutional Order Flow: Trading alongside institutional order flow can increase your chances of success by allowing you to align with the market’s true direction.

How to Trade the London Kill Zone

The London Kill Zone is one of the most important time windows for forex traders, as London is the largest forex market globally. The London session often sets the tone for the day’s price action, creating opportunities for breakouts, trend reversals, and liquidity hunts.

Key Characteristics of the London Kill Zone:

- High Volatility: The London session typically sees high volatility, especially at the open, as institutional traders in Europe place their orders.

- Liquidity Hunts: Smart money frequently pushes price into liquidity zones, triggering stop hunts before setting the true market direction.

- Breakout Trades: The opening of the London session often leads to breakouts from the Asian session’s range, providing opportunities for quick gains.

How to Trade the London Kill Zone:

- Mark Key Levels from the Asian Session:

Before the London Kill Zone begins, mark key levels from the Asian session (typically a more range-bound period), such as highs and lows. These levels often act as areas of liquidity where institutional traders target stop hunts. - Watch for Liquidity Grabs:

The first move at the opening of the London session is often a false move designed to trigger stops. Smart money pushes price into these liquidity zones (e.g., above the Asian session’s high or below the low) before reversing in the opposite direction. Wait for this liquidity grab before entering a trade. - Look for Market Structure Breaks:

Once the liquidity grab occurs, wait for confirmation of a market structure break. For example, if the London open pushes price below the Asian low but then quickly reverses, breaking back above a key level, this could indicate the start of a bullish move. - Trade the Trend Continuation or Reversal:

Based on the liquidity grab and market structure break, either trade the continuation of the trend or a reversal. The London session often establishes the day’s trend direction, so positioning yourself accordingly can lead to profitable trades.

Example Strategy:

- Pre-London Session: Mark the high and low of the Asian session range.

- London Open: Watch for a stop-hunt below the Asian low (for a long position) or above the Asian high (for a short position).

- Confirmation: Wait for price to reverse and break the structure in the opposite direction.

- Entry: Enter the trade after the market structure break, setting your stop-loss just below the liquidity grab for minimal risk.

How to Trade the New York Kill Zone

The New York Kill Zone is another vital window for traders, especially when it overlaps with the London session, creating the most liquid period of the day. The New York session brings fresh institutional orders from the US, adding to the already high volume from Europe.

Key Characteristics of the New York Kill Zone:

- Overlapping Sessions: The overlap of the London and New York sessions creates a significant influx of liquidity and volatility.

- Trend Continuation or Reversal: The New York Kill Zone often continues the trend established in the London session or creates a reversal.

- Reaction to Economic News: The New York session frequently coincides with key economic data releases, causing sharp movements.

How to Trade the New York Kill Zone:

- Analyze the Trend from the London Session:

Before the New York session begins, review the price action from the London session. Identify whether the market is trending or ranging. This will help you anticipate whether the New York Kill Zone will provide a trend continuation or a reversal. - Watch for Key Economic Data Releases:

The New York session often coincides with major economic data releases (e.g., US non-farm payrolls or CPI). These releases can cause sharp price movements, so be prepared for volatility and avoid entering trades just before a data release. - Look for Continuations or Reversals:

If the London session established a strong trend, look for continuation trades during the New York Kill Zone. Alternatively, if the London session created exhaustion, expect a potential reversal. - Use Order Blocks and Fair Value Gaps (FVGs):

Use order blocks and fair value gaps identified during the London session to guide your trades. If price retraces into a bullish or bearish order block during the New York Kill Zone, this can provide an optimal entry point for a high-probability trade.

Example Strategy:

- Pre-New York Session: Identify the prevailing trend or range established during the London session.

- New York Open: Watch for price action around key levels or order blocks created during the London session.

- Confirmation: If price retests an order block or fills a fair value gap, wait for a reversal or continuation confirmation.

- Entry: Enter the trade with confirmation, setting a tight stop-loss below the order block or gap.

Combining the London and New York Kill Zones

One of the most powerful aspects of trading the New York Kill Zone is the overlap with the London session, where institutional traders from both regions are active simultaneously. This overlap often results in the highest liquidity and volatility of the entire trading day.

To take advantage of this, traders can:

- Trade Breakouts and Reversals:

The price moves established in the London Kill Zone can either continue into the New York session or reverse sharply. Be ready for both scenarios by analyzing key levels from the London session. - Wait for Market Structure Shifts (MSS):

A market structure shift (MSS) during the London session often signals the beginning of a new trend, which the New York session will reinforce. If no MSS occurs, the New York session may continue the existing trend. - Take Advantage of Increased Liquidity:

The overlapping session provides increased liquidity, making it easier to execute trades without slippage. Look for liquidity grabs and stop hunts during this period, as institutions use this window to trigger stops and accumulate positions.

Conclusion

The London Kill Zone and the New York Kill Zone are two of the most critical periods for day traders, offering opportunities for high-probability trades by aligning with institutional order flow. By understanding how smart money operates during these sessions, retail traders can improve their ability to trade breakouts, reversals, and liquidity grabs effectively.

To trade these kill zones successfully:

- Prepare in advance by marking key levels and understanding the market structure.

- Wait for liquidity grabs and confirmation before entering trades.

- Align with institutional order flow using tools like order blocks and fair value gaps for precise entries and exits.

Mastering these kill zones can significantly improve your trading results