Last updated on September 26th, 2024 at 12:40 pm

Institutional Order Flow trading is a concept that focuses on the movement of large orders executed by major financial entities. It examines where these significant players place their orders, as well as how they accumulate and distribute positions to generate profits. These big players manipulate prices, typically aiming to push them toward liquidity zones—areas where retail traders have placed their stop-losses or pending orders around key support or resistance levels.

Order Flow Trading helps reveal the directional bias of the market, enabling traders to predict future movements by observing where the price is most likely to go. This insight is particularly valuable because it gives retail traders a chance to follow the “smart money” instead of being caught in the traps set by these large players.

In essence, Institutional Order Flow trading is about following the trail of liquidity—the resting pools of orders that institutions are drawn to—often located at previous highs and lows.

what is Institutional order flow entry drill (IOFED)

Institutional Order Flow Entry Drill (IOFED) occurs when the price retraces to fill less than 50% of a Fair Value Gap (FVG), whereas Consequence Encroachment happens when the price fills exactly 50% of the FVG. In the chart below, you’ll notice how prices retraced to fill less than 50% of the fair value gap before sharply declining.

Understanding the concepts of IOFED and Consequence Encroachment is essential for traders, as they demonstrate that price may not always fill an FVG. Strong institutional order flow can cause prices to rapidly move up or down, leaving gaps partially unfilled. By incorporating these principles into your strategy, you can avoid missing trade opportunities when price action doesn’t fully meet traditional FVG levels.

Liquidity Pools with Insitutional order flow

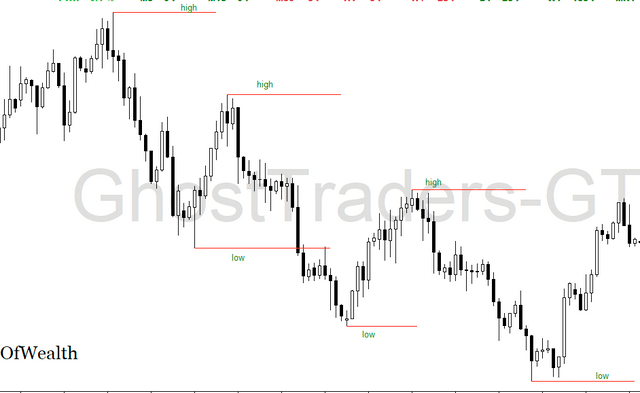

Institutional Order Flow revolves around liquidity pools—areas of resting liquidity such as stop-losses and pending orders placed by retail traders. These liquidity pools often sit at key technical levels, like previous highs and lows, which serve as magnets for institutional traders looking to profit from triggering a flurry of orders.

For instance, if you observe price hovering near a previous low, this is a zone where many traders will have placed stop-losses, expecting the market to continue moving upwards. However, an institution may drive the price downward to trigger these stop-losses, collecting liquidity before pushing the price back up. This liquidity sweep is what enables institutional traders to accumulate positions at better prices with minimal slippage.

Retail traders can use these liquidity pools to their advantage by anticipating where the big players are likely to move prices and positioning themselves accordingly.

Blending Power of Three(PO3) with Institutional Order Flow

Power of Three(PO3) trading principles takes the understanding of Institutional Order Flow a step further by providing actionable strategies that reveal the footprints left by smart money.

One key concept is the idea of market manipulation, where institutions push prices toward liquidity zones to maximize their profitability. Price does not move randomly; rather, it seeks liquidity to fulfill the large orders placed by institutional players. The manipulation generally occurs cyclically—known as accumulation, manipulation, and distribution.

- Accumulation: This is the phase where institutions accumulate positions, often in a narrow range, before making a significant price move. This happens under the guise of price consolidation, which lulls retail traders into false confidence.

- Manipulation: During this phase, prices are driven towards liquidity pools—often against the prevailing market trend—to trigger stop-losses and pending orders. The goal here is to accumulate even more liquidity before making the final, more sustainable price move.

- Distribution: Once the institutions have accumulated enough liquidity, they distribute their positions, causing the price to reverse or continue its intended trend.

Understanding these phases allows traders to time their entries and exits more effectively, avoiding the traps set by large players while aligning their positions with the overall market direction.

Key Indicators to Watch in Institutional Order Flow Trading

When analyzing institutional order flow, several indicators can help traders gauge where liquidity pools might lie and where institutions may likely move the market:

- Volume Profile: Volume is a key indicator in Order Flow trading. A surge in volume, especially at significant levels, may signal that institutions are actively buying or selling. Volume Profile indicators help identify areas where the most trading activity has occurred, signaling where institutions are accumulating or distributing orders.

- Liquidity Voids: These are areas where the price has moved rapidly without much resistance, leaving behind minimal trading activity. Price tends to return to these areas to “fill in” the liquidity, offering an opportunity for savvy traders to position themselves ahead of these retracements.

- Previous Highs and Lows: These are the prime zones where liquidity rests, often in the form of stop-loss orders. Institutions know this, and they aim to drive prices toward these levels to trigger a wave of stop-losses, after which they capitalize on the newly created liquidity.

Practical Application: Institutional Order Flow Strategy

- Identify Liquidity Pools: Look for previous highs and lows on your chart, particularly those accompanied by increased volume. These areas are prime candidates for liquidity sweeps.

- Wait for Manipulation: Watch for signs of market manipulation—such as sudden price moves towards key levels—without corresponding fundamental news or catalysts. These moves often signal that institutions are targeting liquidity pools.

- Enter with the Smart Money: Once you identify a liquidity sweep (price breaking through a key level and then quickly reversing), this is your opportunity to enter the market. The reversal signals that institutions have collected liquidity and are now positioned for the next significant move.

- Time Your Exits: Once price has filled in the liquidity or reached another area of resting liquidity, consider exiting your position.

Types of Institutional Order Flow and Trading Approaches

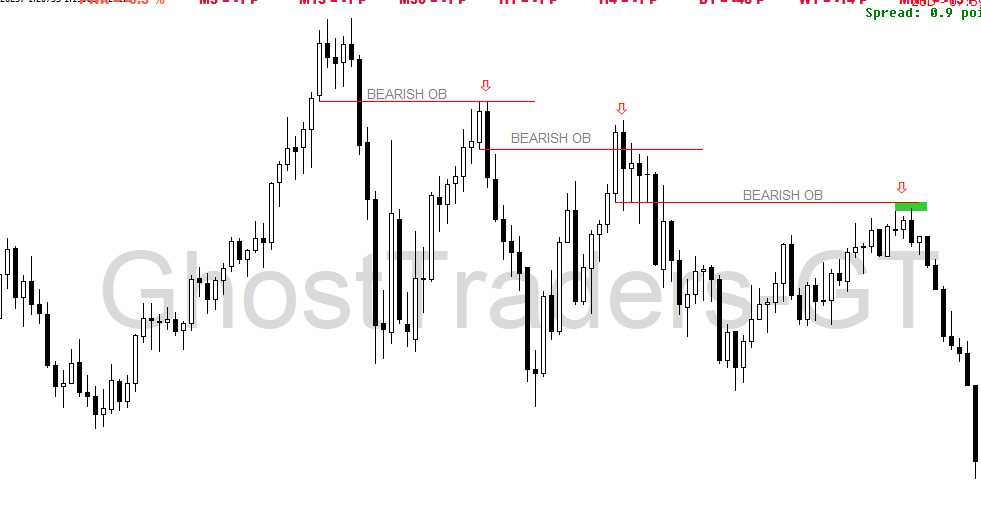

A bearish institutional order flow anticipates price-seeking sell-side liquidity. In this scenario, constructing trading setups using bearish order blocks can be highly effective. Since price tends to gather sell-side liquidity during bearish institutional order flow, bullish order blocks are more likely to falter as price gathers sell-side liquidity at previous lows, reinforcing the bearish sentiment. When the market structure is bearish, focus on bearish order blocks and fair value gaps for entry points.

Conversely, a bullish institutional order flow expects price to pursue buy-side liquidity. Creating trading setups using bullish order blocks and fair value gaps becomes advantageous in this context. Just as with bearish order flow, bullish order blocks are prone to failure during bullish institutional order flow as price accumulates buy-side liquidity at previous lows. When the market structure is bullish, concentrate on bullish order blocks for entry opportunities.

Fair Value Gap Trading with Institutional Order Flow

Fair Value Gaps (FVGs) are utilized for trade entries, while order flow provides the directional bias. Once a trader identifies the market’s order flow or trend direction, they can use Fair Value Gaps to time their entries. A Bearish Fair Value Gap signals a strong bearish order flow, indicating the market is likely to decline. On the other hand, a Bullish Fair Value Gap points to a dominant bullish order flow, suggesting upward momentum. Understanding the interplay between order flow and Fair Value Gaps is crucial for making precise and informed trades.

Limitations of Order Flow Trading

Order flow trading is not without its challenges. It requires a substantial learning curve and consistent practice to master. Additionally, it can be susceptible to market noise, making it difficult to identify reliable trading signals.

However, with dedicated backtesting and hands-on experience, these challenges can be overcome. Building pseudo-experience through backtesting can assist in grasping the intricacies of order flow trading. It’s crucial to understand concepts like fair value gaps and order blocks for entry purposes, once the directional bias has been identified.

Key Takeaways for Successful Order Flow Trading

- Choose the Right Timeframe: Begin by observing daily order flow. If it’s unclear, switch to H4 and H1 for a clearer perspective. Higher time frames like weekly and monthly should be considered for setups with longer horizons.

- Directional Bias: An understanding of order flow provides you with a directional bias of the market. This is crucial for making informed trading decisions.

- Consider Multiple Timeframes: Weekly and monthly order flow can impact smaller timeframes. While focusing on daily setups, periodically check weekly and monthly order flow to account for broader influences.

By integrating these key takeaways into your trading strategy, you can leverage order flow concepts to enhance your trading decisions and potentially achieve better outcomes.

This video mainly focuses on order blocks and institutional order flow. This video is taken from a one-on-one Zoom session. The main focus of this session was smart money trading. This was mainly focused on order flow and how we can combine everything with fair value gaps, order blocks, liquidity pools, and liquidity voids. But in this session, we didn’t discuss identifying an Order block and Institutional Order flow

Conclusion

Institutional Order Flow trading gives retail traders a unique advantage by allowing them to align with smart money instead of being caught in its traps. By understanding how liquidity pools work and how institutions manipulate price to their advantage, traders can avoid common retail pitfalls and start trading with a more strategic, informed approach. Blending Other smart money trading principles with Order Flow concepts offers a powerful toolkit to enhance your market understanding and, ultimately, your profitability.

By following the trail of liquidity and observing institutional behavior, you can start thinking like the big players—and trading alongside them, rather than against them.