Last updated on September 26th, 2024 at 01:01 pm

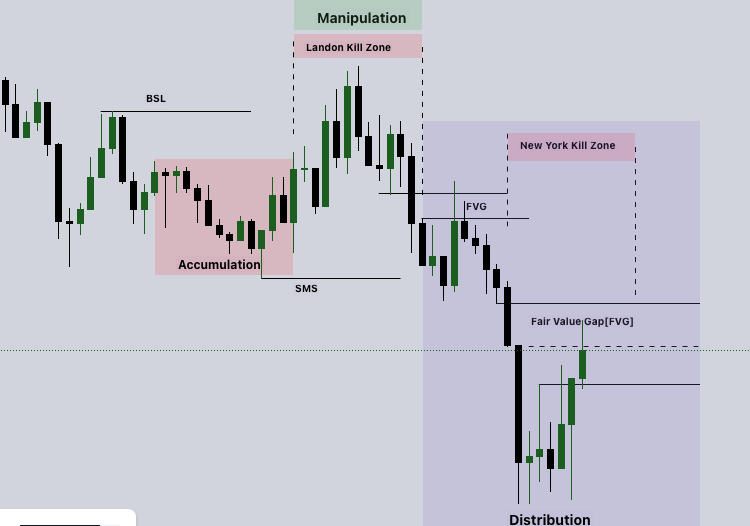

Understanding the Power of 3 (PO3) is crucial for successful intraday trading. Power of 3 (PO3) consists of three key elements: accumulation, manipulation, and distribution. During accumulation Price collects orders on both sides of the market. Manipulation is when price deliberately move in a false direction to trick traders into taking the wrong position or getting knocked out of their positions.

Finally, distribution occurs when accumulated positions are released after manipulation, usually near the high or low of the day, depending on the market’s direction. By comprehending these three elements, traders can make more informed decisions and better navigate market dynamics.

Power of Three Trading with Forex Trading Sessions

- The Asian session is between Midnight to 4:00 a.m. New York Time

- London is open from 2:00 am to 11:00 am New York Time

- New York is open from 7:00 am to 4:00 pm UTC

PO3 Phases

- Accumulation: This phase represents the initial stage where smart money, typically institutional traders or market makers, starts accumulating positions in a particular asset. During this phase, prices are often stable or in a consolidation pattern.

- Manipulation: The manipulation phase follows accumulation. It involves smart money manipulating the price to create a specific market sentiment. This manipulation can include fakeouts and stop-hunting to lure retail traders into the market.

- Distribution: After manipulating the price, the smart money enters the distribution phase. In this stage, they start selling their accumulated positions to retail traders who entered during the manipulation phase. This often leads to a significant price drop or rally.

The Power of 3 trading strategy aims to identify and capitalize on these phases to make profitable trades. Traders using this strategy look for specific price patterns and indicators that signal the transition between these phases.

Practical Application of the PO3 Trading Strategy:

- Identify a period of consolidation or ranging market. This is a sign that market makers are accumulating assets.

- Look for a key price level such as Fair Value Gaps (FVG) or Order Blocks for entries. These are levels where market makers are likely to place their orders.

- Wait for a false breakout or stop-loss hunt to occur /Buy side or sell side liquidity to be collected. This is a sign that market makers are manipulating the market.

- Enter a trade in the direction of the main trend.

- Place your stop loss below the key price level.

- Take profit at your next target level.

Tips for using the Power of 3 Trading Strategy:

- Use multiple timeframes to confirm your trade setups.

- Be patient and wait for the right trade setup.

- Use proper risk management and position sizing.

- Backtest your trading strategy on historical data before using it in live trading.

It’s important to note that the Power of 3 strategy, like any trading strategy, requires careful analysis and risk management. There will be times when market makers do not follow the typical three-phase pattern.

However, by understanding the Power of 3 concepts, traders can improve their chances of success in the markets. Successful implementation involves a deep understanding of market dynamics and the ability to recognize the signs of accumulation, manipulation, and distribution.