When most people think of forex trading, especially new traders, they often imagine it as a path to quick riches. This idea has been heavily promoted by so-called gurus, but the truth is far more complicated. Forex was never built to make it easy for retail traders to profit. If anything, it was designed to profit off of us. The big institutions have a significant advantage—they control liquidity. As retail traders, we don’t have liquidity; we are liquidity. That’s why the vast majority, nearly 95%, of retail traders fail.

Understanding the Market Dynamics

The forex market is not a battle between big institutions and retail traders. Instead, we as small traders attempt to profit from the market moves initiated by larger players. These institutions are not targeting one another; they are hunting down retail traders. The term “liquidity” reflects this reality. Large players need liquidity to move the market in their favor, and we provide that liquidity with our trades. This is why so many retail traders lose; the market wasn’t built to help us win but to profit from our losses.

The False Promise of Quick Success in Forex

As an academy that mentors traders globally, GhostTraders has noticed a common misconception among many South African traders. There’s a pervasive belief that forex is a get-rich-quick scheme. The reality couldn’t be further from that. Many don’t take the time to master risk management, and this is one of the main reasons they fail.

I don’t blame traders for having these unrealistic expectations. The people who introduced forex to us sold us this idea of fast money. I fell victim to this thinking when I started. I spent money on courses and mentorship programs from these so-called gurus who hyped forex beyond reality. Their teachings distorted my psychology, filling me with dreams of doubling my account every month. Of course, that’s nonsense. It may sound achievable in theory, but in practice, it’s an unrealistic goal.

The Turning Point: A Shift in Mindset About Forex

It took some hard lessons for me to realize that the problem wasn’t just with the market or my trading skills—it was with what I was consuming mentally. So, I made a conscious decision to stop following these gurus. Even today, I follow none of them. I’ve come to understand that forex trading is not about following someone else’s strategy but about developing patience and mastering risk management.

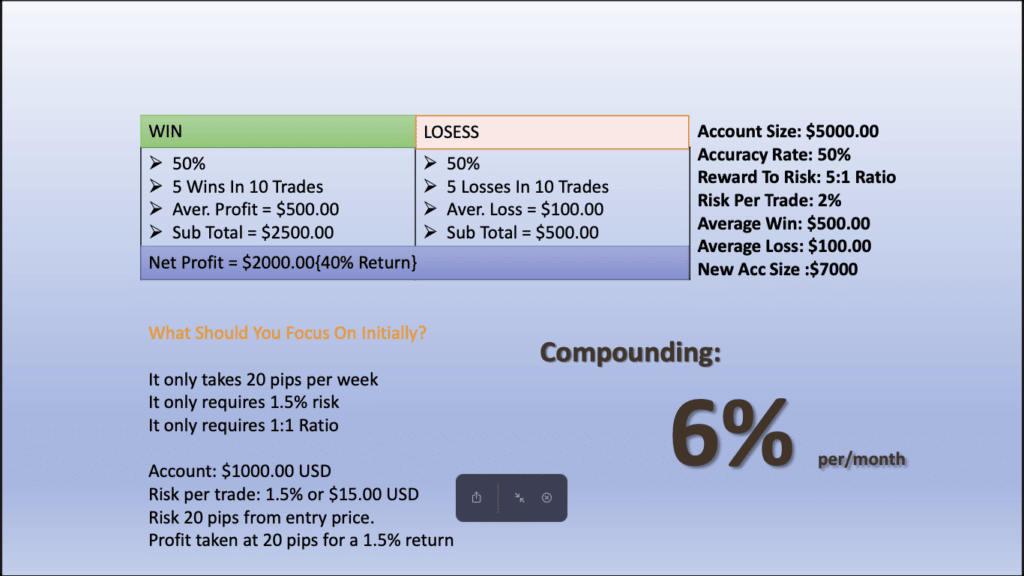

I began to risk only 1-2% per trade and aim for a monthly return of 5-10%. It turned out that I wasn’t a bad trader after all. The issue was that I had been following the wrong advice. Now, I see the same mistakes in many of the traders I mentor. Some of them expect to become profitable in five days when it took me five years to be consistently profitable. They haven’t even taken the time to master themselves in trading, which is crucial for long-term success.

Finding Your Unique Edge as a Forex Trader

As a trader, you have to discover what makes you unique. For example, after reviewing my trading history, I realized that over 80% of my trades are sell positions. Not only that, but most of my wins come from these sales positions. If you look at our analysis on platforms like YouTube, Instagram, and Telegram, you’ll notice that my setups are often sold setups. I’ve developed an eye for these opportunities, and it’s a strength I’ve learned to lean into.

I’ve also realized that I’m better suited to swing trading than day trading. I don’t enjoy sitting in front of the charts all day, and swing trading allows me the flexibility I need. This self-awareness has been essential to my growth as a trader.

GhostTraders: Built on Education, Not Hype

This self-discovery and learning process is exactly why GhostTraders was founded in 2018. We built this platform to educate traders, not to hype them up with unrealistic dreams. Forex is all about risk, and as traders, we are essentially professional money managers. Our job is to manage our losses effectively and let the wins come naturally as a result. By focusing on minimizing losses and mastering ourselves, we can achieve consistent profitability.

Final Thoughts

Forex trading isn’t for the impatient or the faint-hearted. It requires discipline, self-awareness, and a strong focus on risk management. The market wasn’t designed to help retail traders succeed, but that doesn’t mean you can’t profit. The key is to master yourself, understand your strengths and weaknesses, and commit to the long game. Only then can you hope to achieve consistent success in this challenging but rewarding field.