Mitigation blocks and breakers are two critical price action concepts in smart money trading. They refer to specific zones where institutions adjust their positions and where prices are likely to react in the future.

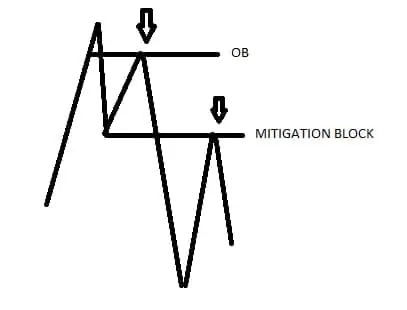

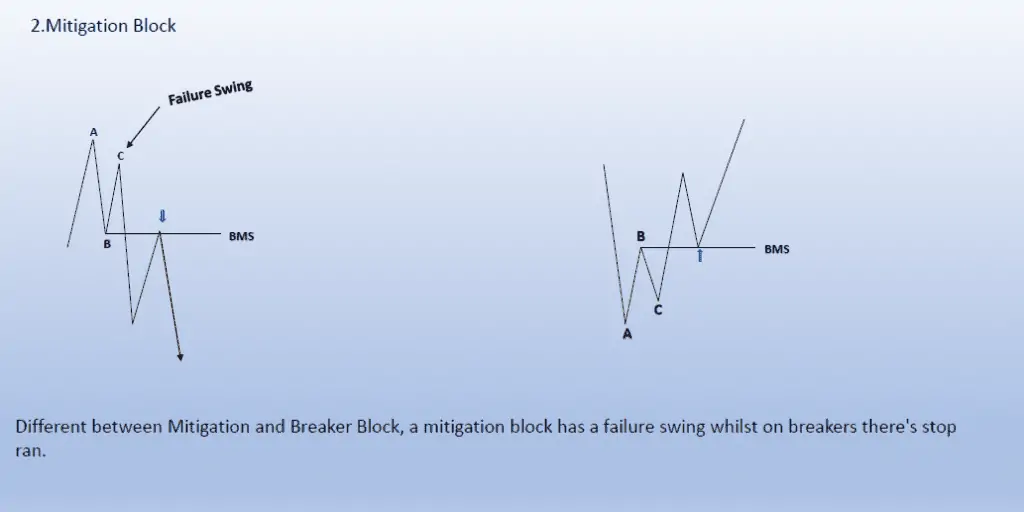

- Mitigation Blocks:

A mitigation block is an area where institutional traders have previously made an inefficient move and are looking to mitigate (or recover) their positions. These blocks represent zones where price is likely to revisit and reverse because institutions need to unwind or mitigate the losses from their initial positions. - Breakers:

A breaker is a price level that previously acted as support or resistance but was broken by smart money. After price breaks through this level, it often returns to retest the area, creating an opportunity for traders to enter in the direction of the new trend.

Both concepts are rooted in institutional trading behavior and reflect how smart money handles large orders and liquidity in the market. By understanding these zones, traders can position themselves to trade harmoniously with the institutional flow, improving the likelihood of success.

Mitigation Blocks Explained

Mitigation blocks form when institutions need to “fix” or mitigate the effects of a prior imbalance caused by large orders. These zones act as magnets for price action, as smart money revisits these areas to balance their books and close or adjust their positions.

How Mitigation Blocks Form:

- Imbalance:

Institutional traders might create an imbalance in price due to placing a large order during high volatility, or due to price moving too quickly in one direction. This creates an inefficient price movement, which needs to be “mitigated” later. - Price Returns to Mitigate:

After the imbalance, price typically returns to the area where the institutional positions were placed. This gives smart money a chance to adjust their positions (mitigate their earlier trades). - Reversal Opportunity:

When price returns to a mitigation block, it often reacts strongly, providing retail traders with an opportunity to enter trades in the direction of the mitigation.

How to Identify Mitigation Blocks:

- Look for inefficient price moves (sharp moves without retracements), followed by consolidation.

- Identify the last consolidation zone before the sharp move, as this is where the institutional imbalance likely occurred.

- Price will revisit this consolidation area to allow institutions to mitigate their positions, creating a mitigation block.

Breakers Explained

A breaker is a zone where price breaks through a previously respected support or resistance level, often trapping retail traders who were trading in the wrong direction. After the breakout, the smart money will revisit the breaker level to confirm it as the new direction, and price will likely continue its trend.

How Breakers Form:

- Break of Structure:

A breaker forms when price breaks through a key level of support or resistance, creating a structural change in the market. This break often traps retail traders who are on the wrong side of the market. - Retest of the Breaker:

After the breakout, price often returns to retest the area that was broken, confirming the new trend direction. This creates an entry opportunity for traders looking to ride the new trend. - Continuation of the Trend:

Once the breaker is confirmed, price will continue in the direction of the break, allowing traders to confidently enter the market.

How to Identify Breakers:

- Look for a break of structure, where price breaks through a key support or resistance level.

- Wait for price to retest the broken level (the breaker). This retest provides an ideal entry point to join the new trend.

- Ensure that the break and retest are supported by institutional order flow, confirming that smart money is behind the move.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

How to Trade Mitigation Blocks and Breakers

Now that we’ve explained what mitigation blocks and breakers are, let’s break down how to trade them successfully. The key to trading these concepts is timing your entry around institutional price moves and using confirmation to avoid false signals.

Step 1: Identify the Market Context

Before trading mitigation blocks or breakers, it’s important to identify the overall market context. Are we in a trending market, or is the market ranging? Understanding the broader market structure will help you determine whether to trade with the trend or wait for a reversal.

- In trending markets, focus on trading mitigation blocks in the direction of the trend or breakers that align with the new trend direction.

- In ranging markets, wait for price to break out of the range and look for breakers to form, signaling a new trend.

Step 2: Spot Mitigation Blocks and Breakers

Once you’ve established the market context, look for potential mitigation blocks or breakers.

- For mitigation blocks, identify areas where institutional traders have left an imbalance. Look for sharp price moves followed by a return to the zone of consolidation.

- For breakers, watch for a clear break of structure at key support or resistance levels. Wait for price to retest the breaker zone before entering.

Step 3: Wait for Confirmation

Before entering a trade, always wait for confirmation of the mitigation block or breaker. Confirmation can come in the form of price action patterns, such as:

- Rejection Candles: When price reaches a mitigation block or breaker, look for strong rejection candles (e.g., pin bars or engulfing candles) to confirm that institutions are defending the level.

- Market Structure Shifts: Look for a change in market structure that supports your trade direction. For example, if price revisits a mitigation block and forms higher highs and higher lows, this confirms bullish momentum.

Step 4: Enter the Trade

Once confirmation is in place, enter your trade at the mitigation block or breaker zone. Use tight risk management by placing your stop-loss just beyond the zone of the mitigation block or breaker. This protects you from further manipulation while giving the trade room to develop.

- For mitigation blocks, enter after price revisits the block and shows signs of reversing in the intended direction.

- For breakers, enter after the retest of the breaker level, ensuring the new trend is confirmed.

Step 5: Manage Risk and Take Profits

Mitigation blocks and breakers offer high-probability trade setups, but proper risk management is still essential. Always use tight stop-losses to protect against unexpected moves and set clear take-profit levels.

- Take Profits: Consider taking partial profits at the next key level of support or resistance, or use a trailing stop to lock in gains as the trade progresses.

- Risk-to-Reward Ratio: Aim for at least a 1:2 or 1:3 risk-to-reward ratio when trading mitigation blocks or breakers to ensure profitability over the long term.

Common Mistakes to Avoid

When trading mitigation blocks and breakers, it’s important to avoid common mistakes:

- Entering Too Early:

Don’t rush into the trade before confirmation. Always wait for price action signals to confirm that institutions are defending the zone. - Ignoring Market Structure:

Make sure the overall market structure supports your trade. For example, trading a bullish mitigation block in a bearish market can lead to false signals. - Overleveraging:

Keep your risk in check by using tight stop-losses and risking only a small percentage of your capital on each trade. Overleveraging can lead to significant losses if the trade goes against you.

Conclusion

Mitigation blocks and breakers are powerful tools for trading in line with institutional order flow. By understanding how institutions mitigate their positions and how breakers signal shifts in market structure, traders can enter high-probability setups with confidence.