EUR/USD is most volatile in the USA during the London session, specifically the London Kill Zone, and during the New York session, specifically the New York Kill Zone. Although many traders residing in the U.S. might not be able to take advantage of the London session since it’s too early in the morning, they can take advantage of the New York session, specifically targeting the New York Kill Zone and the New York PM session.

Understanding Market Volatility

Volatility refers to the extent of price movements within a specific period. Higher volatility means larger price swings, presenting more opportunities for traders. For EUR/USD, the two most critical trading sessions impacting volatility are:

- London Session (3 AM – 12 PM EST)

- New York Session (8 AM – 5 PM EST)

These sessions are crucial because they represent major financial hubs where liquidity is highest, and institutional traders are most active.

The London Kill Zone (2 AM – 5 AM EST)

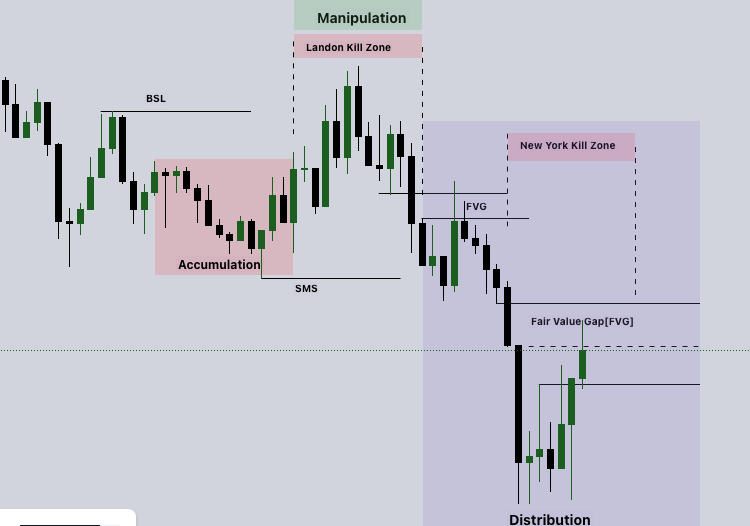

The London Kill Zone, occurring between 2 AM and 5 AM EST, is a key period of market activity. During this time, major European banks open, and significant economic data releases can cause sharp price movements. Traders outside of the U.S. often capitalize on this session as it aligns with high liquidity and institutional order flow.

However, for U.S.-based traders, participating in this session may be challenging due to its early hours. This is why focusing on the New York session is often more practical.

The New York Kill Zone (7 AM – 10 AM EST)

The New York Kill Zone, occurring between 7 AM and 10 AM EST, is the best opportunity for U.S. traders to capitalize on EUR/USD volatility. This period overlaps with the later part of the London session, creating a surge in liquidity and market movement. Here’s why this timeframe is significant:

- Overlap with London: The most liquid market conditions occur when both London and New York sessions are open.

- Institutional Order Flow: Banks, hedge funds, and financial institutions execute trades during this time, leading to strong market movements.

- Economic News Releases: Key U.S. and European economic reports, such as Non-Farm Payrolls (NFP), CPI, and interest rate decisions, are often released, increasing volatility.

The New York PM Session (1 PM – 3 PM EST)

While the early part of the New York session sees the most volatility, the PM session from 1 PM to 3 PM EST still offers significant trading opportunities. Institutional traders return after the midday slowdown, often adjusting positions before the market close.

During this time, EUR/USD can exhibit sharp reversals or trends depending on market conditions. Traders should watch for:

- Post-lunch liquidity surge as U.S. traders re-engage.

- End-of-day positioning from institutional traders adjusting for the next session.

- Reaction to earlier economic data, especially if morning releases created an initial price move that later corrects.

Key Strategies to Trade EUR/USD Volatility

For traders looking to maximize their opportunities during these key volatile periods, here are a few effective strategies:

1. Breakout Trading

- Identify key support and resistance levels before the Kill Zones.

- Enter trades when price breaks above or below these levels with strong momentum.

- Use stop losses to manage risk, placing them slightly below/above previous swing points.

2. Liquidity Grab and Reversal

- Observe price movements around liquidity zones where institutional traders place orders.

- Wait for price to sweep liquidity and show signs of reversal before entering a trade.

- Confirm reversals with candlestick patterns like pin bars or engulfing patterns.

3. News Trading

- Monitor the economic calendar for high-impact news releases during the Kill Zones.

- Enter trades based on the market’s reaction to news, using stop orders to catch breakout movements.

- Be cautious of spreads widening during news events and potential slippage.

Conclusion

For traders in the U.S., the best time to trade EUR/USD is during the New York Kill Zone (7 AM – 10 AM EST) and the New York PM Session (1 PM – 3 PM EST). While the London Kill Zone is also highly volatile, it occurs too early in the morning for most U.S.-based traders.

By focusing on these optimal trading windows, traders can take advantage of high liquidity, institutional order flow, and major market movements, maximizing their profitability while managing risk effectively.