Last updated on April 30th, 2025 at 12:46 am

The London Kill Zone is a prime trading window, typically occurring between 7:00 AM and 10:00 AM GMT. It represents a period of high liquidity and volatility, where institutions place significant orders and the market often makes critical moves. Many traders capitalize on the sharp price movements during this session, but not every London Kill Zone offers clear and profitable opportunities.

There are times when staying out of the market during this window is a better strategy, helping traders avoid unnecessary risks, choppy conditions, or manipulative price action. This article explains when and why traders should avoid the London Kill Zone and provide alternative strategies for safer and more effective trading.

What is the London Kill Zone?

The London Kill Zone coincides with the opening hours of the London trading session, which is known for its high liquidity and large institutional orders. As Europe’s largest financial center, London attracts significant institutional activity, and the market tends to make false breakouts, liquidity grabs, or structural shifts during this period. However, certain market conditions can make the London Kill Zone more challenging or unprofitable to trade.

When to Avoid the London Kill Zone

Here are several scenarios when it’s wise to stay on the sidelines and wait for more favorable trading conditions.

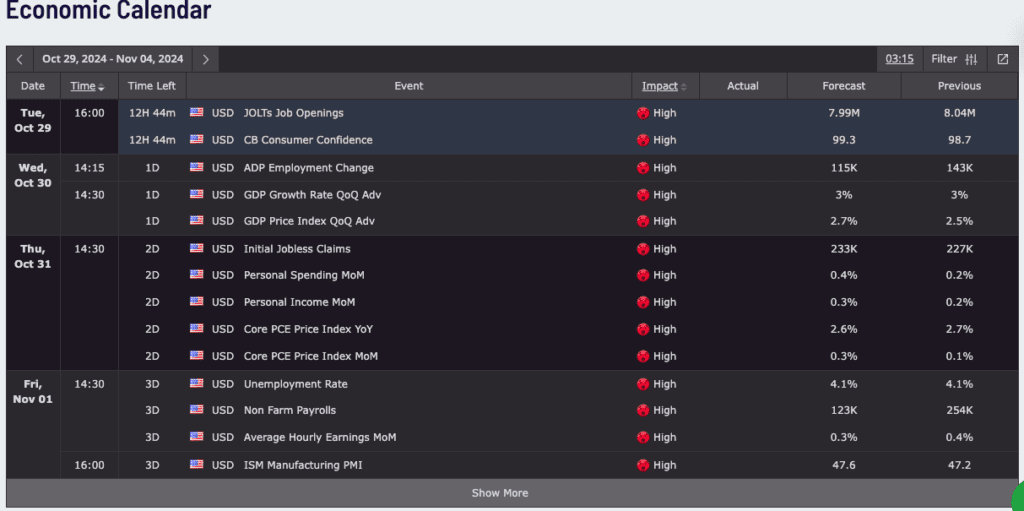

1. Pre-Major News Events or Economic Releases

Why It’s Risky:

If significant economic data—such as central bank rate decisions, inflation reports, or NFP (Non-Farm Payroll) figures—is scheduled shortly after the London Kill Zone, market participants may remain indecisive, leading to erratic price movements. Institutions often delay their orders until after the news release to take advantage of the liquidity spike.

How to Manage It:

- Avoid trading the initial hours of the London session if a major economic release is due later in the day.

- Instead, wait for the New York session to confirm the trend after the news event.

2. Days with Low Volatility (Bank Holidays or Major Events)

Why It’s Risky:

During bank holidays in major financial centers or global events like G7 summits or central bank conferences, market participation is lower, resulting in reduced liquidity and unpredictable price action. Even though the London Kill Zone opens, the lack of institutional participation can cause false signals and whipsaw movements.

How to Manage It:

- Check the economic calendar for holidays in the UK, US, or European Union.

- If trading volume is expected to be low, skip trading for the day or focus on other active sessions like Asia or New York.

3. Range-Bound or Choppy Markets

Why It’s Risky:

If the market has been consolidating for an extended period, the London Kill Zone may not offer clear breakouts or directional moves. Institutions often accumulate positions quietly during consolidations, causing false breakouts and liquidity traps in the early session.

How to Manage It:

- Avoid trading if the previous day’s range is tight or if the Asian session failed to create meaningful highs or lows.

- Wait for a confirmed breakout of the consolidation range before entering trades.

4. When the New York Session Holds Key Market Drivers

Why It’s Risky:

Sometimes, the market holds back during the London session if key US economic data or events, such as an FOMC announcement, are scheduled for the New York session. Institutions may avoid initiating major moves during the London Kill Zone to avoid being on the wrong side of a larger trend shift later in the day.

How to Manage It:

- Monitor the New York Kill Zone (12:00 PM – 3:00 PM GMT) for trading opportunities instead.

- Use the London session to identify liquidity zones that may be tested or manipulated during the New York session.

5. Inconsistent Market Structure or Indecisive Trends

Why It’s Risky:

If the market structure across different timeframes is inconsistent—e.g., the daily chart shows a bullish trend while the 1-hour chart shows bearish momentum—it may indicate that institutions are uncertain about the market’s direction. Trading during these conditions increases the likelihood of getting caught in false moves or whipsaws.

How to Manage It:

- Avoid trading until the market structure aligns across multiple timeframes.

- Wait for a market structure shift (MSS) during the London session to confirm the trend before placing trades.

6. Post-News Event Price Action

Why It’s Risky:

If a high-impact news event took place just before the London session, the market may enter a cool-down period, with erratic or untrustworthy movements. Institutions may need time to digest the news, leading to low-quality setups during the initial hours of the London session.

How to Manage It:

- Use the London session to observe how price reacts to the post-news environment.

- Wait for the New York PM session to confirm any new trend directions.

How to Trade Smartly When Skipping the London Kill Zone

When it’s wise to avoid the London Kill Zone, traders can remain active by adjusting their strategies.

- Focus on Higher Timeframes

- Use the higher timeframes (4 hours or daily) to identify order blocks and liquidity pools.

- Mark these levels in advance and wait for the market to align with your bias during other sessions.

- Monitor the New York Kill Zone

- The New York Kill Zone offers excellent trading opportunities, especially when the London session fails to deliver clear setups.

- Use the Asian session’s high and low as key levels to watch for liquidity grabs during New York trading hours.

- Trade the Retest Instead of the Breakout

- If the London session breaks out during low participation, wait for a retest of the broken level during the New York session. This ensures that you are entering trades with better confirmation.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

Conclusion

While the London Kill Zone offers excellent trading opportunities, it’s important to recognize when market conditions are unfavorable. Low volatility, major news events, bank holidays, or inconsistent market structures can increase the risk of false signals and choppy price action.

By knowing when to sit out the London session and shift focus to other sessions or higher timeframes, traders can avoid unnecessary losses and preserve their capital. Staying disciplined and waiting for the right market conditions will ultimately lead to more consistent success in trading.