What is a Propulsion Block?

propulsion blocks are price zones that mark the starting point of an aggressive, high-momentum move initiated by institutional traders. It often appears after a period of accumulation or consolidation, indicating that smart money has built up a large position and is ready to drive the market in a particular direction.

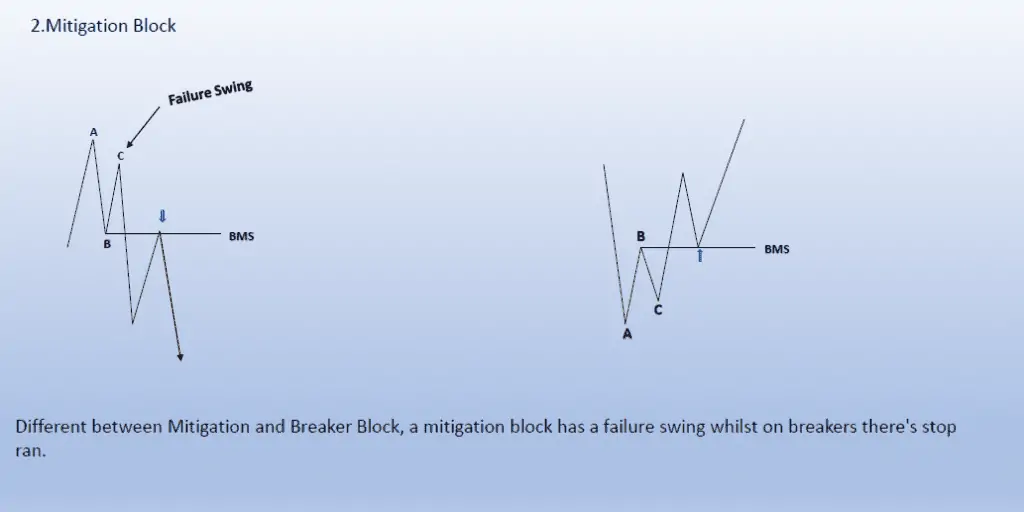

Unlike order blocks or mitigation blocks, which are more focused on position adjustments and rebalancing, propulsion blocks signal the beginning of a strong trend or breakout. Once price moves away from a propulsion block, it rarely returns immediately, as institutions aim to sustain momentum.

Key Characteristics of a Propulsion Block:

- Aggressive Price Move: Propulsion blocks are marked by rapid, large moves in price, signaling institutional engagement.

- Consolidation Before Breakout: These blocks often follow a tight consolidation zone, where institutions accumulate their positions before driving the market.

- Continuation of Momentum: Once price leaves a propulsion block, it tends to continue in the same direction without retracing immediately.

- Key Liquidity Zones: Propulsion blocks are often located near key highs or lows, where liquidity is gathered before a breakout.

How Propulsion Blocks Form

Propulsion blocks are created by institutions executing large trades in a specific direction, generating a significant shift in market sentiment. These shifts often occur during session opens (e.g., in London or New York) or after important economic events, when liquidity is high.

The price action leading to a propulsion block usually follows these steps:

- Accumulation: Institutions accumulate their positions quietly over several candles or a range, causing price to consolidate.

- Liquidity Grab: Price might briefly spike in the opposite direction to trigger stop-loss orders and create liquidity for large orders.

- Breakout: A sudden surge in momentum occurs, leaving behind the propulsion block, as smart money pushes price in their intended direction.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

How to Identify a Propulsion Block on a Chart

Spotting a propulsion block requires attention to consolidation zones and sharp breakouts. Here’s how you can identify them:

- Look for Tight Consolidation Before the Move:

Identify areas where price has been moving in a tight range with small candles, suggesting institutional accumulation. - Spot a Sharp Breakout with Momentum:

Mark the first large candle that breaks out of the consolidation zone. This breakout candle is the start of the propulsion block. - Define the Block Boundaries:

The opening and closing of the first breakout candle mark the high and low of the propulsion block. This zone becomes a critical reference point. - Volume Spike:

Look for an increase in trading volume during the breakout. A volume spike confirms institutional involvement.

How to Trade Propulsion Blocks Effectively

Once you’ve identified a propulsion block, the next step is to trade the momentum continuation or catch the retest if price returns to the block. Below is a step-by-step guide on how to trade propulsion blocks.

Step 1: Identify the Propulsion Block

- Find a consolidation zone that precedes a sudden breakout.

- Mark the high and low of the first breakout candle to define the propulsion block.

- Confirm the breakout with a volume increase or other signs of institutional activity.

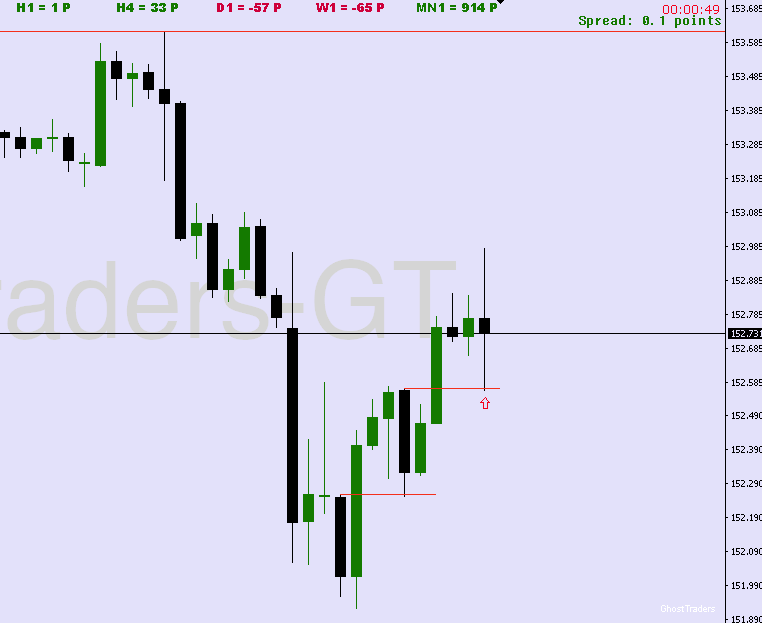

Step 2: Wait for a Retest (Optional)

In some cases, price may retrace back to the propulsion block before continuing in the original direction. This retest offers a low-risk entry.

- Wait for price to revisit the propulsion block zone.

- Look for price rejection patterns (e.g., pin bars, engulfing candles) as confirmation.

- Enter the trade once price shows signs of respecting the propulsion block.

Step 3: Trade the Momentum Continuation

If price doesn’t return to the block immediately, trade the continuation of the momentum. This strategy involves entering the trade shortly after the breakout.

- Enter the trade in the direction of the breakout once the propulsion block forms.

- Use a stop-loss below the low (for longs) or above the high (for shorts) of the propulsion block.

- Ride the trend until price reaches the next key support or resistance level.

Step 4: Manage Risk and Take Profits

Proper risk management is essential when trading propulsion blocks. Here’s how to protect your capital:

- Stop-Loss Placement: Place your stop-loss just beyond the boundaries of the propulsion block to protect against false reversals.

- Risk-to-Reward Ratio: Aim for at least a 1:2 or 1:3 risk-to-reward ratio to ensure long-term profitability.

- Partial Profit-Taking: Take partial profits as price reaches significant levels, such as swing highs or lows, and trail your stop-loss to lock in gains.

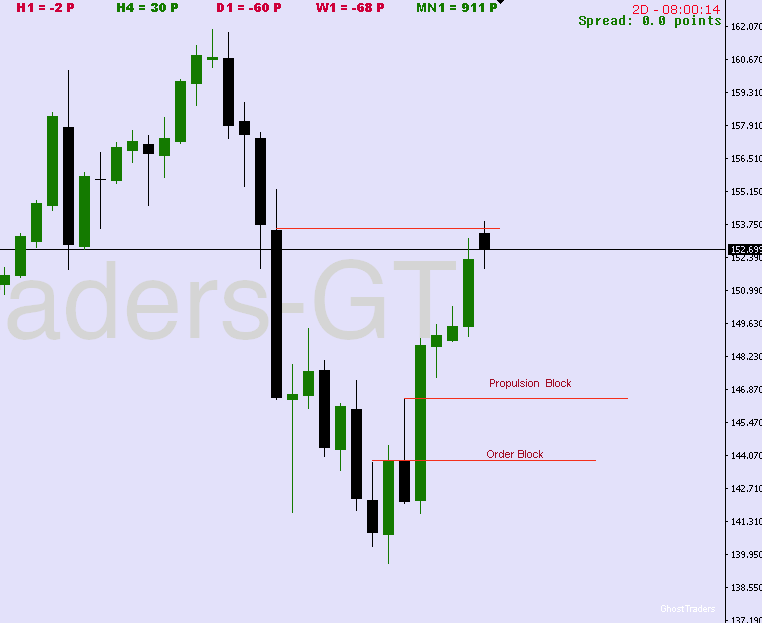

Example of Trading a Propulsion Block

Let’s walk through a real-world example using the GBP/USD on a 15-minute chart:

- Identify the Propulsion Block:

- During the London session, price consolidates between 1.2150 and 1.2170 for several hours.

- A sharp bullish breakout occurs, pushing price to 1.2200 within minutes. This breakout marks the start of the propulsion block.

- Mark the Propulsion Block:

- Use the opening and close of the first breakout candle (1.2170 to 1.2185) as the boundaries of the propulsion block.

- Wait for a Retest:

- After the initial breakout, price retraces back to 1.2175, testing the propulsion block.

- A bullish engulfing candle forms, confirming institutional support at the block.

- Enter the Trade:

- Enter a long trade at 1.2175, with a stop-loss below the propulsion block at 1.2165.

- Set your take-profit at the next resistance level at 1.2230.

- Manage the Trade:

- As price reaches 1.2230, take partial profits and move your stop-loss to break even to protect your position.

Common Mistakes to Avoid When Trading Propulsion Blocks

- Entering Too Late:

Enter trades as close to the propulsion block as possible to minimize risk. Chasing price after it has moved far from the block can lead to losses. - Ignoring Market Context:

Always trade propulsion blocks in line with the overall trend. A propulsion block that forms against the trend may not hold. - Not Waiting for Confirmation:

If price revisits the block, wait for reversal patterns before entering. Avoid jumping into trades without proper confirmation.

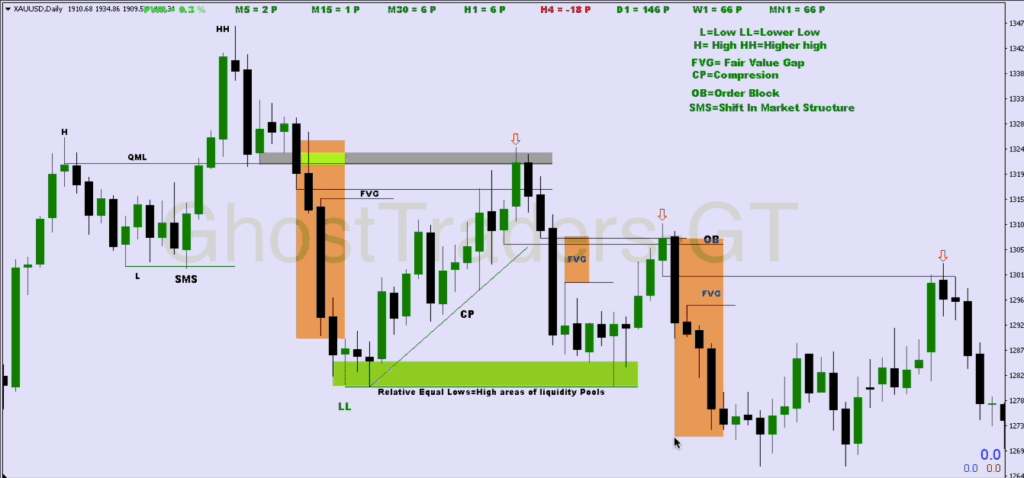

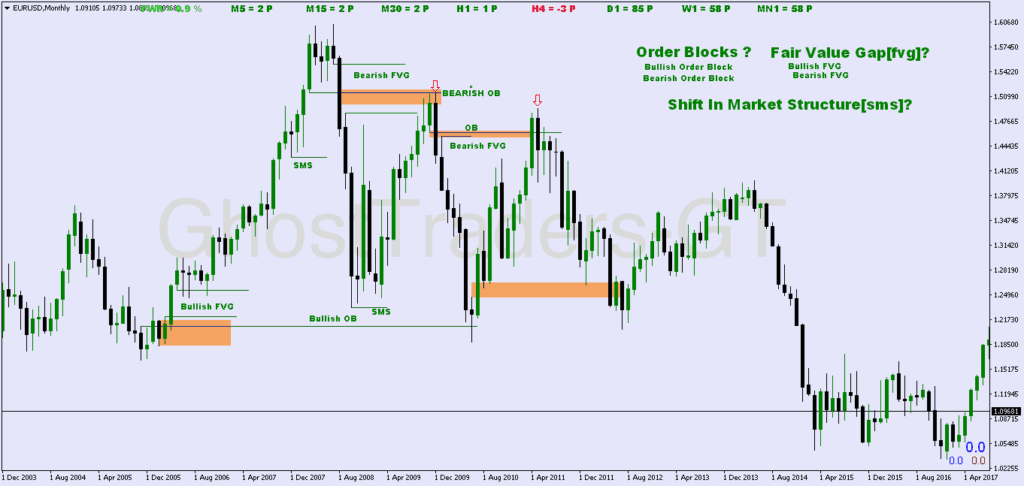

Combining Propulsion Blocks with Other Smart Money Concepts

To increase the probability of success, combine propulsion blocks with other institutional trading concepts:

- Order Blocks: If an order block aligns with the propulsion block, it adds confluence to your trade.

- Fair Value Gaps (FVGs): Look for propulsion blocks that coincide with fair value gaps, as these areas offer strong entry points.

- Kill Zones: Trading propulsion blocks during high-liquidity periods, such as the London or New York Kill Zones, increases the likelihood of success.

Conclusion

Propulsion blocks are powerful tools for capturing high-momentum moves initiated by institutional traders. By understanding how these blocks form and knowing when to enter trades, you can align with smart money and improve your trading outcomes.

Whether you trade the momentum continuation or wait for a retest, propulsion blocks offer low-risk, high-reward opportunities that can enhance your strategy. Always trade in line with the broader market structure, use proper risk management, and combine propulsion blocks with other smart money concepts to maximize your chances of success.

With practice and discipline, mastering propulsion blocks will give you a significant edge in the market, allowing you to capitalize on institutional momentum and ride trends with confidence.