Day trading can be profitable, but it requires precise timing, discipline, and knowledge of how institutional traders move the markets, for high-probability day trading setups. Most retail traders fall into traps set by large financial institutions that create false breakouts, liquidity hunts, and rapid reversals. To achieve consistency, day traders need to align their trades with institutional order flow.

This article provides a roadmap for identifying high-probability setups rooted in smart money concepts, such as liquidity zones, order blocks, mitigation blocks, and market structure shifts (MSS). We’ll walk through several types of setups and show how you can capitalize on them to improve your day trading results.

What Makes a Setup High Probability?

A high-probability trade setup offers a greater chance of success because it aligns with institutional flows. Here are the key characteristics of high-probability setups:

- Clear Market Structure: Price follows identifiable patterns such as trends, consolidations, or reversals.

- Liquidity Hunt or Grab: Price targets key liquidity areas (e.g., above swing highs or below lows) to trigger stop-losses.

- Smart Money Entry Zones: The setup occurs near order blocks, mitigation blocks, or breakers—areas of institutional interest.

- Confluence of Signals: Multiple technical signals (e.g., fair value gaps, Fibonacci levels, or session opens) align to strengthen the setup.

Let’s explore specific high-probability setups you can look for during the trading day.

1. Liquidity Grab Setup

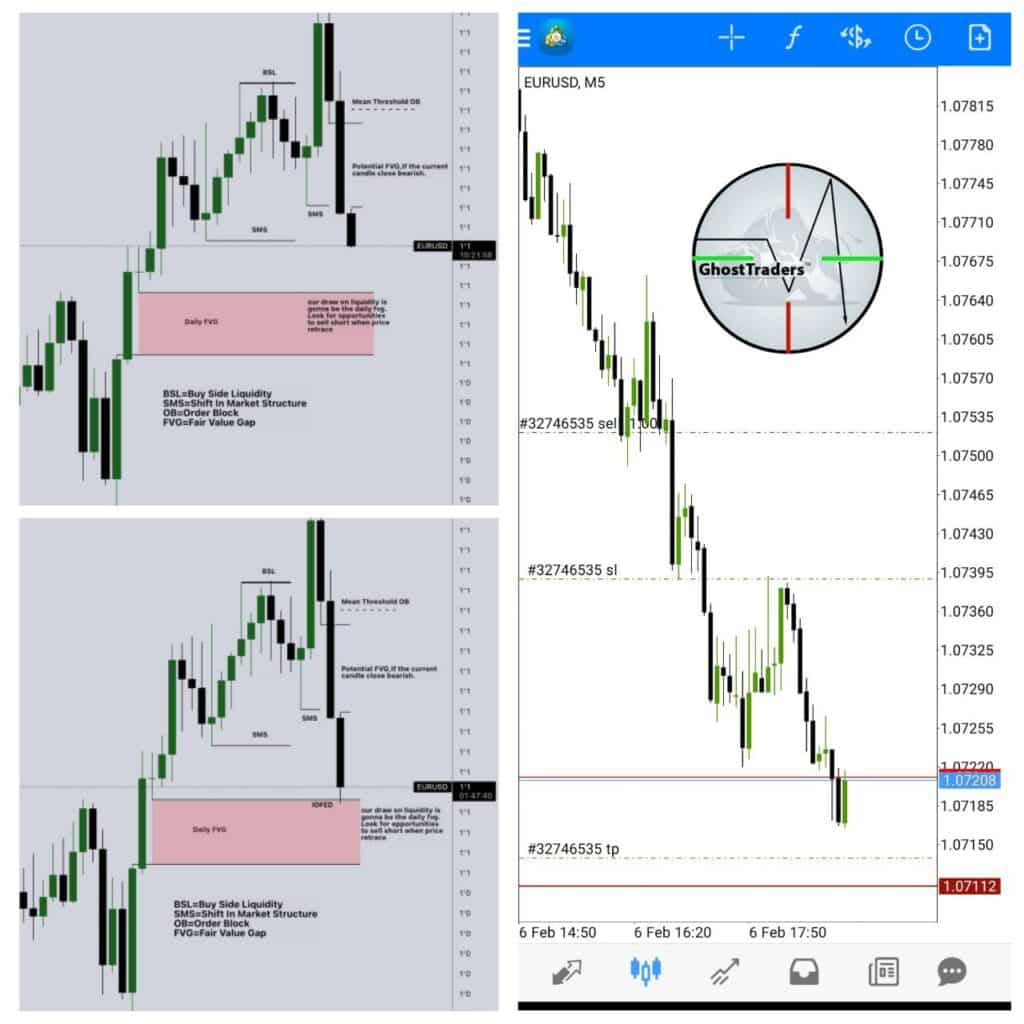

A liquidity grab setup occurs when smart money hunts for liquidity by driving price to stop out retail traders before reversing in the intended direction. Institutions use liquidity hunts to fill their large orders efficiently, which creates opportunities for traders who understand this tactic.

How to Spot a Liquidity Grab Setup:

- Identify swing highs and lows from previous sessions (e.g., Asian or London session highs/lows).

- Look for false breakouts where price briefly spikes above/below these levels and quickly reverses.

- Confirm the reversal with candlestick patterns (e.g., pin bars or engulfing patterns).

How to Trade It:

- Wait for Price to Sweep Liquidity: Let the price spike above/below a key level and look for signs of reversal.

- Enter on Confirmation: Once a reversal candle forms, enter the trade in the opposite direction of the spike.

- Set Stop-Loss: Place your stop-loss beyond the liquidity zone to avoid further manipulation.

- Target: Aim for the next support or resistance level as your take-profit target.

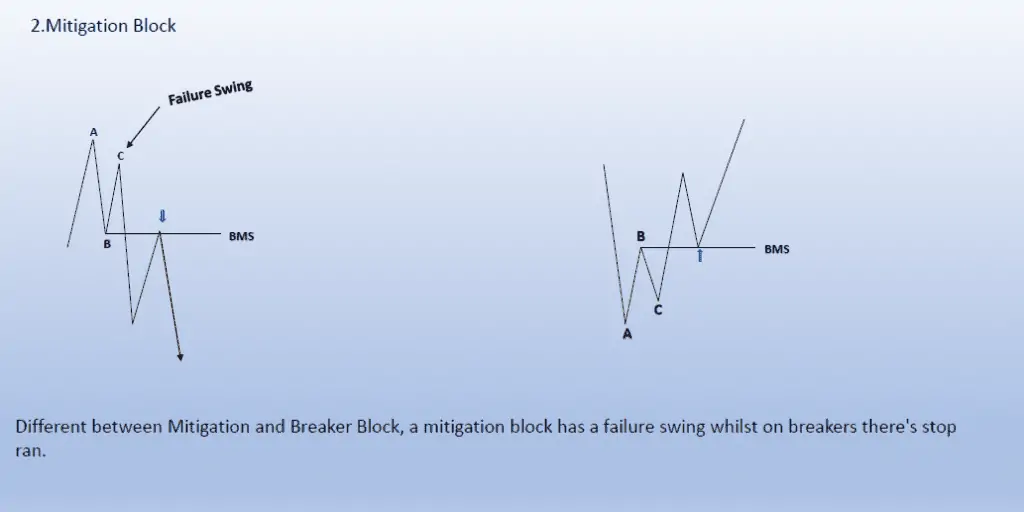

2. Mitigation Block Setup

A mitigation block setup takes advantage of areas where institutions previously caused price imbalances. When price revisits these areas, smart money uses the opportunity to mitigate previous trades, making it a high-probability entry zone.

How to Spot a Mitigation Block Setup:

- Look for areas of consolidation or pullbacks before a strong move. The last candle before the breakout is the mitigation block.

- Price tends to retrace back to this block, offering an entry point.

How to Trade It:

- Identify the Mitigation Block: Mark the last consolidation or retracement area before a breakout.

- Wait for the Retest: Wait for price to revisit the block.

- Enter on Reversal Signal: Look for rejection candles or a market structure shift near the mitigation block to confirm entry.

- Place Stop-Loss: Place your stop-loss just beyond the block.

- Target: Use Fibonacci extensions or previous highs/lows for your take-profit target.

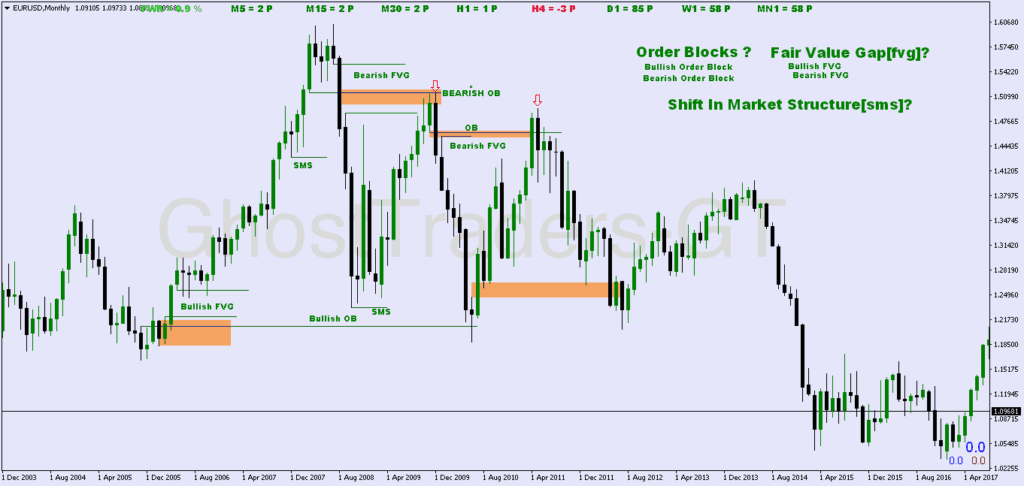

3. Order Block Setup for High Probability Day Trading

Order blocks are zones where institutional traders accumulate or distribute their positions. When price revisits these zones, it often bounces or reverses due to institutional buying or selling pressure.

How to Spot an Order Block Setup:

- Identify a sharp move followed by consolidation or pullbacks. The last up candle before a bearish move or the last down candle before a bullish move marks the order block.

- Price will typically return to this area before continuing in the original direction.

How to Trade It:

- Mark the Order Block: Identify the last up or down candle before the sharp move.

- Wait for Retest: Let the price return to the order block to provide an entry opportunity.

- Enter on Rejection Candle: Look for a candlestick pattern confirming that institutions are defending the level.

- Stop-Loss and Target: Place a stop-loss beyond the order block and target the nearest key level.

4. Market Structure Shift (MSS) Setup

A market structure shift (MSS) signals a trend reversal. Smart money traders monitor these shifts to enter early into new trends or catch reversals. An MSS occurs when price breaks a key high or low, changing the trend direction.

How to Spot an MSS Setup:

- Identify the current trend by analyzing recent swing highs and lows.

- Look for a break of structure (BOS) where price breaks a key high (in a downtrend) or a key low (in an uptrend).

- Confirm the trend shift with a retest of the broken structure.

How to Trade It:

- Identify the BOS: Spot the moment when price breaks a significant high or low.

- Wait for Retest: Let the price retest the broken structure (now acting as support or resistance).

- Enter on Confirmation: Enter the trade once a reversal pattern forms at the retest point.

- Stop-Loss and Target: Place your stop-loss beyond the retest level and aim for a Fibonacci extension or the next structural point as your target.

5. New York and London Kill Zones for High Probability Day Trading

The New York and London Kill Zones are periods of peak liquidity when institutions place large orders. Trading during these windows increases the probability of capturing strong directional moves.

How to Spot a Kill Zone Setup:

- London Kill Zone: 7:00 AM – 10:00 AM (London time)

- New York Kill Zone: 7:00 AM – 10:00 AM (New York time)

- Look for breakouts or liquidity grabs during these windows as institutions seek liquidity to execute large orders.

How to Trade It:

- Identify the Kill Zone: Focus on trading around the opening of the London or New York sessions.

- Mark Key Levels: Mark the Asian session’s high/low and the previous day’s key levels.

- Wait for Liquidity Grab or Breakout: Look for a false breakout or a clean trend breakout at these key levels.

- Enter on Confirmation: Enter the trade in the direction of the breakout or after a liquidity grab reversal.

- Stop-Loss and Target: Place your stop-loss beyond the kill zone and target the next key level or session high/low.

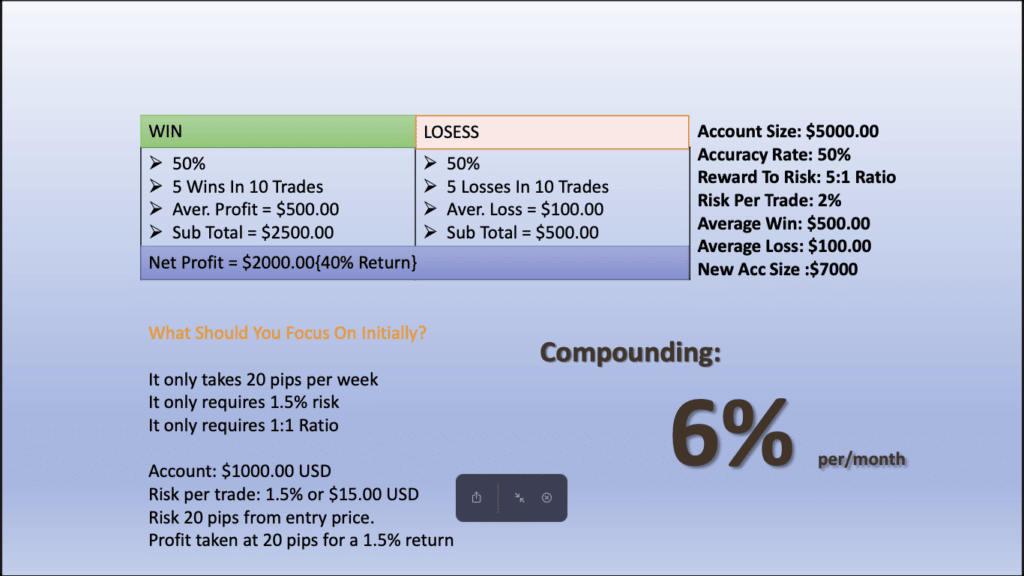

Risk Management for High Probability Day Trading

Even with high-probability setups, proper risk management is essential. Here are some tips to manage your trades effectively:

- Use Tight Stop-Losses: Always place a stop-loss just beyond key levels to minimize risk.

- Risk 1-2% per Trade: Never risk more than 2% of your trading capital on a single trade.

- Use a Favorable Risk-to-Reward Ratio: Aim for at least a 1:2 or 1:3 risk-to-reward ratio to maintain profitability.

- Take Partial Profits: Lock in profits by scaling out of trades at key levels to reduce risk.

Conclusion

High-probability day trade setups are the cornerstone of a profitable trading strategy, especially when aligned with smart money concepts. By focusing on liquidity grabs, order blocks, mitigation blocks, market structure shifts, and kill zones, you can trade with greater confidence and avoid the common pitfalls of retail traders.

The emphasizes the importance of following institutional flows and trading with precision. By mastering these setups and incorporating them into your day trading plan, you’ll significantly improve your ability to capture profitable trades and avoid market traps. Stay patient, follow the market structure, and always manage your risk effectively.

This guide equips you with the tools and strategies needed to identify high-probability setups. Practice these setups consistently, and with time, you’ll develop the discipline and skill required to trade in line with smart money.