a daily bias is essential for aligning trades with institutional order flow and maximizing profitability. However, even with a clear bias, markets do not always move in a straight line—traders frequently encounter consolidation hurdles, which act as periods of stagnation or range-bound movement. These hurdles can frustrate traders by creating choppy conditions, often triggering stop-losses and trapping those who trade without patience or precision.

In this article, we’ll explore how to develop an effective daily bias, how to identify consolidation hurdles and strategies for trading around these market phases with confidence.

What is Daily Bias?

A daily bias is the expected direction or trend for the trading day, based on market structure, liquidity, and key levels. Having a daily bias allows traders to align their trades with smart money flow, improving the likelihood of entering high-probability setups. However, the daily bias does not guarantee straightforward price movement—markets often oscillate between consolidations and trending phases before reaching liquidity targets.

Developing a daily bias involves understanding how different trading sessions influence market direction and spotting signs of institutional intent.

How to Develop a Daily Bias

Below are the steps to build an accurate daily bias using ICT principles.

1. Start with Higher Timeframes for Context

- Use the 4-hour or daily chart to determine the broader market trend. Are we seeing higher highs and higher lows (bullish bias) or lower highs and lower lows (bearish bias)?

- Identify order blocks, liquidity zones, and fair value gaps (FVGs) on these higher timeframes—these levels provide the foundation for the day’s expected movement.

2. Identify Key Session Levels

- Mark the previous day’s high and low, as these are significant liquidity points that institutions often target.

- Use the Asian session’s high and low to create a range—if these levels are broken during the London or New York session, it can signal a potential continuation or reversal.

3. Monitor Market Structure Shifts (MSS)

- A market structure shift (MSS) on the lower timeframes, such as the 15-minute chart, can signal that the market is aligning with the expected daily bias.

- If the bias is bullish, look for breaks of recent highs; if bearish, watch for breaks of recent lows.

4. Wait for the London and New York Session Confirmation

- Confirm the daily bias during the London open (7:00 AM GMT) or New York open (12:00 PM GMT). These sessions provide the liquidity needed to drive the market in the intended direction.

What Are Consolidation Hurdles?

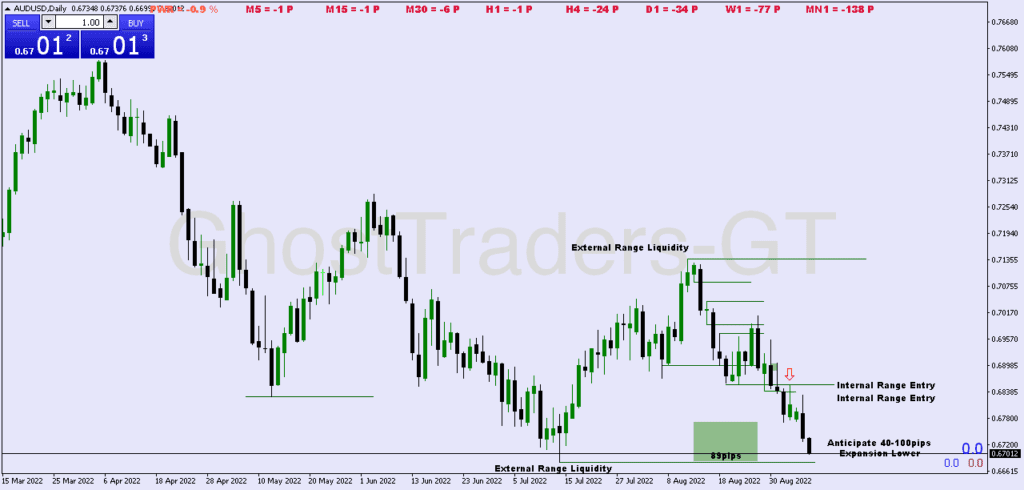

Even with a clear daily bias, the market often encounters consolidation hurdles—periods when price becomes range-bound and fails to move decisively in either direction. These hurdles occur as institutions accumulate or distribute orders, waiting for the right moment to push the market forward.

Consolidation hurdles can trap retail traders who expect immediate breakouts or trend continuations. Choppy conditions can lead to whipsaw movements, triggering stop-losses and forcing early exits before the real move unfolds.

How to Identify Consolidation Hurdles

- Range-Bound Price Action

- When price oscillates between a clear support and resistance level without showing directional intent, a consolidation hurdle is likely in place.

- This range is often established during the Asian session and extends into the London session before a breakout occurs.

- Low Volume and Narrow Candles

- Consolidation hurdles are often accompanied by narrow candles with low volatility. These periods indicate that institutions are accumulating or distributing positions quietly.

- Failed Breakouts and Whipsaws

- Be cautious of false breakouts during consolidation phases—price may breach the range temporarily before reversing sharply to trap retail traders.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

How to Trade Around Consolidation Hurdles

Trading through consolidation hurdles requires patience, discipline, and a focus on liquidity zones. Below are strategies for managing trades during these phases.

1. Wait for a Liquidity Grab

Consolidation hurdles often precede liquidity grabs, where price sweeps the range of highs or lows before reversing. This is a classic smart money tactic to trigger stop-losses and build liquidity for the real move.

How to Trade It:

- Identify the Range: Mark the highs and lows of the consolidation range.

- Wait for the Liquidity Grab: Avoid trading the initial breakout—wait for price to sweep one side of the range and reverse.

- Enter on the Reversal: Use engulfing candles or pin bars to confirm the reversal, then enter the trade in the direction of the daily bias.

2. Trade the Retest After the Breakout

Once price breaks out of the consolidation range, institutions often retest the broken level before continuing the move. This retest provides a second chance to enter the trade in the trend’s direction.

How to Trade It:

- Identify the Breakout: Monitor the London or New York session for a decisive breakout beyond the consolidation range.

- Wait for the Retest: Enter the trade when price pulls back to the broken level or an order block formed during the breakout.

- Set Stop-Loss and Profit Target: Place the stop-loss just inside the range and aim for the next liquidity pool as your target.

3. Avoid Overtrading Consolidation Phases

One of the biggest challenges during consolidation hurdles is overtrading. Many traders get frustrated with choppy conditions and take multiple trades, only to be stopped repeatedly.

How to Manage It:

- Limit the number of trades during consolidation phases—focus on high-probability setups only.

- Use smaller position sizes to manage risk, as consolidations often lead to unpredictable price movements.

Tips

- Patience is Key: Wait for confirmation from liquidity grabs or retests before entering trades—don’t rush into positions during consolidation.

- Use Session Timing to Your Advantage: Focus on the London and New York session opens, as these periods provide the liquidity needed to break consolidation hurdles.

- Manage Risk Carefully: Use tight stop-losses during consolidations and reduce position sizes if the market becomes choppy.

- Stay Aligned with the Higher Timeframe Trend: Always trade in the direction of the higher timeframe trend to increase the probability of success.

Conclusion

Mastering daily bias and consolidation hurdles is essential for trading with precision in the Forex market. Developing a daily bias allows traders to align with institutional flows while understanding how to navigate consolidation phases and prevent unnecessary losses.

By focusing on liquidity grabs, retests, and smart money tactics, traders can avoid common pitfalls and capitalize on high-probability setups. With patience, discipline, and a focus on session timing, you’ll be able to trade confidently through consolidations and profit from the trends that follow.