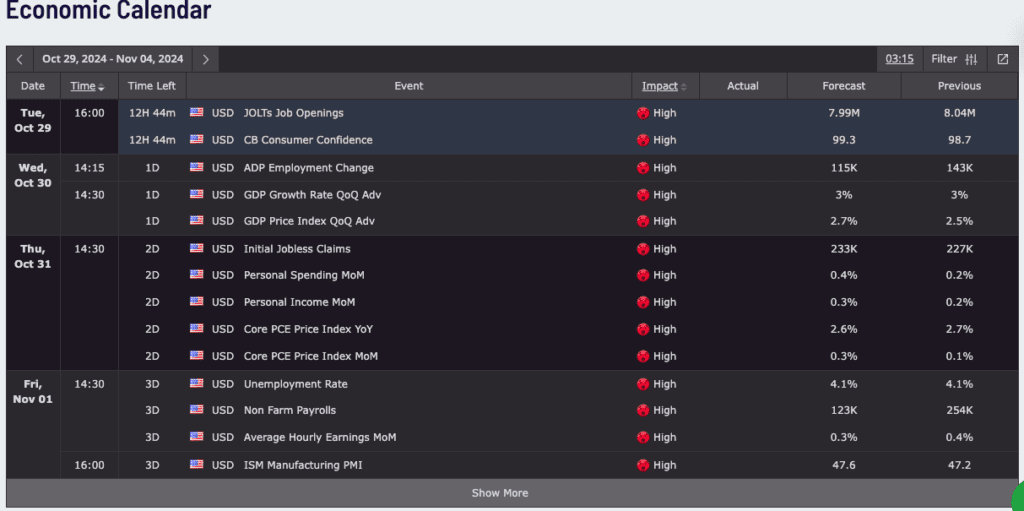

In smart money trading, FOMC (Federal Open Market Committee) meetings and NFP (Non-Farm Payrolls) reports are two of the most important economic events that cause significant market volatility. These events provide institutional traders with liquidity, allowing them to execute large orders while retail traders often get caught on the wrong side of sharp price movements. understanding how to navigate the price action around these key events is crucial for profiting from institutional moves rather than falling victim to market manipulation.

This article will explore how to trade around FOMC and NFP announcements, how institutions use these events to manipulate liquidity, and how you can position yourself to trade with smart money.

What is the FOMC and Why is it Important?

The FOMC (Federal Open Market Committee) is the policy-making body of the U.S. Federal Reserve that meets to decide the direction of monetary policy. The outcomes of these meetings, particularly decisions about interest rates, have a direct impact on the strength of the U.S. dollar and can move global financial markets.

When the FOMC releases its policy statement—which can include rate hikes, cuts, or plans to maintain current rates—it often leads to sharp price movements in the Forex market, especially in USD-related currency pairs. However, before and after these announcements, institutions engage in liquidity hunts, trapping retail traders in false moves before the real trend is established.

What is the NFP and Why is it Important?

The NFP (Non-Farm Payrolls) report is a key indicator of employment health in the U.S. economy. Released on the first Friday of each month, the report measures the number of jobs added (or lost) in the previous month, excluding the farming industry. Because employment levels are closely tied to economic strength, the NFP report significantly impacts market sentiment, particularly for USD-related pairs, stocks, and commodities like gold.

NFP releases often create high volatility, as institutions take advantage of the influx of retail orders placed around these announcements. The NFP can cause large price spikes or fakeouts, which are typically followed by reversal moves or sustained trends.

How Institutions Manipulate Liquidity Around FOMC and NFP Events

Both FOMC and NFP events provide opportunities for institutions to generate liquidity. Before these announcements, price often consolidates, as institutions wait to release critical information. Once the data is released, the market reacts with sharp movements, often reversing shortly after to trap retail traders who chase the initial breakout.

Liquidity Hunts and Stop Runs

- Pre-Event Consolidation: Institutions accumulate positions during periods of low volatility before the FOMC or NFP release. This consolidation phase allows them to prepare for large moves.

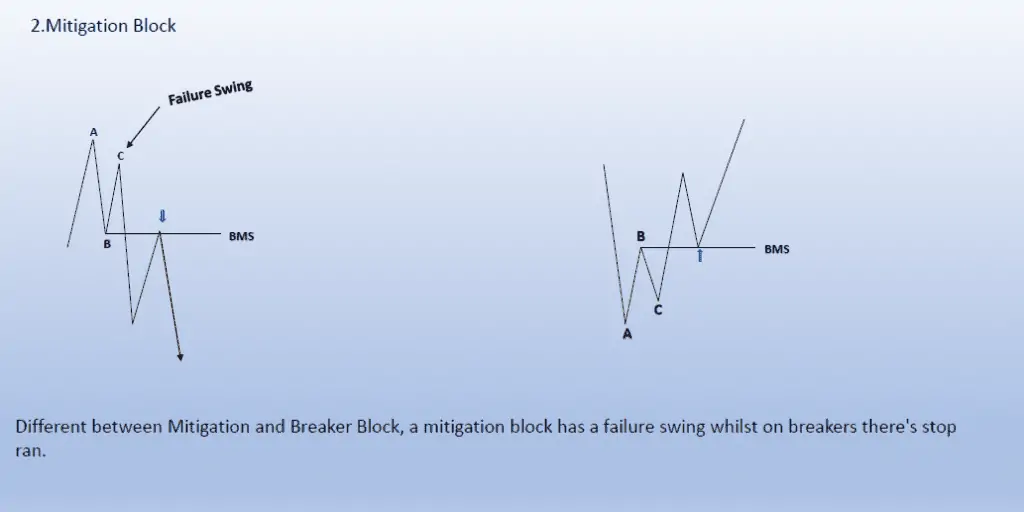

- Initial Fakeout: After the release, price may spike in one direction, only to reverse soon after. This fakeout traps retail traders who enter too early.

- Liquidity Grab: As price moves sharply, it often triggers stop-loss orders, creating liquidity for institutions to place their larger trades.

By understanding these patterns, you can anticipate the manipulation tactics used by institutions and position yourself for the real move after the liquidity grab.

Trading Strategies for FOMC and NFP Events

Here are some key strategies based on ICT principles for navigating the volatile price action around FOMC and NFP releases.

1. Pre-Event Setup and Liquidity Zone Identification

Before the FOMC or NFP release, the market often consolidates in anticipation of the announcement. During this time, it’s essential to identify key liquidity zones—areas where stop-losses are likely clustered.

How to Trade It:

- Identify Key Highs and Lows: Mark the recent swing highs and lows on your chart. These levels often serve as liquidity pools that institutions will target during the event.

- Wait for Price to Sweep Liquidity: Avoid entering a trade until the FOMC or NFP announcement has swept one or both of these liquidity zones.

- Enter on the Reversal: Once the liquidity grab is complete and price shows a clear rejection of the false breakout, enter in the opposite direction with confirmation from price action (e.g., pin bars, engulfing candles).

2. Trade the Retest After the News Reaction

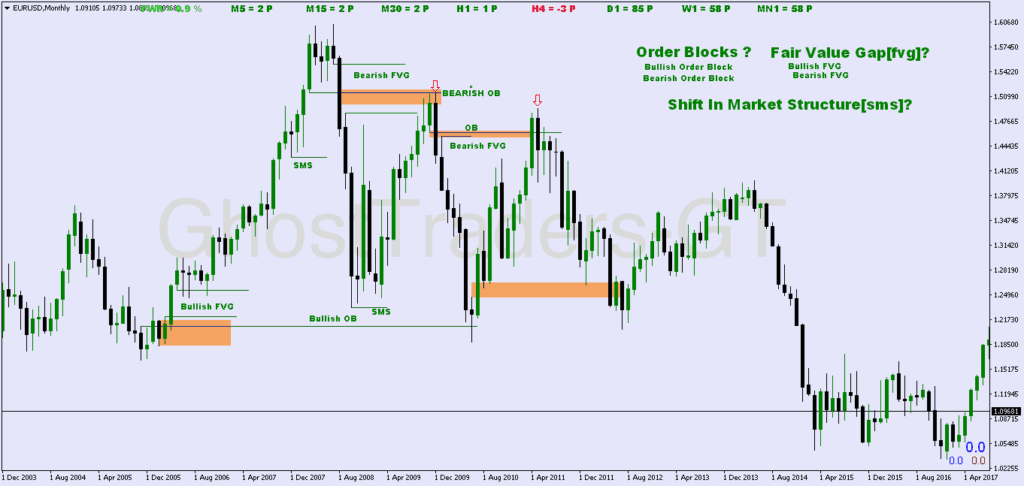

After the initial reaction to the FOMC or NFP report, the market often retests key levels—such as order blocks or fair value gaps—before continuing in the real direction. This strategy helps you avoid being caught in the initial volatility and allows you to enter after the market has stabilized.

How to Trade It:

- Wait for the Initial Reaction: Avoid trading the initial spike. Instead, allow price to make its first impulsive move.

- Identify Key Levels for Retest: Look for order blocks or fair value gaps (FVGs) on higher timeframes (1-hour or 4-hour charts) created during the event.

- Enter on the Retest: Once price revisits these key areas, enter the trade with confirmation of a reversal or continuation move.

- Stop-Loss and Target: Place your stop-loss just beyond the order block or FVG and aim for the next major liquidity zone as your target.

3. Post-Event Trend Continuation

Sometimes, after the FOMC or NFP volatility subsides, the market resumes its long-term trend. This is where trend-following strategies can be particularly effective, as the event acts as a catalyst for the continuation of a previously established trend.

How to Trade It:

- Identify the Long-Term Trend: Use higher timeframes (e.g., daily or 4-hour) to determine the overall trend before the event.

- Wait for Event-Induced Volatility to Settle: Once the initial volatility has calmed, monitor how price reacts at key levels (order blocks, FVGs, or previous highs/lows).

- Enter on a Break of Structure: Look for a market structure shift (MSS) that confirms the trend is resuming. Enter a trade in line with the long-term direction.

- Hold for a Larger Move: Use the next major swing high or low as your take-profit target.

Risk Management During High-Impact Events

Trading around FOMC and NFP releases involves high volatility, which can lead to significant risk if not managed properly. Here are some tips to protect your capital:

- Use Tight Stop-Losses: Due to the sharp movements and reversals, always place tight stop-losses just beyond the swing high/low or the retested order block.

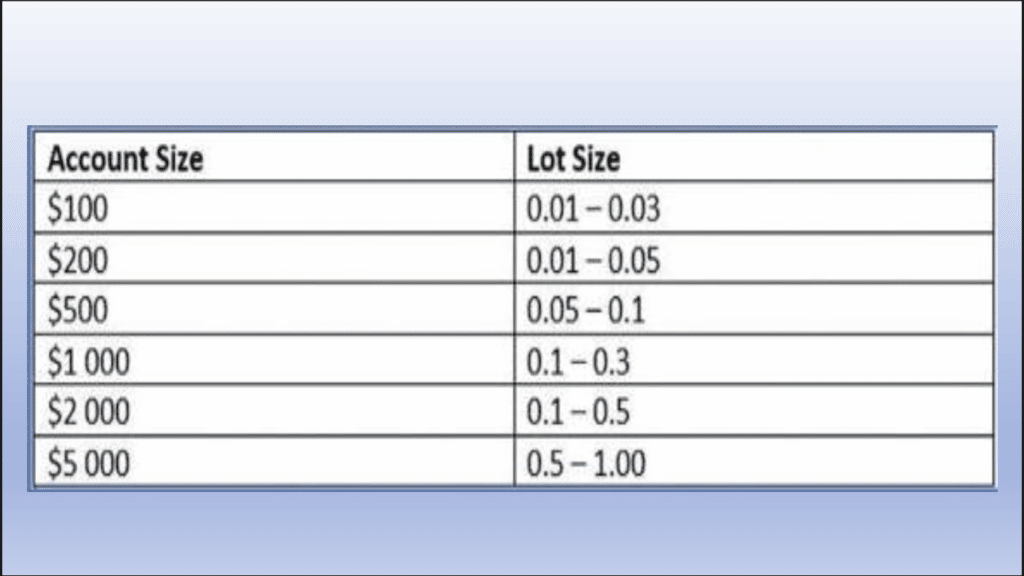

- Reduce Position Size: Trading during high-volatility events means greater price swings. To manage risk, consider reducing your position size while maintaining appropriate stop-loss distances.

- Wait for Confirmation: Never rush into trades based on the initial reaction. Wait for confirmation that the liquidity grab is complete before entering a position.

Conclusion

Thank Both FOMC meetings and NFP reports are high-impact events that offer lucrative opportunities for traders who understand how to navigate the resulting volatility. By using smart money strategies such as identifying liquidity zones, waiting for retests, and aligning with the broader trend, you can profit from these events rather than falling victim to institutional manipulation.

Incorporate these strategies into your trading plan, manage your risk carefully, and practice patience. With time and experience, trading around FOMC and NFP releases can become a powerful addition to your trading arsenal.