In financial markets, retail traders often get trapped by reacting to surface-level price movements. Institutions, hedge funds, and banks, however, approach the market with a completely different mindset. Instead of chasing impulsive moves, institutional traders manipulate liquidity, accumulate positions, and align their trades with market inefficiencies. As a trader, learning to view price through institutional perception is essential for capturing high-probability setups and avoiding retail traps.

This article explores how to shift your mindset to see price as institutions do, using concepts such as liquidity, order flow, and market manipulation. It also offers practical strategies to align your trades with institutional activity, helping you trade with smart money, not against it.

The Institutional View of the Market

Institutions control the vast majority of market liquidity. Their objective is to accumulate and distribute large orders without creating obvious price shifts that reveal their intent. To accomplish this, they manipulate liquidity zones, induce false breakouts, and trigger stop-loss orders placed by retail traders.

The institutional perception of the market revolves around three key principles:

- Liquidity Hunting: Institutions seek liquidity pools (clusters of retail stop-losses) to enter or exit large positions.

- Order Flow Management: Institutions move price in phases, accumulating and distributing orders across key levels.

- Price Inefficiencies: Gaps, fair value imbalances, and liquidity voids are targeted for rebalancing before the next move.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

Key Concepts for Viewing Price with Institutional Perception

1. Liquidity Pools and Smart Money Manipulation

From the institutional perspective, price is drawn to liquidity pools like a magnet. Liquidity pools consist of stop-loss orders and pending orders placed by retail traders near swing highs, swing lows, or key psychological levels.

- Highs and Lows: Institutions often manipulate price to break these levels temporarily, collecting liquidity before reversing.

- Accumulation and Distribution Zones: Institutions use consolidation phases to quietly accumulate or distribute large orders, before initiating sharp moves.

How to Trade It:

- Mark key highs and lows from the previous session or week. Watch for liquidity grabs (stop hunts) around these levels, which signal the start of institutional moves.

- Avoid breakout trades unless confirmed by a retest. Institutions often engineer false breakouts to trap retail traders.

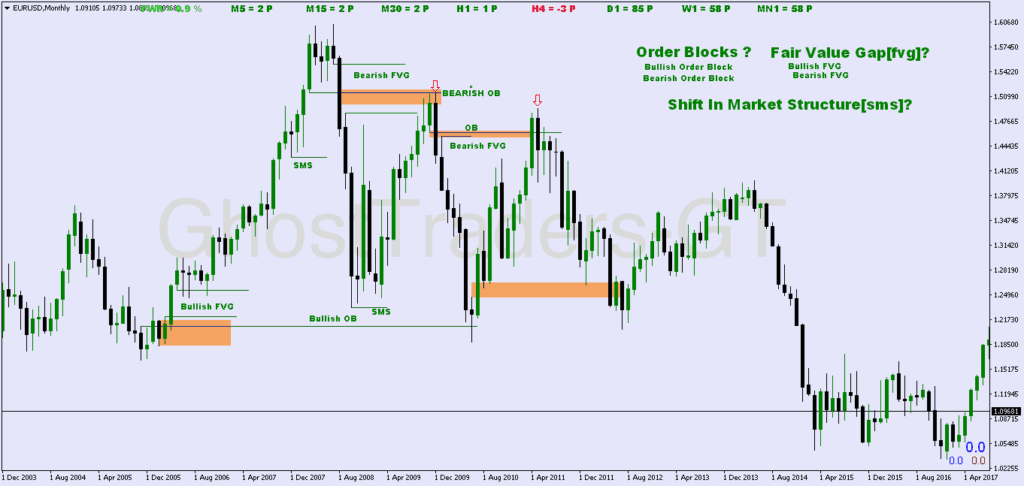

2. Order Blocks: Institutional Areas of Interest

An order block is a price zone where institutions have previously entered large buy or sell orders, creating a significant market move. These blocks serve as support or resistance levels where price is likely to react during a revisit.

- Bullish Order Block: A down candle before an upward move. This zone serves as support if price retraces.

- Bearish Order Block: An up candle before a downward move, acting as resistance when revisited.

How to Trade It:

- Wait for price to revisit the order block. Use candlestick patterns like pin bars or engulfing candles for confirmation before entering.

- Place stop-losses beyond the order block boundary to protect against manipulation.

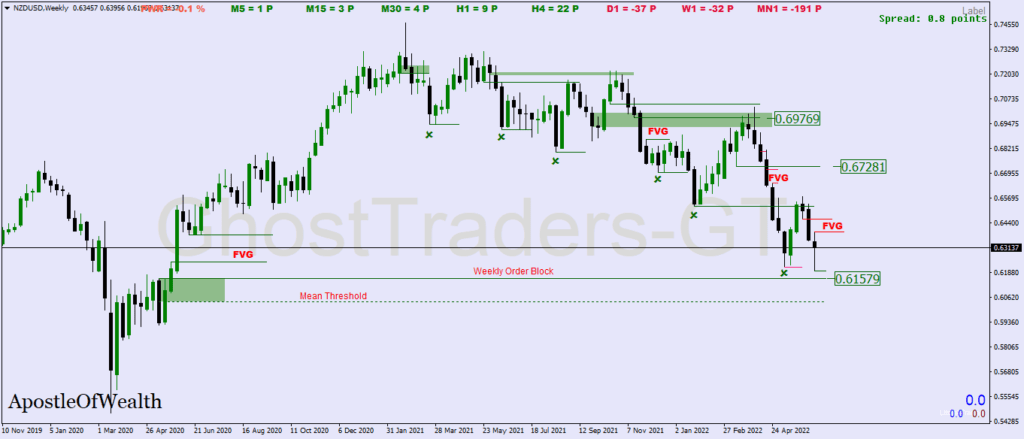

3. Fair Value Gaps (FVGs) and Rebalancing

When institutions move the market rapidly, they leave behind price inefficiencies in the form of Fair Value Gaps (FVGs). An FVG is an area where price action moved so quickly that there was little to no liquidity traded at intermediate levels.

- Rebalancing: Price tends to revisit these gaps to rebalance liquidity before continuing in the original direction.

How to Trade It:

- Identify FVGs on higher timeframes (e.g., 4-hour or daily).

- Wait for price to fill the gap and align with the broader trend before entering a trade.

4. Market Structure Shifts (MSS) and Institutional Intent

Institutions use market structure shifts to reveal changes in their positioning. A shift in market structure occurs when price breaks a key swing high or low, signaling that institutions are switching from accumulation to distribution—or vice versa.

- Bullish MSS: Price breaks above a swing high, indicating a shift from bearish to bullish sentiment.

- Bearish MSS: Price breaks below a swing low, signaling a shift from bullish to bearish sentiment.

How to Trade It:

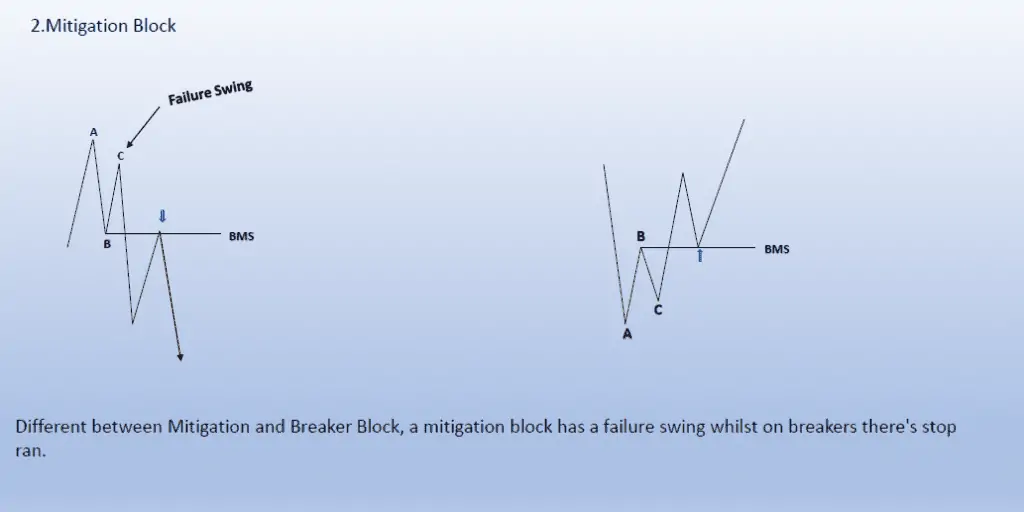

- Use market structure shifts as confirmation for order block retests.

- Look for breaker blocks to form after a structural break, providing additional confluence.

5. Session Timings and Kill Zones

Institutions are most active during specific market sessions, such as the London and New York sessions. These sessions provide the liquidity needed to execute large orders efficiently. The kill zones—specific windows within these sessions—often coincide with institutional moves.

- London Kill Zone (7:00 AM – 10:00 AM GMT): Watch for false breakouts and liquidity grabs during the session open.

- New York Kill Zone (12:00 PM – 3:00 PM GMT): Look for retracements into order blocks formed during the London session.

How to Trade It:

- Align trades with session timing. Use kill zones to spot liquidity hunts and market structure shifts that confirm institutional intent.

Common Mistakes When Adopting Institutional Perception

- Ignoring Market Context:

- Always analyze the broader trend and higher timeframes to confirm your bias.

- Overtrading Liquidity Grabs:

- Not every liquidity hunt will result in a reversal. Look for confluence with other smart money concepts before entering.

- Trading Without Confirmation:

- Avoid impulsive trades. Wait for market structure shifts or price action signals before executing.

Conclusion

Learning to view price through the lens of institutional perception allows traders to anticipate liquidity hunts, align with order flow, and avoid retail traps. By focusing on liquidity pools, order blocks, fair value gaps, and market structure shifts, you can position yourself alongside smart money, significantly improving your precision and profitability.

Incorporate these concepts into your trading strategy, align your trades with session timings and kill zones, and practice patience. With consistent effort, you’ll develop the ability to interpret price action as institutions do, giving you a powerful edge in the market.