Markets are dynamic, and understanding how institutional players move price with precision is essential for smart money traders. Two advanced tools in this realm are breakaway gaps and redelivered rebalanced PD arrays. These elements reveal how smart money creates price imbalances and uses them to control market structure.

In this article, we’ll explore these concepts in detail, providing actionable strategies for identifying and trading breakaway gaps and rebalanced PD arrays.

What is a Breakaway Gap?

breakaway gaps occur when price opens significantly above or below the previous trading range, bypassing intermediate levels. This type of gap is a sign that smart money or institutional traders are aggressively positioning for a new trend. It signifies a shift in sentiment and typically marks the beginning of a new trend or the continuation of a major move.

Characteristics of a Breakaway Gap:

- Occurs During Key Sessions:

Breakaway gaps often occur at the opening of major sessions, such as in London or New York, when institutional traders execute large orders. - Leaves an Imbalance:

The gap represents a price imbalance, meaning price skipped certain levels without trading activity, leaving liquidity unfilled. - Confirms Trend Shift:

Breakaway gaps signal a structural shift. If price gaps are above resistance or below support, it confirms a break in market structure (BOS) and indicates smart money involvement.

How to Identify and Trade Breakaway Gaps:

Step 1: Identify the Gap Zone

- Look for sudden price gaps above resistance or below support, leaving no price activity between the previous close and the new open.

- Mark the high and low of the gap as it often acts as a short-term liquidity zone.

Step 2: Trade the Retest of the Gap

- After the gap forms, wait for a retest of the gap area. This often provides an entry point if price respects the gap zone and reverses.

- If the market respects the breakaway gap, it shows institutional interest, making it a high-probability setup.

Step 3: Place Stop-Loss and Targets

- Place your stop-loss just beyond the gap zone to protect against further manipulation.

- Target the next key level in the direction of the gap (e.g., previous highs/lows or Fibonacci extensions).

What is a Redelivered, Rebalanced PD Array?

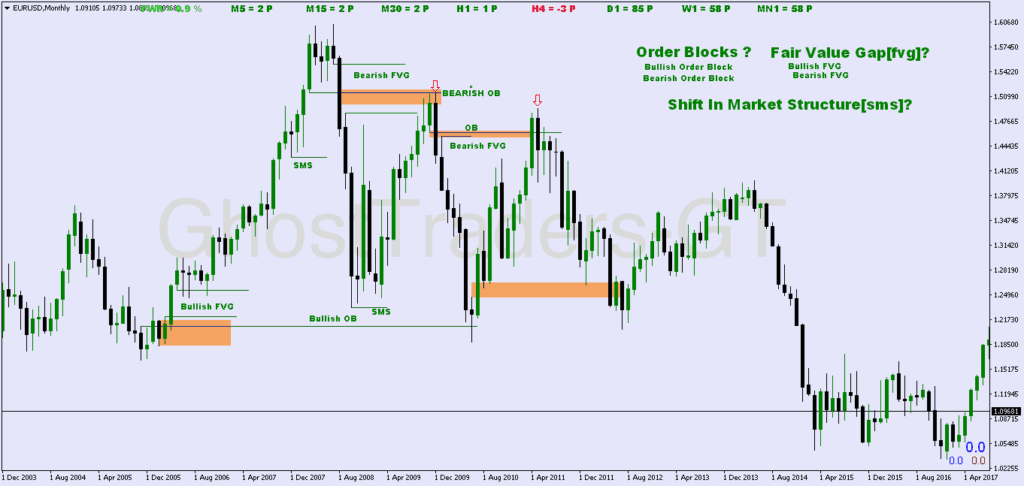

A PD (Price Delivery) Array refers to a structured sequence of price action elements—such as order blocks, fair value gaps (FVGs), or liquidity zones—that guide institutional price movement. Redelivered and rebalanced PD arrays occur when the market returns to previously inefficient zones to fill gaps, rebalance liquidity, or resolve price imbalances. This process reflects how smart money maintains price equilibrium while controlling market structure.

Components of PD Arrays:

- Order Blocks:

Zones where institutions accumulate or distribute positions. - Fair Value Gaps (FVGs):

Price gaps are created by institutional orders that leave inefficiencies. - Liquidity Pools:

Areas with a high concentration of stop-loss orders are targeted for liquidity grabs.

How Redelivery and Rebalancing Work in PD Arrays

When institutions cause imbalances by pushing the market in one direction, they will often redeliver price to previously skipped areas to restore equilibrium. This rebalancing occurs when price revisits fair value gaps, mitigates order blocks, or fills liquidity voids.

How to Identify and Trade Redelivered, Rebalanced PD Arrays:

Step 1: Spot the Imbalance

- Identify zones where price moved quickly, leaving behind gaps or inefficiencies (e.g., FVGs or liquidity voids).

- Mark key order blocks that weren’t retested immediately, as these areas are likely to act as magnets for future price action.

Step 2: Wait for Redelivery

- When price revisits the area of imbalance, this is the redelivery phase. The market returns to fill the gap or mitigate an order block, offering an entry point.

- If the market respects the PD array on the revisit, it confirms institutional activity and provides a high-probability trade.

Step 3: Trade the Rebalance

- Once price rebalances by filling the gap or testing the order block, it often resumes its original trend. Enter the trade after confirmation.

- Use price action signals such as pin bars or engulfing patterns to confirm the reversal or continuation.

Combining Breakaway Gaps and PD Arrays in Trading

The most effective trades come when breakaway gaps and PD arrays align. When a breakaway gap leaves behind a fair value gap or skips over an order block, you can expect price to redeliver to that area later to rebalance.

Example Setup:

- Breakaway Gap Forms: Price opens with a gap above resistance, signaling a bullish trend.

- Fair Value Gap Left Below: The gap leaves a small FVG in the previous consolidation area.

- Redelivery and Rebalance: After the initial rally, price retraces to fill the FVG, offering an entry point aligned with the original trend.

Risk Management for Breakaway Gaps and PD Arrays

Even with high-probability setups, effective risk management is essential. Here are some tips for managing risk when trading breakaway gaps and PD arrays:

- Use Tight Stop-Losses:

Place stop-losses just beyond the gap or PD array to limit risk. - Follow the Trend:

Align your trades with the larger trend to improve your probability of success. - Scale-Out of Positions:

Take partial profits at key levels to lock in gains while keeping a portion of your trade open for larger moves.

Common Mistakes to Avoid

- Chasing Gaps Without Confirmation:

Always wait for a retest or confirmation before entering a trade based on a breakaway gap or PD array. - Ignoring Market Structure:

Make sure your trades align with the overall market structure. Trading against the trend can result in losses, even with good setups. - Overtrading PD Arrays:

Not every revisit to a PD array will result in a profitable trade. Be selective and wait for price action confirmation before committing to a trade.

Conclusion

Understanding and trading breakaway gaps and redelivered rebalanced PD arrays gives traders a powerful edge in the market. These concepts reflect how institutional players move price and manage liquidity to create profitable opportunities for those who know how to identify and trade them effectively.

By mastering these techniques, you can align with smart money flows, avoid retail traps, and improve your trading performance. Use gaps to identify trend shifts and PD arrays to capture rebalancing moves, and always follow proper risk management strategies to protect your capital.