A vacuum block is an advanced trading concept that aligns with smart money strategies, focusing on how price behaves when it leaves behind gaps or imbalances. These vacuum blocks represent areas of inefficient price action that the market is likely to revisit. For traders who understand how to recognize and use them, vacuum blocks offer high-probability opportunities to enter trades with minimal risk while aligning with institutional order flow.

In this article, we’ll explore what a vacuum block is, how it forms, and how to trade it effectively by anticipating price corrections and reversals caused by institutional rebalancing.

What is a Vacuum Block?

A vacuum block refers to a zone in the market where price has moved too quickly, leaving behind a void or inefficiency. These areas typically form when institutional traders enter the market with large orders, causing price to move sharply without filling intermediate liquidity along the way. Because these imbalances are unsustainable, the market often returns to these vacuum blocks to rebalance price, creating an opportunity for traders to enter in line with the original trend.

Key Characteristics of a Vacuum Block:

- Sharp Price Movement: A vacuum block is formed by a fast, aggressive price move, leaving behind minimal or no trading activity at intermediate levels.

- Imbalance or Gap: The sharp move creates an inefficiency—an area where buyers or sellers are unable to engage, leaving a liquidity gap.

- Revisit for Rebalancing: The market will often return to the vacuum block later to mitigate the inefficiency, providing an opportunity for low-risk entries.

How Vacuum Blocks Form

Vacuum blocks typically occur during periods of high volatility or when institutional traders aggressively push the market in one direction. These scenarios often involve economic news releases, market opens (e.g., the London or New York sessions), or stop-hunts designed to capture liquidity.

- Institutional Aggression: Large institutions execute big trades, moving the market sharply and creating a liquidity gap.

- Price Void: The rapid move leaves a vacuum in the order flow, meaning price didn’t engage with all potential buyers or sellers along the way.

- Future Rebalancing: Since these gaps disrupt price equilibrium, the market tends to revisit and fill the vacuum block before continuing in the original direction.

How to Identify Vacuum Blocks on a Chart

Recognizing a vacuum block on the chart involves spotting sharp, impulsive price movements that leave behind untested zones. Here’s how to find them:

- Look for Rapid Impulsive Moves: Identify strong price moves (up or down) with little to no pullbacks.

- Mark the Beginning of the Move: The vacuum block typically starts at the first candle of the impulsive move or a consolidation area just before the breakout.

- Check for Gaps or Imbalances: Confirm that the area was left untested, with price skipping over intermediate levels, leaving behind a gap or fair value imbalance.

- Identify Liquidity Pools Below or Above: Look for areas where liquidity pools (e.g., stop-loss orders) might exist. The market is likely to revisit the vacuum block to trigger these stops and rebalance.

How to Trade a Vacuum Block

Trading vacuum blocks involves waiting for the market to return to the block, creating an opportunity to enter a high-probability trade. Here’s a step-by-step guide:

Identify the Vacuum Block

- Spot a sharp price move, marking the area where the move began.

- Use the first candle of the impulsive move or a small consolidation zone as the vacuum block boundary.

- Confirm that price moved rapidly, leaving gaps or skipped areas, indicating a liquidity void.

Wait for the Return to the Vacuum Block

- After the initial sharp move, don’t rush into the trade.

- Wait for price to revisit the vacuum block, as the market tends to correct these imbalances.

- The return to the block signals the start of a rebalancing process where institutions adjust their positions.

Enter on Confirmation

- Look for rejection candles (e.g., pin bars, engulfing patterns) when price reenters the vacuum block.

- Use lower time frames to identify a reversal or continuation pattern at the block.

- Enter the trade in the direction of the original impulsive move, once you see signs that the vacuum is being filled and the trend is resuming.

Manage Risk with Tight Stop-Losses

- Place your stop-loss beyond the boundary of the vacuum block.

- This keeps your risk small and protects you if the block fails to hold as expected.

- Use a 1:2 or 1:3 risk-to-reward ratio to ensure profitability over the long term.

Take Profits at Key Levels

- As the trade progresses, take partial profits at key support or resistance levels.

- Use Fibonacci extensions or nearby liquidity zones as targets.

- If the original move had significant momentum, trail your stop-loss to capture larger moves while locking in profits.

Common Mistakes to Avoid When Trading Vacuum Blocks

- Entering Too Early:

Avoid entering trades immediately after a sharp move. Wait for price to revisit the vacuum block and show signs of reversal before entering. - Ignoring Market Structure:

Always trade in line with the overall market trend. A vacuum block that forms in a bearish market may not hold if you try to trade against the trend. - Poor Risk Management:

Even with high-probability setups, it’s essential to manage risk by placing tight stop-losses and using proper position sizing.

Combining Vacuum Blocks with Other Smart Money Concepts

Vacuum blocks work best when combined with other institutional trading concepts. Here are a few ways to enhance your strategy:

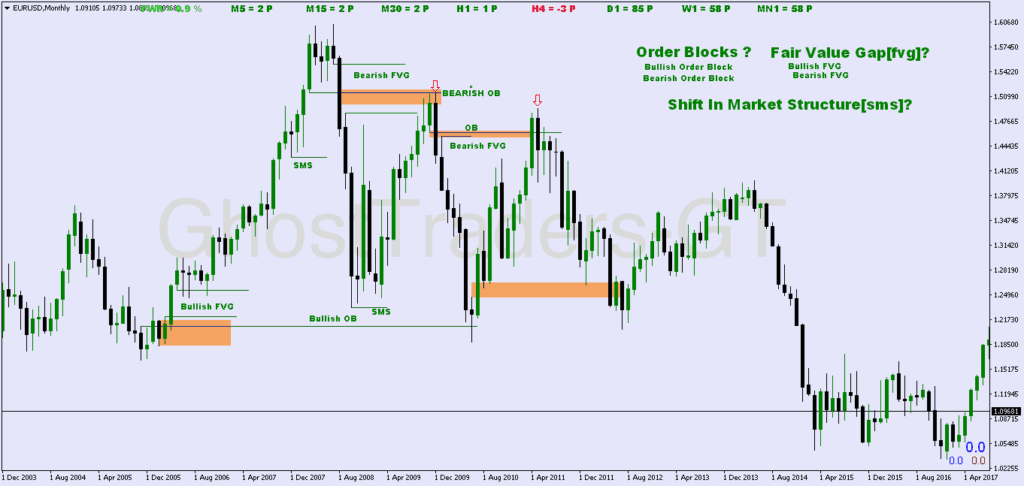

- Order Blocks: If the vacuum block aligns with an order block, it adds confluence to the trade.

- Fair Value Gaps (FVGs): Look for vacuum blocks that overlap with fair value gaps, as price is more likely to rebalance at these levels.

- Market Structure Shifts (MSS): Use vacuum blocks to confirm a shift in market structure, helping you catch early reversals or trend continuations.

Conclusion

Vacuum blocks are an essential tool for traders looking to trade in line with smart money flows. These areas of price inefficiency reveal where the market is likely to return for rebalancing, creating opportunities to enter high-probability trades with minimal risk.

By patiently waiting for the market to revisit these blocks, entering on confirmation, and managing your risk effectively, you can trade with the confidence that comes from understanding institutional behavior. Combining vacuum blocks with other smart money strategies—such as order blocks, fair value gaps, and market structure shifts—further enhances your edge.

With consistent practice, mastering vacuum blocks can significantly improve your trading results, helping you align with institutional order flow and capture precise entries in volatile markets.