In Forex and financial markets, the new week opening gap is a powerful phenomenon that offers insights into institutional order flow and provides traders with profitable opportunities. This concept focuses on the price difference between the previous week’s close and the new week’s opening price. These gaps occur because markets close over the weekend, and institutional traders position themselves based on economic developments or shifts in sentiment that unfold outside of market hours. Understanding how to trade these gaps is essential for aligning with smart money flows and capturing early-week momentum.

This article explores the mechanics of new week opening gaps, explains why they occur, and outlines strategies for trading them effectively.

What is a New Week Opening Gap?

A new week opening gap is the difference between the previous Friday’s closing price and the Sunday or Monday opening price when markets resume trading. Gaps reflect an imbalance between buyers and sellers, often caused by economic developments, geopolitical events, or institutional positioning that occurs while markets are closed.

The size and direction of the gap can offer insight into how institutions are positioned for the week ahead. These gaps act as magnets for price, with the market often attempting to fill the gap before continuing in the prevailing trend.

Types of New Week Opening Gaps

1. Bullish Opening Gap

- Description: The new week opens above the previous week’s close, indicating that buying pressure has built over the weekend.

- Behavior: Institutions may continue buying momentum or allow price to retrace and fill the gap before resuming the trend upward.

2. Bearish Opening Gap

- Description: The new week opens below the previous week’s close, signaling that selling pressure developed over the weekend.

- Behavior: The market may either continue dropping or retrace upward to fill the gap before continuing lower.

3. Neutral or Small Gap

- Description: When the opening price is close to the previous week’s close, it indicates indecision or minimal institutional activity over the weekend.

- Behavior: The market often consolidates or creates a liquidity hunt early in the session before establishing a directional move.

Why Do New Week Gaps Occur?

- Institutional Positioning:

- Large financial institutions adjust their positions based on news events that occur after markets close. These adjustments cause imbalances in price when markets reopen.

- Economic Developments:

- News such as interest rate changes, geopolitical developments, or trade agreements can shift sentiment over the weekend, resulting in a gap at the open.

- Market Sentiment Shift:

- A sudden change in investor sentiment—bullish or bearish—can create an order imbalance that manifests as a gap at the start of the new week.

- Low Liquidity Conditions:

- Because the market opens with limited liquidity on Sunday or Monday, gaps are more likely to occur as even small institutional orders can push price significantly.

How to Identify and Trade New Week Opening Gaps

Step 1: Identify the Gap at the Open

- Compare the previous Friday’s close to the new week’s opening price.

- Mark the high and low of the gap zone—this will serve as key levels for your trading strategy.

Step 2: Determine the Likelihood of a Gap Fill

- Small Gaps: These are more likely to be filled early in the session. Look for quick retracements and gap closures.

- Large Gaps: These often act as signals of strong institutional intent, and while they may eventually be filled, the immediate move may continue in the direction of the gap.

Step 3: Use Price Action for Confirmation

- Look for reversal patterns (e.g., pin bars, engulfing candles) if the market attempts to close the gap.

- If the market respects the gap boundary, it signals that institutions are holding their positions, providing an opportunity for a continuation of trade.

Step 4: Align Trades with Session Timing

- The London open (7:00 AM GMT) is often when the market makes a decisive move. Look for liquidity hunts and attempts to fill or confirm the gap during this time.

- The New York session (12:00 PM GMT) may either reinforce the London trend or cause a reversal.

Trading Strategies for New Week Opening Gaps

Strategy 1: Gap Fill Trade

This strategy focuses on capturing the market’s attempt to fill the gap. In many cases, price returns to close the gap before resuming the original trend.

Steps to Trade the Gap Fill:

- Identify the Direction of the Gap: Mark the high and low of the gap zone.

- Wait for a Retest of the Gap Boundary: Enter the trade once price starts to fill the gap.

- Stop-Loss Placement: Place your stop-loss beyond the opposite side of the gap, in case of further manipulation.

- Target: Set your take-profit target at the previous week’s closing price, completing the gap fill.

Strategy 2: Continuation After the Gap

This strategy assumes that institutional momentum will continue in the direction of the gap. Rather than waiting for a fill, you trade in the direction of the gap’s movement.

Steps to Trade the Continuation:

- Identify the Gap Direction: Mark the opening price and the previous week’s close.

- Enter on the Retest of the Gap Boundary: If price pulls back to retest the boundary but fails to fill the gap, it signals institutional intent to continue the trend.

- Stop-Loss Placement: Set your stop-loss just beyond the retested gap boundary.

- Target: Use the next swing high or low or a Fibonacci extension as your profit target.

Strategy 3: Reversal from a Failed Gap

In some cases, price will attempt to continue in the direction of the gap but fail to hold beyond the gap boundary, creating a reversal opportunity.

Steps to Trade the Reversal:

- Wait for Price to Break and Fail: Monitor if price initially moves in the direction of the gap but reverses sharply.

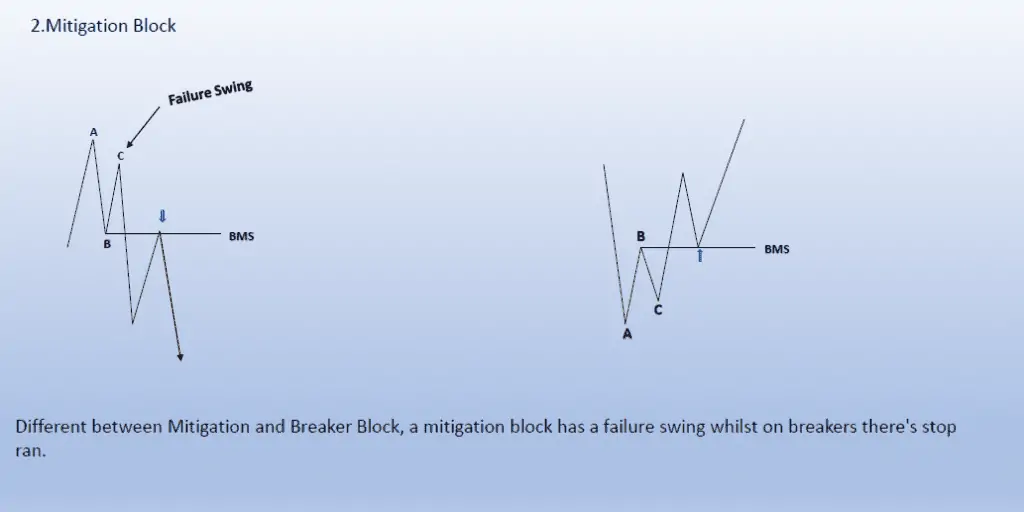

- Enter on Confirmation: Use market structure shifts (MSS) or candlestick patterns to confirm the reversal.

- Stop-Loss Placement: Set your stop-loss just beyond the high or low of the gap.

- Target: Aim for the opposite boundary of the gap or the previous week’s close as your profit target.

Tips for Trading New Week Gaps

- Use Higher Timeframes for Context:

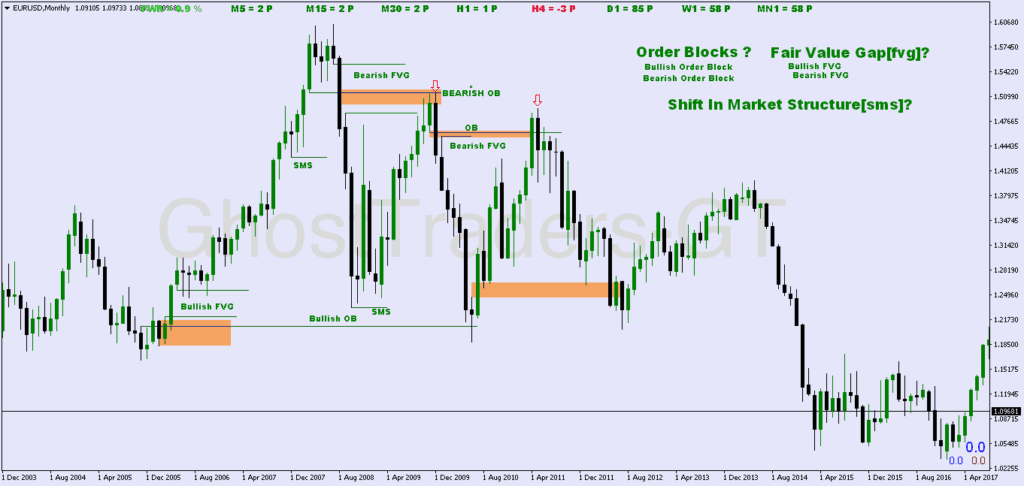

- Analyze the weekly chart to determine the broader trend and bias for the new week.

- Monitor Session Activity:

- Pay close attention to the London and New York sessions, as these are the most likely times for gap fills or reversals.

- Avoid Overtrading:

- Not every gap will provide a valid trade opportunity. Be selective and trade only with confirmation.

- Align with Market Structure:

- Ensure your trades align with the larger trend and market structure shifts for better accuracy.

Conclusion

The new week opening gap offers valuable insights into institutional intent and provides profitable trading opportunities for those who understand how to interpret these gaps. Whether you trade a gap fill, continuation, or reversal, the key is to align your strategy with price action, session timing, and market structure.

By patiently waiting for confirmation and managing your risk effectively, you can take advantage of these gaps and position yourself alongside smart money as the market unfolds throughout the week.