In smart money trading, understanding how price behaves within specific timeframes and seasons is essential to aligning with institutional order flow. Daily rebalancing theory, explores how institutions adjust their positions daily while following broader seasonal trends. By mastering these principles, traders can anticipate shifts in price behavior, align with institutional intent, and take advantage of cyclical movements throughout the year.

This article provides a comprehensive look at daily rebalancing theory and how it fits into the bigger picture of seasonal trends. We will explore the mechanics of intraday rebalancing, how institutions adjust liquidity across the trading day, and how to use seasonal cycles for longer-term opportunities.

What is the Daily Rebalancing Theory?

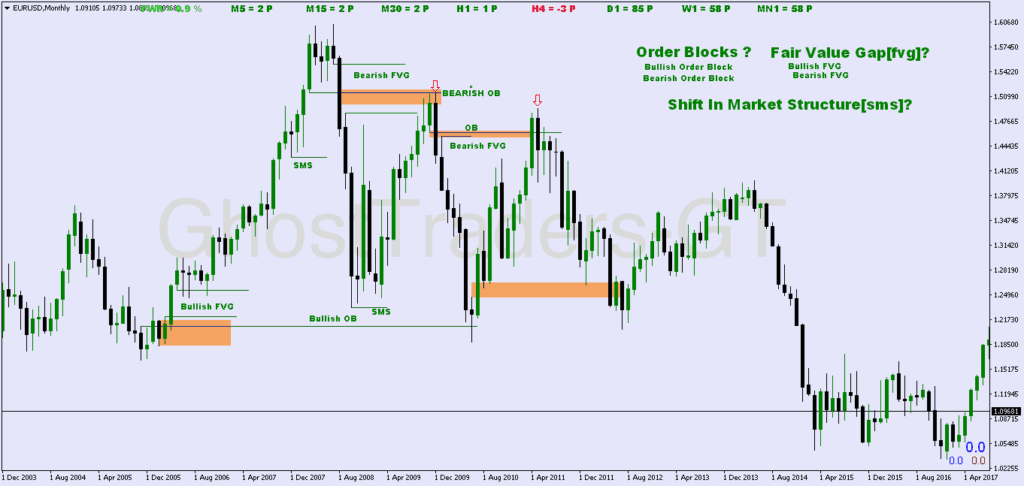

Daily rebalancing theory refers to how institutional traders adjust positions and correct price imbalances within a single trading day. This adjustment aims to rebalance price action toward areas of fair value—zones where supply and demand meet. As the market operates in phases of imbalance (rapid price moves) and equilibrium (consolidation), institutions work to rebalance these inefficiencies over time.

At the seasonal level, institutions also adjust their portfolios in response to recurring cycles, market conditions, and economic shifts, aligning with macro trends that drive quarterly or yearly movements.

How Daily Rebalancing Works

Throughout the trading day, price moves between areas of liquidity and fair value. Rapid price movements often leave behind imbalances (fair value gaps), which the market must correct by returning to unfilled zones. Institutions target these zones to rebalance liquidity and adjust their positions accordingly.

Here’s how the daily rebalancing process unfolds:

- Accumulation Phase: Early in the session (typically during the Asian session), price consolidates as institutions begin accumulating orders quietly.

- Manipulation Phase: During the London or New York opens, liquidity grabs occur, triggering stop-losses and capturing liquidity from retail traders.

- Rebalancing Phase: As price moves throughout the day, it revisits unfilled zones (such as fair value gaps) to restore balance.

- Close-of-Day Adjustment: By the end of the trading day, institutions reposition to ensure their books are balanced and aligned with seasonal trends.

How Seasonal Trends Affect Daily Rebalancing

Beyond the daily adjustments, institutions align their trading activities with seasonal trends. These trends follow cyclical patterns such as quarterly rebalancing, end-of-month flows, and macroeconomic events (e.g., earnings reports or rate hikes). Understanding these seasonal patterns provides traders with an additional layer of confluence.

- Quarterly Adjustments: Institutions rebalance portfolios at the end of each quarter to align with financial targets and economic forecasts.

- Monthly Trends: At the start and end of the month, price tends to spike as institutions close positions or enter new trades for the following month.

- Holiday Seasons: Major holidays (like Christmas or Chinese New Year) can influence market activity, resulting in reduced liquidity or end-of-year portfolio shifts.

Trading Strategies Based on Daily Rebalancing and Seasonal Trends

Below are some strategies that incorporate daily rebalancing theory and seasonal trends to help traders align their trades with institutional activity.

1. Trade with the Daily Bias in Line with Seasonal Cycles

Institutions operate with a daily bias—a directional intent for the day that aligns with broader seasonal flows. Your task is to identify the daily trend early and trade with the bias.

How to Trade It:

- Identify the Daily Bias: Use the London session open to determine whether the market is bullish or bearish for the day.

- Align with the Seasonal Trend: Check if the quarterly or monthly trend is in the same direction.

- Enter on Pullbacks: Use order block retests or fair value gap fills to enter trades in line with the daily bias.

2. Rebalance at Key Sessions (Kill Zones)

Daily rebalancing often occurs at specific times during the London and New York sessions. Institutions target liquidity pools and fair value gaps to adjust their positions.

How to Trade It:

- Watch the Kill Zones: Monitor the London Kill Zone (7:00 AM – 10:00 AM GMT) and New York Kill Zone (12:00 PM – 3:00 PM GMT) for rebalancing moves.

- Look for Liquidity Grabs: Enter trades after a liquidity grab, targeting key session highs or lows.

- Target Fair Value Zones: Use fair value gaps created during earlier sessions as targets for rebalancing trades.

3. Use Seasonal Cycles for Position Trades

While intraday rebalancing occurs daily, seasonal cycles offer excellent opportunities for longer-term trades. Institutions often rebalance portfolios around key events, such as the end of a quarter or yearly earnings reports.

How to Trade It:

- Identify Seasonal Bias: Use the quarterly trend to develop a directional bias.

- Enter During Monthly Rebalances: Look for trade entries around the start or end of the month, where price often realigns with the broader trend.

- Hold for the Seasonal Move: Once the seasonal direction is confirmed, hold the trade for a longer duration to capture the entire move.

Common Mistakes to Avoid

- Ignoring Market Context:

- Always align your trades with the larger trend to avoid being caught in false moves.

- Overtrading Rebalancing Moves:

- Not every session will offer a valid setup. Focus on high-probability trades with confluence from seasonal cycles.

- Misinterpreting the Bias:

- Use multiple timeframes to confirm both the daily and seasonal biases before entering trades.

Conclusion

Understanding daily rebalancing theory and seasonal trends allows traders to align with institutional flows and anticipate market behavior more effectively. By tracking daily price adjustments within the context of quarterly and yearly cycles, traders can enter the market with precision and confidence.

Incorporate these principles into your trading strategy by identifying daily biases, monitoring kill zones, and aligning with seasonal trends. With patience and discipline, this approach will help you stay ahead of the market, trading alongside institutions rather than against them.