The smart money trading framework emphasizes the importance of specific block types that mark institutional footprints. These blocks—such as order blocks, breaker blocks, mitigation blocks, propulsion blocks, and vacuum blocks—are key areas where institutional traders place large orders. Identifying and understanding these blocks provides traders with high-probability entry zones, helping them trade with precision by following institutional flows.

In this article, we’ll explore the various ICT block types, their characteristics, and how to use them effectively in your trading strategy.

1. Order Block

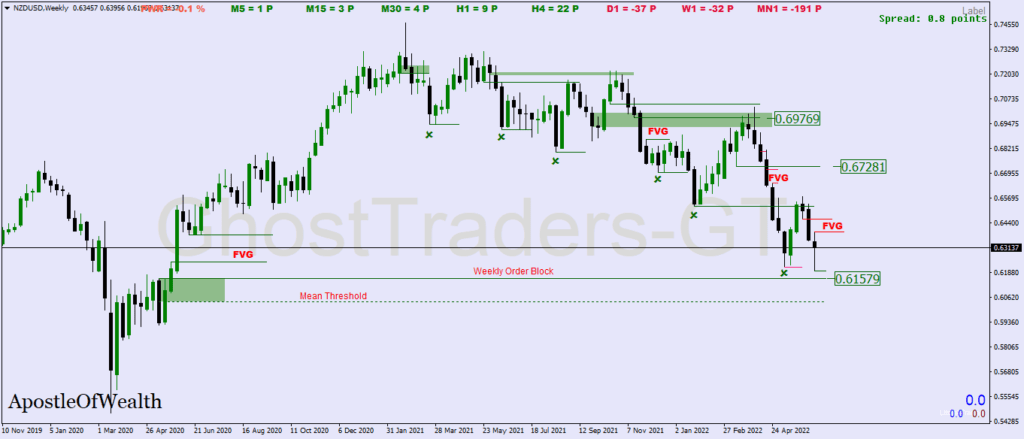

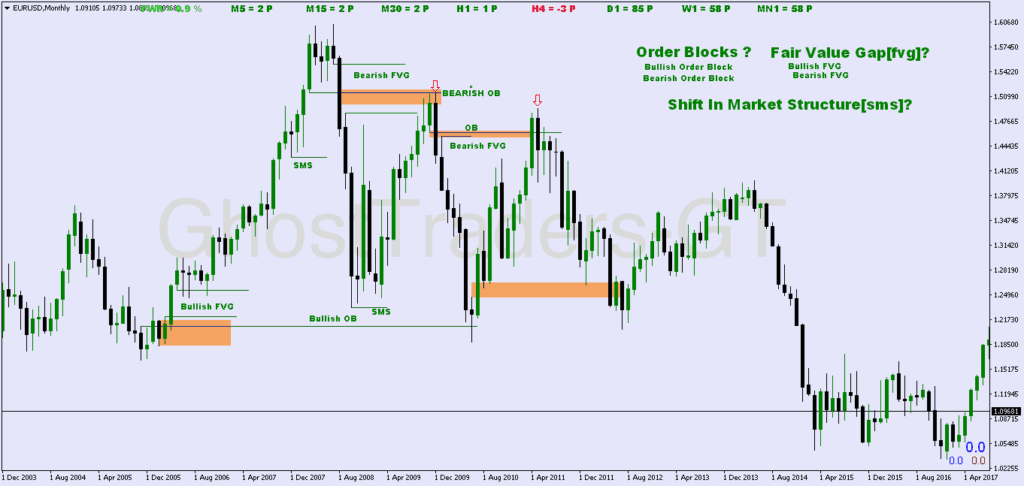

An order block is a consolidation zone where institutions accumulate or distribute positions before making a decisive market move. This block serves as a point of interest for traders, as price often returns to these zones to test the strength of institutional orders.

Characteristics of an Order Block:

- Bullish Order Block: The last down candle before a strong upward move.

- Bearish Order Block: The last up candle before a significant downward move.

- High Impact Zones: Price tends to respect order blocks as future support or resistance.

How to Trade It:

Wait for a retest of the order block and enter a confirmation signal (e.g., a rejection candle or market structure shift). Set your stop-loss beyond the block boundary for tight risk management.

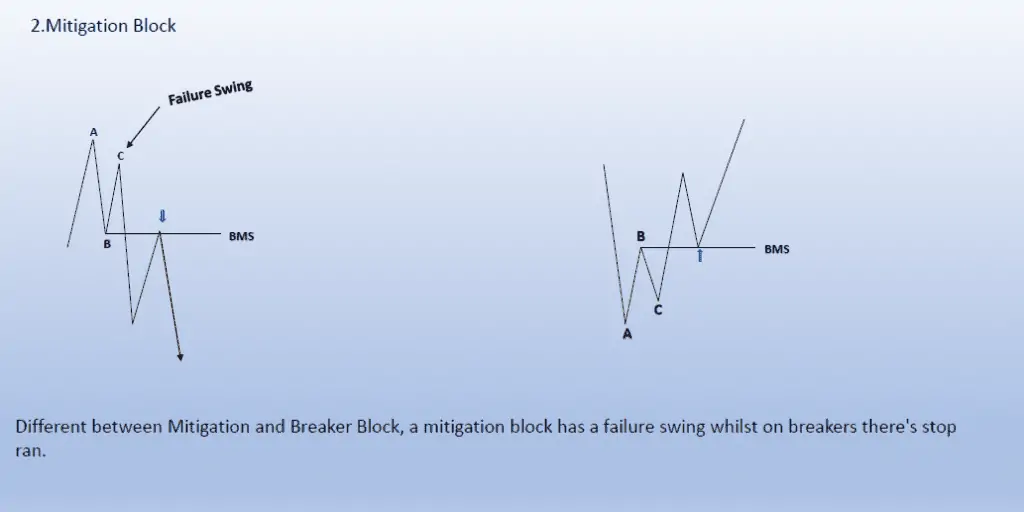

2. Breaker Block

A breaker block forms when price breaks through a key level—such as a recent high or low—and retests that level to confirm a new trend direction. This block traps retail traders who were caught on the wrong side of the market during the break.

Characteristics of a Breaker Block:

- Bullish Breaker Block: Forms when price breaks a resistance level and retests it as support.

- Bearish Breaker Block: Forms when price breaks a support level and retests it as resistance.

- Trap Indicator: It’s often accompanied by a liquidity grab to trap retail traders.

How to Trade It:

Enter after the price retests the breaker block, confirming that smart money is driving the new trend. Use tight stops beyond the breaker zone to protect against further manipulation.

3. Mitigation Block

A mitigation block occurs when the market returns to an order block to correct inefficiencies left behind by an impulsive move. This block allows institutions to finalize unfilled orders or adjust their positions before continuing the original trend.

Characteristics of a Mitigation Block:

- Price Imbalance: Rapid moves create liquidity voids, which price later fills through mitigation.

- Trend Continuation: Mitigation blocks typically align with the prevailing trend.

- Institutional Rebalancing: Institutions use these zones to mitigate earlier trade inefficiencies.

How to Trade It:

Wait for the market to return to the mitigation block. Enter a reversal signal when price respects the block and resumes the trend.

4. Propulsion Block

A propulsion block signals the beginning of a high-momentum move initiated by institutional traders. These blocks indicate where smart money aggressively pushes price in a new direction, leaving little chance for retail traders to enter before the move accelerates.

Characteristics of a Propulsion Block:

- Aggressive Market Shift: The block marks the starting point of a sharp price movement.

- Minimal Retracement: Once price leaves the propulsion block, it tends to continue without immediate retracement.

- Momentum Zones: These blocks often align with major session openings (e.g., London or New York).

How to Trade It:

Enter in the direction of the initial breakout or wait for a retest of the propulsion block to catch the continuation move. Place your stop-loss below the block for a bullish setup or above the block for a bearish one.

5. Vacuum Block

A vacuum block is formed when price moves too quickly, leaving behind unfilled liquidity gaps. These areas represent inefficiencies in the market, and price tends to return to these blocks later to rebalance.

Characteristics of a Vacuum Block:

- Price Inefficiency: Fast price action creates gaps or voids that need to be corrected.

- Rebalancing Move: The market often returns to the vacuum block to fill the liquidity gap.

- Liquidity Zone: Acts as a magnet for future price action.

How to Trade It:

Wait for the price to return to the vacuum block and show signs of rejection or reversal. Enter once confirmation occurs, aiming to capture the rebalancing move.

6. Reclaimed Order Block

A reclaimed order block occurs when price temporarily breaks through a block but returns to respect it later. This move often traps retail traders who think the block has failed, only to see price reverse back into the original trend.

- How It Works: Price fakes a breakout beyond the block, then reclaims it, confirming institutional intent.

- Trap Setup: Retail traders get caught on the wrong side, creating fuel for the institutional move.

How to Trade:

Wait for the reclaim of the order block and enter with confirmation to ride the resumed trend.

How to Use ICT Block Types in Your Trading Strategy

Using ICT block types effectively requires patience, precision, and an understanding of market structure. Below are some tips for incorporating these blocks into your strategy:

- Combine with Market Structure:

Align your trades with the overall trend. Use blocks that fit into the broader market structure shifts or continuation patterns. - Look for Confluence:

Use liquidity pools, fair value gaps (FVGs), and kill zones alongside ICT blocks to confirm your setups. The more elements align, the higher the probability of success. - Use Multi-Timeframe Analysis:

Identify ICT blocks on higher timeframes (daily or 4-hour) and refine your entries on lower timeframes (15-minute or 5-minute). This ensures you trade with the larger trend while optimizing entry points. - Wait for Confirmation:

Never trade a block blindly. Wait for reversal candles or market structure shifts to confirm that the block is being respected. - Practice Patience and Risk Management:

Trading ICT blocks requires discipline. Stick to tight stop-losses just beyond the block boundaries and aim for at least a 1:2 risk-to-reward ratio.

Conclusion

Mastering the different types of blocks—including order blocks, breaker blocks, mitigation blocks, and more—allows traders to stay ahead of institutional moves. Each block type serves a unique role, whether it’s signaling a trend shift, a rebalancing of liquidity, or a continuation of momentum.

Incorporating these blocks into your strategy, along with market structure analysis, confluence factors, and precise entries, will elevate your trading game. With practice and discipline, blocks can become powerful tools that give you the edge needed to trade alongside institutional flows and achieve consistent success in the market.