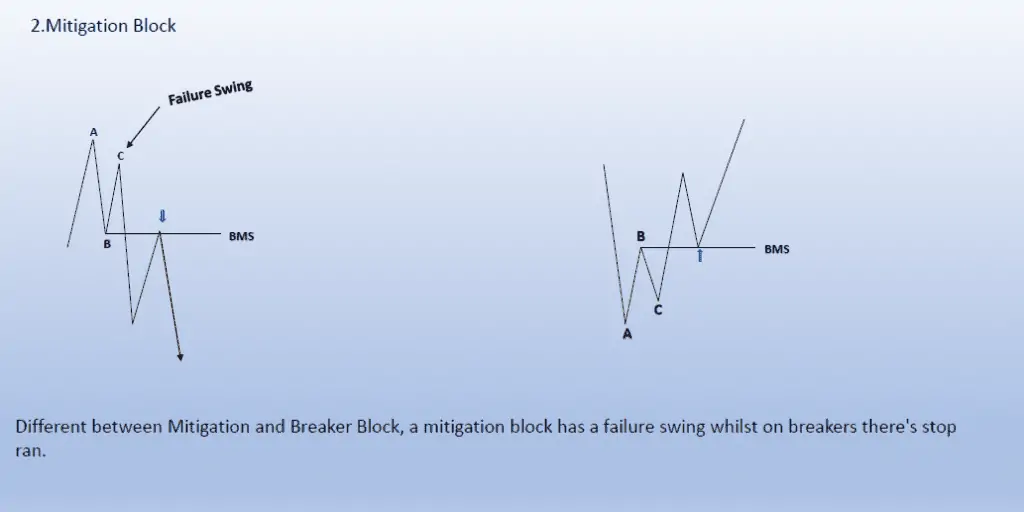

Order block mitigation refers to the process where price revisits an order block to correct inefficiencies or unfilled positions caused by a prior impulsive move. When institutional traders execute large trades, price often moves so quickly that not all orders are filled efficiently, leaving behind imbalances or liquidity voids. To maintain market efficiency, the price tends to revisit these zones, allowing institutions to finalize or adjust their positions.

Why Institutions Mitigate Order Blocks:

- Unfilled Orders: Not all intended positions are filled during the initial move.

- Correcting Imbalances: Rapid moves leave behind price inefficiencies that need to be rebalanced.

- Creating Liquidity: Institutions often trigger a pullback to accumulate more liquidity for future moves.

Mitigation allows smart money to optimize their entries and exits without disrupting market structure, while retail traders who understand this behavior can use it to enter trades with precision.

How Mitigation of the Order Block Works

When price returns to an order block, it is retesting the zone to either fill remaining institutional orders or create a trap for retail traders. Once mitigation is complete, the market typically resumes in the direction of the original trend.

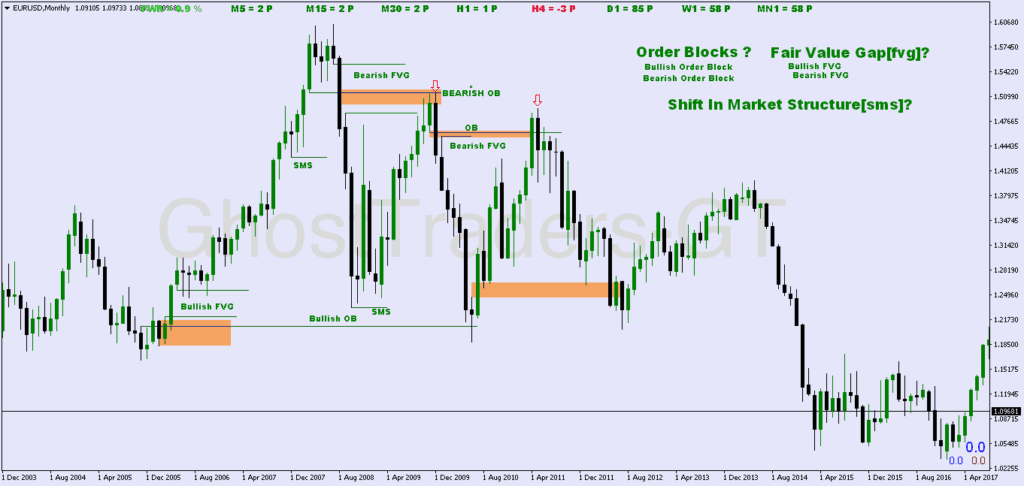

- Initial Move: Institutions initiate an aggressive move, creating an order block.

- Formation of Imbalance: The rapid movement leaves behind a price imbalance, often marked by a fair value gap (FVG).

- Mitigation Pullback: Price returns to the order block to mitigate the imbalance or fill unfilled orders.

- Continuation of the Trend: After mitigation, the market resumes the original trend, allowing traders to enter at a favorable price.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

How to Identify Mitigated Order Blocks on the Chart

Spotting mitigation zones requires attention to price structure and the behavior around order blocks. Follow these steps to identify mitigated order blocks:

Step 1: Identify the Original Order Block

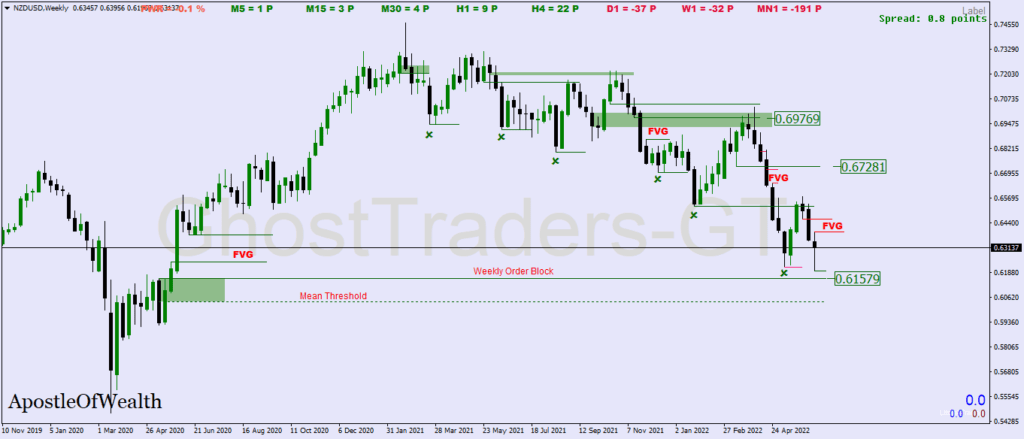

- Look for a consolidation area (bullish or bearish) before a sharp price move.

- A bullish order block is marked by a down candle before an upward surge, and a bearish order block is marked by an up candle before a downward move.

Step 2: Check for Imbalance

- Identify if the sharp price move leaves behind a price imbalance or fair value gap—zones where there was little or no trade activity.

- Mark these areas, as the price is likely to return to fill them during the mitigation process.

Step 3: Wait for Price to Retest the Order Block

- After the initial breakout, watch for a retracement to the order block zone.

- This retest is the mitigation phase, where institutions revisit the zone to complete their positions or rebalance the market.

Step 4: Look for Rejection Patterns

- Once price revisits the order block, look for reversal signals such as pin bars, engulfing candles, or a change in market structure.

- These patterns confirm that mitigation is complete and the trend is ready to resume.

How to Trade Mitigated Order Blocks Effectively

Here’s a step-by-step strategy for trading mitigated order blocks.

Entry Strategy: Trading the Retest of a Mitigated Order Block

- Mark the Original Order Block: Identify the key consolidation zone or candle before the breakout move.

- Wait for the Mitigation Pullback: Let the price retrace to the order block. Avoid entering prematurely—patience is key.

- Enter on Confirmation: Once price reaches the order block, look for confirmation signals (e.g., bullish or bearish rejection candles).

- Place Stop-Loss: Set your stop-loss just beyond the order block boundary to protect against further pullbacks.

- Set Profit Targets: Use key levels such as swing highs/lows or Fibonacci extensions as your take-profit targets.

Key Tips for Trading Mitigation Blocks

- Trade in the Direction of the Trend:

Mitigated order blocks usually align with the original trend, so avoid trading against the larger market structure. - Look for Confluence:

Combine order block mitigation with other factors such as fair value gaps, Fibonacci retracements, or liquidity zones for higher probability setups. - Use Multiple Time Frames:

Identify order blocks on higher time frames (4-hour, daily) for stronger setups, and use lower time frames for precision entries. - Patience is Crucial:

Wait for the price to fully revisit the block and show clear signs of rejection before entering. Entering too early can lead to unnecessary losses.

Common Mistakes to Avoid

- Entering Without Confirmation:

Always wait for a confirmation signal (such as a pin bar or engulfing pattern) to avoid being caught in a false move. - Trading Against the Market Structure:

Avoid trading mitigated order blocks against the overall trend—these setups work best when aligned with institutional momentum. - Ignoring Fair Value Gaps:

Don’t overlook price imbalances. These areas often align with order blocks and increase the probability of a successful trade.

Mitigated Order Block vs. Regular Order Block

| Aspect | Regular Order Block | Mitigated Order Block |

|---|---|---|

| Purpose | Mark initial institutional entry | Corrects imbalances from the original move |

| Price Behavior | Price respects the block immediately | Price revisits the block before continuing |

| Use Case | Used for initial trend setups | Used for re-entries or continuation trades |

| Risk Management | Stop-loss below the block | Stop-loss beyond the mitigated boundary |

Conclusion

Understanding mitigated order blocks provides traders with a deeper insight into how institutions manage their positions and correct market inefficiencies. By identifying these blocks and waiting for price to return and mitigate the imbalance, traders can enter high-probability trades in the direction of the trend with minimal risk.

The key to trading mitigated order blocks lies in patience, confirmation, and alignment with market structure. When combined with other smart money concepts—such as fair value gaps and liquidity pools—this strategy becomes a powerful tool for navigating volatile markets and capturing precise entries.

With practice and discipline, mastering the mitigation of order blocks can significantly enhance your trading performance by helping you anticipate where institutional traders are likely to act and position yourself accordingly.