In financial markets, liquidity is essential for smooth price movement. Institutions need liquidity to place large orders without causing excessive market volatility. As part of the ICT (Inner Circle Trader) methodology, previous-day highs and lows act as critical liquidity pools—zones where institutional traders hunt for orders to fuel the next market move. Understanding how to use these liquidity pools provides traders with insights into market manipulation and high-probability entry points.

This article explores the role of previous day highs and lows as liquidity pools, how to identify these key levels, and how to trade them effectively using ICT principles.

What Are Liquidity Pools?

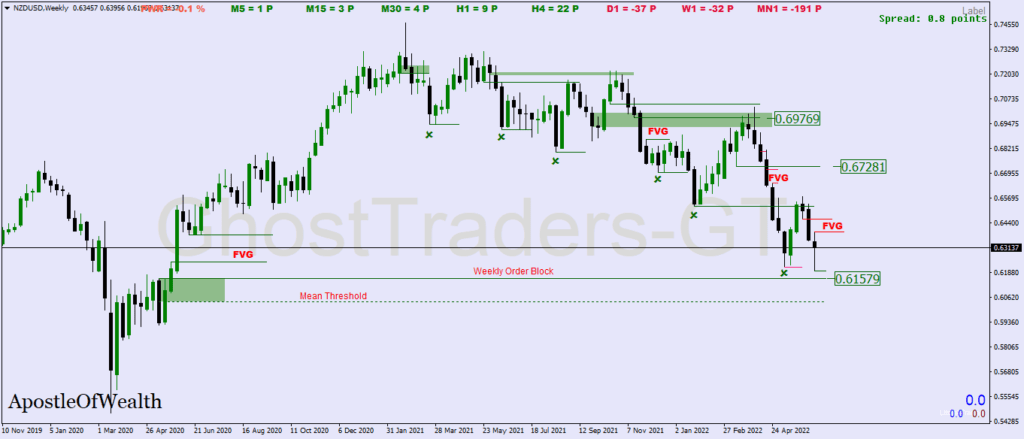

Liquidity pools are areas in the market where a large concentration of orders—both stop-losses and pending orders—accumulates. These pools are often targeted by institutional traders who seek to capture liquidity to fill their large orders. When these pools are breached, price often reverses or accelerates, creating excellent trading opportunities for those aligned with the institutional flow.

Why Previous Day Highs and Lows Act as Liquidity Pools

The highs and lows of the previous trading day are naturally attractive liquidity zones. Many traders place stop-loss orders just above the previous day’s high or just below the previous day’s low, assuming these levels represent strong support or resistance. Institutions, however, know that these areas are ripe for liquidity grabs, and they often push price beyond these levels to trigger stops, generate liquidity, and then reverse the market.

How Institutions Use Previous Day Highs and Lows:

- Stop-Hunts: Institutions push price beyond the previous day’s levels to trigger stop-loss orders placed by retail traders.

- Liquidity Injection: Once the stops are taken out, institutions fill their large orders using the liquidity generated by the stop-hunt.

- Reversal or Continuation: Price either reverses sharply after grabbing liquidity or continues in the direction of the breakout, depending on the broader market context.

Course Bundle

Up To 50% Off

Access all courses with a once-off purchase.

Benefits

How to Identify and Mark Previous Day Highs and Lows

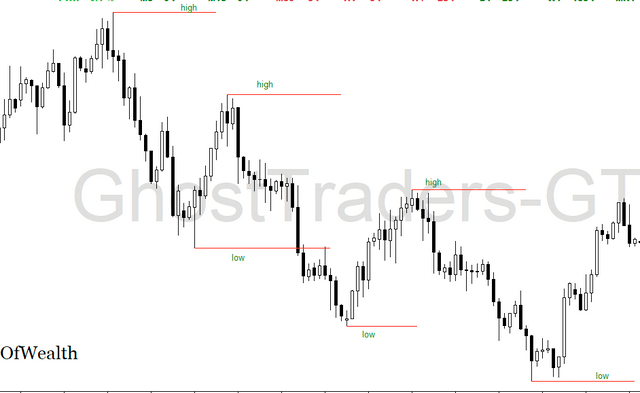

- Mark the Previous Day’s High and Low:

- On your chart, identify the highest point and lowest point of the previous trading day. Use horizontal lines to mark these levels as potential liquidity pools.

- Monitor Price Action Around These Levels:

- As the market approaches these levels during the current session, watch for false breakouts or rejections.

- Align with Session Opens:

- Liquidity hunts often occur during the London and New York sessions, when institutional traders are most active. Keep an eye on how price behaves during these periods.

How to Trade Previous Day Highs and Lows as Liquidity Pools

The key to trading these liquidity pools is waiting for confirmation. Smart money will often push price beyond the high or low to generate liquidity, but the real opportunity comes when the market reverses or confirms a breakout. Here are two effective strategies for trading the previous day’s highs and lows.

Strategy 1: Reversal from a Liquidity Grab

This strategy focuses on false breakouts—when price briefly breaches the previous day’s high or low but quickly reverses. This indicates that the liquidity grab is complete, and institutions are shifting the market direction.

Steps to Trade a Reversal:

- Wait for Price to Breach the Previous Day’s High or Low:

- Let the market push beyond the key level to trigger stop-loss orders and capture liquidity.

- Look for Reversal Signals:

- Once price re-enters the range, watch for candlestick patterns like pin bars or engulfing candles to confirm the reversal.

- Enter the Trade:

- Enter in the opposite direction of the breakout after confirmation.

- Stop-Loss Placement:

- Place your stop-loss just beyond the high or low to avoid further manipulation.

- Profit Target:

- Target the midpoint of the previous range or key intraday levels for profit.

Strategy 2: Trend Continuation After a Breakout

In some cases, the breach of the previous day’s high or low leads to a strong trend continuation. This occurs when institutions generate enough liquidity to sustain a directional move.

Steps to Trade a Continuation:

- Wait for the Breakout and Retest:

- After the high or low is broken, let the price pull back to retest the level.

- Confirm the Breakout:

- Look for signs that the market is holding the breakout level as support (for a bullish move) or resistance (for a bearish move).

- Enter the Trade:

- Enter after the retest with confirmation from a candlestick pattern or market structure shift.

- Stop-Loss Placement:

- Place your stop-loss just inside the previous day’s range.

- Profit Target:

- Aim for the next significant support or resistance level or use Fibonacci extensions to project potential targets.

Session Timing and Liquidity Hunts

Trading the previous day’s highs and lows becomes even more effective when aligned with the key trading sessions. Institutions are most active during the London and New York sessions, making these periods ideal for liquidity hunts.

- London Session:

Look for liquidity grabs at the start of the session, especially around Asian session highs and lows. These grabs often set the tone for the rest of the day. - New York Session:

Monitor how the market reacts to the previous day’s levels during the New York Open. Price may either confirm the earlier move from the London session or reverse sharply, creating excellent trading opportunities.

Common Mistakes to Avoid

- Entering Too Early:

- Wait for price to fully breach the level and confirm a reversal before entering. Premature entries can result in unnecessary losses.

- Ignoring Market Context:

- Always analyze the broader trend and higher timeframes. Trading against the trend increases the risk of failure.

- Poor Risk Management:

- Even with high-probability setups, use tight stop-losses and maintain a favorable risk-to-reward ratio (at least 1:2) to ensure long-term profitability.

- Overtrading:

- Not every breach of the previous day’s high or low results in a trade-worthy setup. Be selective and focus on the setups with confluence from market structure or session timing.

Conclusion

Using the previous day’s highs and lows as liquidity pools is a powerful strategy in the ICT methodology. These levels act as magnets for price, drawing in retail traders’ stop-losses and triggering institutional liquidity hunts. By waiting for confirmation of either a reversal or a continuation, traders can align with smart money moves and enter trades with confidence.

Combining this strategy with session timing and market structure analysis will further enhance your trading results. With practice, you’ll develop the ability to spot these liquidity grabs and capitalize on them, improving your overall consistency and profitability.