Definition

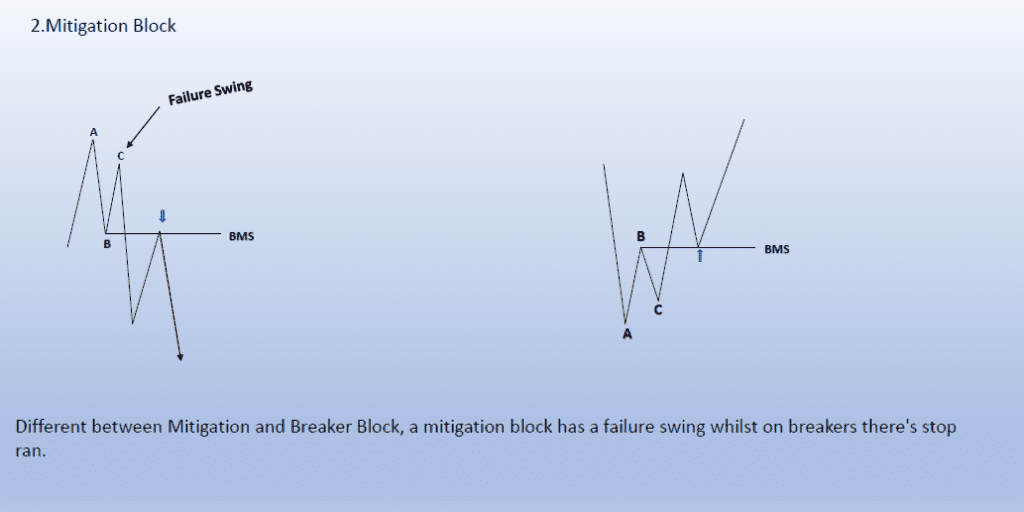

A mitigation block in forex is a failure to swing high or low in the market due to an order block. It indicates price zones where institutions correct or “mitigate” the impact of earlier trades that caused an imbalance in the market. When institutional traders enter or exit large positions, they sometimes cause price to move inefficiently, leaving imbalances. These imbalances are later mitigated when the market returns to the original point, offering institutional traders an opportunity to resolve their positions.

Mitigation blocks are often formed in areas of consolidation or retracement before a strong move. Institutions use these areas to adjust their positions, and price often reacts when they return to these levels.

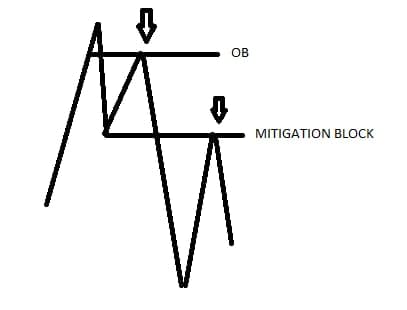

In the below examples, we can see price is failing to form a higher high due to the order block, therefore we expect price to decline and take out the previous low to form a lower low but as price goes down create a lower low there will be liquidity void created. Price will then retrace and close 50%-60% of The Liquidity Void, using the previously violated low which is referred to as our mitigation block.

Key Characteristics of Mitigation Blocks:

- Form after a strong move: Look for areas of consolidation before a significant price move, as this consolidation often represents institutional accumulation or distribution.

- Inefficient price moves: Price moves rapidly away from these zones, leaving an imbalance in the market.

Price revisits the block: After a strong move, price often retraces back to the original area where the institutional orders were executed, forming the mitigation block.

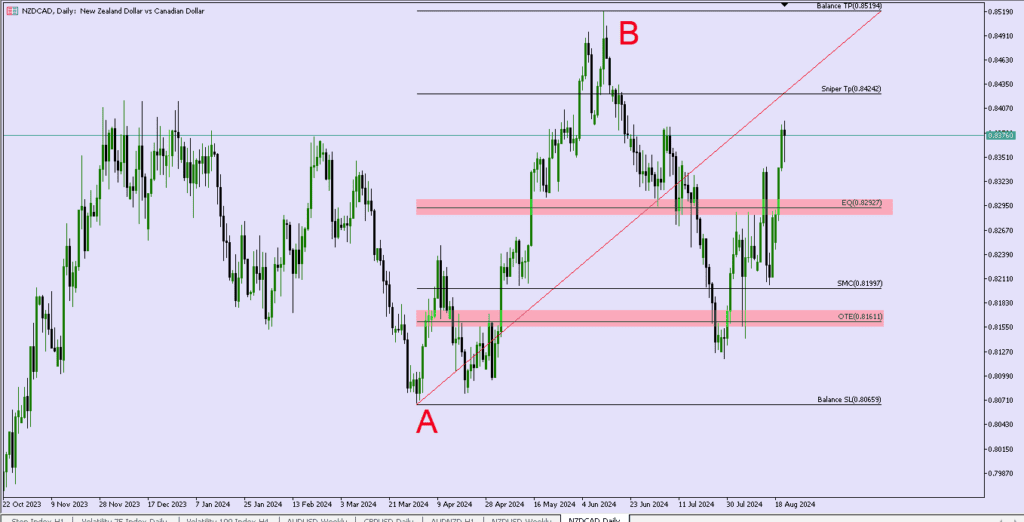

In the chart, you can see that price filled the liquidity void, and then used our mitigation level as a reference point to go short.

In The Chart, we had an order block entry opportunity followed by our mitigation block entry as indicated.

There are two types of mitigation blocks in Forex

1. bearish mitigation block in forex

A bearish mitigation block in forex occurs when there`s a failure swing in the market resulting in a lower high being formed after price has failed to collect buy-side liquidity on previous highs due to an order block or rejection block. so this means a bearish mitigation block is a result of a failure swing due to an order block or rejection block. pushing price down to collect sell-side liquidity on the nearest previous low thus forming a lower low

after price has formed a lower low it will pull back up to fill the liquidity void that has been created as price was pushed down by the order block, in an attempt of price pulling back to fill in liquidity voids, it will use the previously violated low as a point of reference to fill 50% of the liquidity void than continue to bearish/sell. Having these in mind we can then use the previously violated low as our entry point and also our Fibonacci we can see the previously violated low lining up with our equilibrium which will give confluence.

2. bullish mitigation block in forex

A bullish mitigation block in forex occurs when there`s a failed collection of sell-side liquidity on previous lows in the market. resulting in a high low being formed after price has failed to collect sell-side liquidity on previous highs due to an order block or rejection block. this means a bullish mitigation block is a result of a failed collection of sell-side liquidity on previous lows due to an order block or rejection block. Pushing price up to collect buy-side liquidity on the nearest previous high thus forming a higher high.

After price has formed a higher high it will pull back down to fill the liquidity void that has been created as price was pushed up by the order block or rejection block. in an attempt to price pulling back to fill in liquidity voids, it will use the previously violated high as a point of reference to fill 50% of the liquidity void and then continue to be bullish. Having these in mind we can then use the previously violated high as our entry point and also using our Fibonacci we can see the previously violated low lining up with our equilibrium which will give confluence.

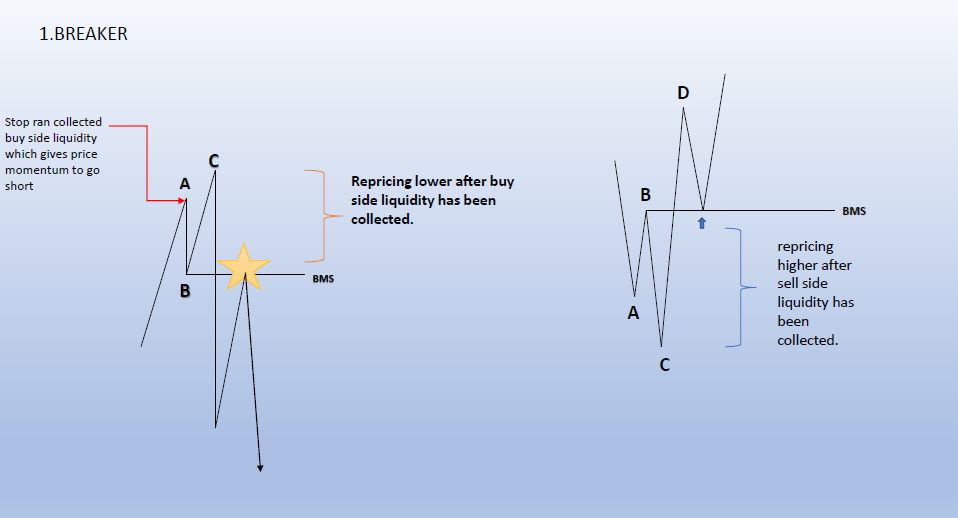

What Are Breakers?

A breaker is a price zone where the smart money has previously entered the market, causing a break in the market structure. Breakers occur when price reverses after creating a support or resistance level and breaks through it, leading to a stop-hunt or liquidity grab.

After the structure break, price often returns to retest the breaker zone before continuing in the direction of the break. This retest provides traders with an opportunity to enter trades aligned with the new trend.

Key Characteristics of Breakers:

- Break of structure (BOS): A breaker forms when price breaks a significant support or resistance level, signaling a potential shift in market direction.

- Retest of the broken zone: Price often returns to retest the breaker area, confirming the validity of the break.

- Continuation of the new trend: After the retest, price usually continues in the direction of the break, creating an opportunity for traders to enter trades with the trend.

How to Identify Mitigation Blocks and Breakers

Spotting mitigation blocks and breakers on a chart is crucial to trading them successfully. Here’s how you can identify them:

1. Identifying Mitigation Blocks:

- Look for an area of consolidation or retracement before a strong price move. This area represents where institutions have placed large orders.

- Identify a rapid move away from this zone, creating an imbalance in price. This sharp move often leaves a gap or inefficient price movement that needs to be mitigated.

- Watch for price to return to the original consolidation area, as this will be your mitigation block. Price will often react strongly at this zone as institutions resolve their previous positions.

2. Identifying Breakers:

- Look for a break of structure (BOS), where price breaks through a key support or resistance level, indicating that the market is shifting direction.

- After the break, wait for price to retest the broken level. This retest creates the breaker, offering an opportunity to join the new trend.

- Confirm the validity of the breaker by looking for a rejection candle or other price action signals that show institutional interest in defending the level.

How to Trade Mitigation Blocks and Breakers

Let’s break down how to trade mitigation blocks and breakers step by step.

Step 1: Analyze the Market Context

Before entering any trade, it’s essential to analyze the overall market structure. Identify whether the market is trending or ranging. This helps determine whether you should trade a continuation or a reversal.

- In a trending market, mitigation blocks are more likely to provide continuation setups.

- In a ranging or choppy market, breakers often signal a shift in market direction.

Step 2: Identify the Mitigation Block or Breaker

Once you understand the market context, look for potential mitigation blocks or breakers.

- Mitigation Blocks: Identify the last area of consolidation before a strong move. This is your mitigation block zone, where price is likely to return and react.

- Breakers: Watch for breaks of structure (BOS) at key support or resistance levels. When price breaks these levels and retests them, a breaker is formed.

Step 3: Wait for Confirmation

Before entering the trade, wait for confirmation that the mitigation block or breaker is valid. Confirmation can come from price action signals such as:

- Rejection candles: Look for strong rejection candles (like pin bars or engulfing candles) at the mitigation block or breaker zone. This indicates that smart money is defending the level.

- Change in market structure: If price starts to form higher highs and higher lows (for bullish setups) or lower lows and lower highs (for bearish setups), this confirms the start of a new trend.

Step 4: Enter the Trade

Once confirmation is in place, enter your trade with proper risk management. Set your stop-loss just beyond the mitigation block or breaker zone to protect against further manipulation. This keeps your risk small while allowing room for the trade to develop.

Step 5: Manage the Trade and Take Profits

As the trade progresses, manage your risk by moving your stop-loss to break even once the trade is in profit. Use key levels such as previous highs, lows, or Fibonacci levels to set take-profit targets.

- For mitigation blocks, consider taking partial profits at key resistance or support levels.

- For breakers, target the next level of significant support or resistance to maximize gains.

Common Mistakes to Avoid

When trading mitigation blocks and breakers, it’s important to avoid common mistakes:

- Entering Too Early:

Don’t rush into the trade before confirmation. Always wait for price action signals to confirm that institutions are defending the zone. - Ignoring Market Structure:

Make sure the overall market structure supports your trade. For example, trading a bullish mitigation block in a bearish market can lead to false signals. - Overleveraging:

Keep your risk in check by using tight stop-losses and risking only a small percentage of your capital on each trade. Overleveraging can lead to significant losses if the trade goes against you.